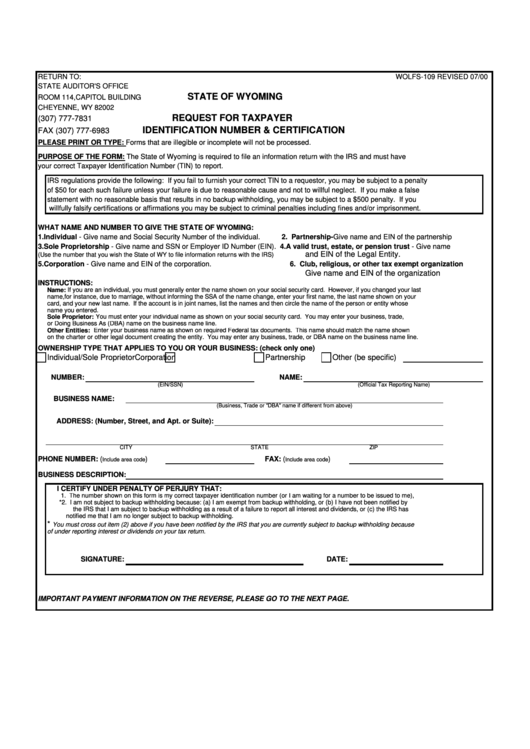

RETURN TO:

WOLFS-109 REVISED 07/00

STATE AUDITOR'S OFFICE

STATE OF WYOMING

ROOM 114,CAPITOL BUILDING

CHEYENNE, WY 82002

REQUEST FOR TAXPAYER

(307) 777-7831

IDENTIFICATION NUMBER & CERTIFICATION

FAX (307) 777-6983

PLEASE PRINT OR TYPE: Forms that are illegible or incomplete will not be processed.

PURPOSE OF THE FORM: The State of Wyoming is required to file an information return with the IRS and must have

your correct Taxpayer Identification Number (TIN) to report.

IRS regulations provide the following: If you fail to furnish your correct TIN to a requestor, you may be subject to a penalty

of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. If you make a false

statement with no reasonable basis that results in no backup withholding, you may be subject to a $500 penalty. If you

willfully falsify certifications or affirmations you may be subject to criminal penalties including fines and/or imprisonment.

WHAT NAME AND NUMBER TO GIVE THE STATE OF WYOMING:

1. Individual - Give name and Social Security Number of the individual.

2. Partnership-Give name and EIN of the partnership

3. Sole Proprietorship - Give name and SSN or Employer ID Number (EIN).

4. A valid trust, estate, or pension trust - Give name

and EIN of the Legal Entity.

(Use the number that you wish the State of WY to file information returns with the IRS)

5. Corporation - Give name and EIN of the corporation.

6. Club, religious, or other tax exempt organization

Give name and EIN of the organization

INSTRUCTIONS:

Name: If you are an individual, you must generally enter the name shown on your social security card. However, if you changed your last

name,for instance, due to marriage, without informing the SSA of the name change, enter your first name, the last name shown on your

card, and your new last name. If the account is in joint names, list the names and then circle the name of the person or entity whose

name you entered.

Sole Proprietor: You must enter your individual name as shown on your social security card. You may enter your business, trade,

or Doing Business As (DBA) name on the business name line.

Other Entities: Enter your business name as shown on required Federal tax documents. This name should match the name shown

on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on the business name line.

OWNERSHIP TYPE THAT APPLIES TO YOU OR YOUR BUSINESS: (check only one)

Individual/Sole Proprietor

Corporation

Partnership

Other (be specific)

NUMBER:

NAME:

(EIN/SSN)

(Official Tax Reporting Name)

BUSINESS NAME:

(Business, Trade or "DBA" name if different from above)

ADDRESS: (Number, Street, and Apt. or Suite):

CITY

STATE

ZIP

PHONE NUMBER: (

)

FAX: (

)

Include area code

Include area code

BUSINESS DESCRIPTION:

I CERTIFY UNDER PENALTY OF PERJURY THAT:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me),

*2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by

the IRS that I am subject to backup withholding as a result of a failure to report all interest and dividends, or (c) the IRS has

notified me that I am no longer subject to backup withholding.

*

You must cross out item (2) above if you have been notified by the IRS that you are currently subject to backup withholding because

of under reporting interest or dividends on your tax return.

SIGNATURE:

DATE:

IMPORTANT PAYMENT INFORMATION ON THE REVERSE, PLEASE GO TO THE NEXT PAGE.

1

1 2

2