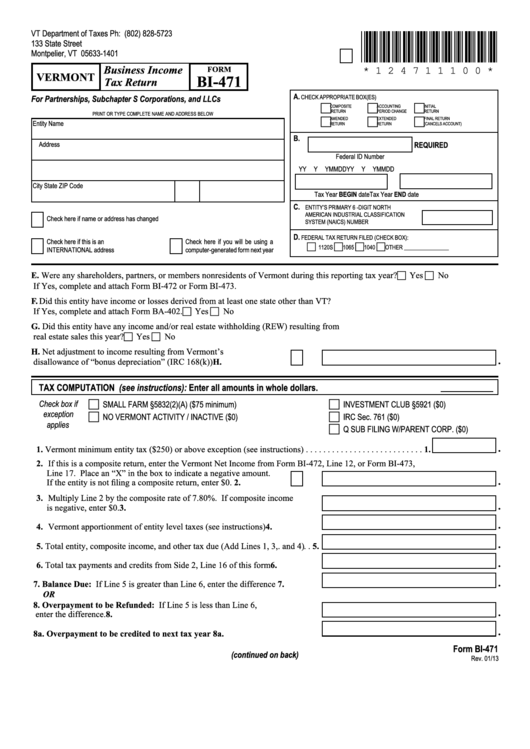

Form Bi-471 - Vermont Business Income Tax Return - 2013

ADVERTISEMENT

VT Department of Taxes

Ph: (802) 828-5723

*124711100*

133 State Street

Montpelier, VT 05633-1401

Business Income

* 1 2 4 7 1 1 1 0 0 *

FORM

VERMONT

BI-471

Tax Return

A.

For Partnerships, Subchapter S Corporations, and LLCs

CHECK APPROPRIATE BOX(ES)

COMPOSITE

ACCOUNTING

INITIAL

RETURN

PERIOD CHANGE

RETURN

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

AMENDED

EXTENDED

FINAL RETURN

Entity Name

RETURN

RETURN

(CANCELS ACCOUNT)

B.

REQUIRED

Address

Federal ID Number

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

M

M

D

D

City

State

ZIP Code

Tax Year BEGIN date

Tax Year END date

C.

ENTITY’S PRIMARY 6 -DIGIT NORTH

AMERICAN INDUSTRIAL CLASSIFICATION

Check here if name or address has changed

SYSTEM (NAICS) NUMBER

D.

FEDERAL TAX RETURN FILED (CHECK BOX):

Check here if this is an

Check here if you will be using a

1120S

1065

1040

OTHER ________________

INTERNATIONAL address

computer-generated form next year

E. Were any shareholders, partners, or members nonresidents of Vermont during this reporting tax year? . . . . . . Yes

No

If Yes, complete and attach Form BI-472 or Form BI-473 .

F. Did this entity have income or losses derived from at least one state other than VT?

If Yes, complete and attach Form BA-402 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

G. Did this entity have any income and/or real estate withholding (REW) resulting from

real estate sales this year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes

No

H. Net adjustment to income resulting from Vermont’s

.

H.

disallowance of “bonus depreciation” (IRC 168(k)) . . . . . . . . . . . . . . . .

TAX COMPUTATION (see instructions):

Enter all amounts in whole dollars.

Check box if

SMALL FARM §5832(2)(A) ($75 minimum)

INVESTMENT CLUB §5921 ($0)

exception

NO VERMONT ACTIVITY / INACTIVE ($0)

IRC Sec. 761 ($0)

applies

Q SUB FILING W/PARENT CORP. ($0)

.

1. Vermont minimum entity tax ($250) or above exception (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. If this is a composite return, enter the Vermont Net Income from Form BI-472, Line 12, or Form BI-473,

Line 17 . Place an “X” in the box to indicate a negative amount .

.

If the entity is not filing a composite return, enter $0. . . . . . . . . . . . .

2.

3. Multiply Line 2 by the composite rate of 7 .80% . If composite income

.

is negative, enter $0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

.

4. Vermont apportionment of entity level taxes (see instructions) . . . . . . . . . . . 4.

.

5. Total entity, composite income, and other tax due (Add Lines 1, 3, . and 4) . . 5.

.

6. Total tax payments and credits from Side 2, Line 16 of this form . . . . . . . . . 6.

.

7. Balance Due: If Line 5 is greater than Line 6, enter the difference . . . . . . . 7.

OR

8. Overpayment to be Refunded: If Line 5 is less than Line 6,

.

enter the difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

.

8a. Overpayment to be credited to next tax year . . . . . . . . . . . . . . . . . . . . . . 8a.

Form BI-471

(continued on back)

Rev. 01/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2