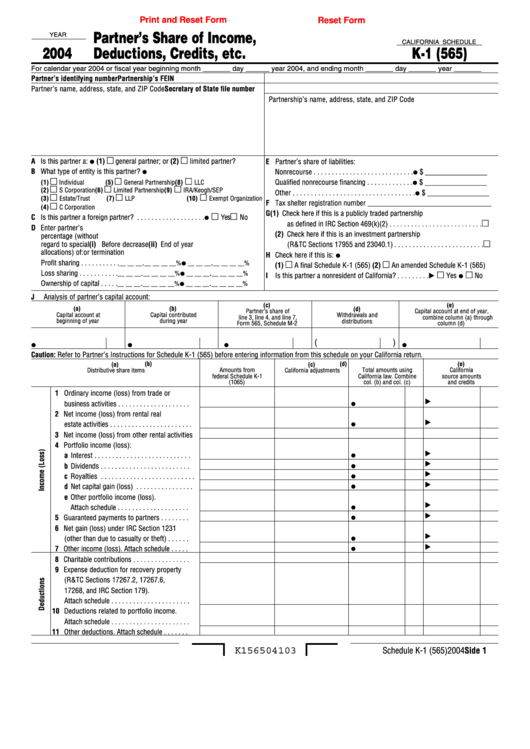

Print and Reset Form

Reset Form

Partner’s Share of Income,

YEAR

CALIFORNIA SCHEDULE

2004

Deductions, Credits, etc.

K-1 (565)

For calendar year 2004 or fiscal year beginning month _______ day ______ year 2004, and ending month _______ day _______ year _______

Partner’s identifying number

Partnership’s FEIN

Partner’s name, address, state, and ZIP Code

Secretary of State file number

Partnership’s name, address, state, and ZIP Code

¼

A Is this partner a:

(1)

general partner; or (2)

limited partner?

E Partner’s share of liabilities:

¼

¼

B What type of entity is this partner?

Nonrecourse . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _________________

¼

Qualified nonrecourse financing . . . . . . . . . . . . .

$ _________________

(1)

Individual

(5)

General Partnership

(8)

LLC

¼

(2)

S Corporation

(6)

Limited Partnership

(9)

IRA/Keogh/SEP

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ _________________

(3)

Estate/Trust

(7)

LLP

(10)

Exempt Organization

F Tax shelter registration number __________________________________

(4)

C Corporation

G (1) Check here if this is a publicly traded partnership

¼

C Is this partner a foreign partner? . . . . . . . . . . . . . . . . . . .

Yes

No

as defined in IRC Section 469(k)(2) . . . . . . . . . . . . . . . . . . . . . . . . . .

D Enter partner’s

(2) Check here if this is an investment partnership

percentage (without

regard to special

(i) Before decrease

(ii) End of year

(R&TC Sections 17955 and 23040.1) . . . . . . . . . . . . . . . . . . . . . . . . .

allocations) of:

or termination

¼

H Check here if this is:

¼

.

.

Profit sharing . . . . . . . . . . .

__ __ __

__ __ __ __%

__ __ __

__ __ __ __%

(1)

A final Schedule K-1 (565)

(2)

An amended Schedule K-1 (565)

¼

.

.

Loss sharing . . . . . . . . . . .

¼

__ __ __

__ __ __ __%

__ __ __

__ __ __ __%

I Is this partner a nonresident of California? . . . . . . . . .

Yes

No

¼

.

.

Ownership of capital . . . . .

__ __ __

__ __ __ __%

__ __ __

__ __ __ __%

J

Analysis of partner’s capital account:

(c)

(e)

(a)

(b)

(d)

Partner’s share of

Capital account at end of year,

Capital account at

Capital contributed

Withdrawals and

line 3, line 4, and line 7,

combine column (a) through

beginning of year

during year

distributions

Form 565, Schedule M-2

column (d)

¼

¼

¼

(

) ¼

Caution: Refer to Partner’s Instructions for Schedule K-1 (565) before entering information from this schedule on your California return.

(b)

(d)

(e)

(a)

(c)

Amounts from

Total amounts using

California

Distributive share items

California adjustments

federal Schedule K-1

California law. Combine

source amounts

(1065)

col. (b) and col. (c)

and credits

1 Ordinary income (loss) from trade or

¼

business activities . . . . . . . . . . . . . . . . . . . .

2 Net income (loss) from rental real

¼

estate activities . . . . . . . . . . . . . . . . . . . . . . .

3 Net income (loss) from other rental activities

4 Portfolio income (loss):

¼

a Interest . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

b Dividends . . . . . . . . . . . . . . . . . . . . . . . . .

¼

c Royalties . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

d Net capital gain (loss) . . . . . . . . . . . . . . . .

e Other portfolio income (loss).

¼

Attach schedule . . . . . . . . . . . . . . . . . . . .

¼

5 Guaranteed payments to partners . . . . . . . .

6 Net gain (loss) under IRC Section 1231

¼

(other than due to casualty or theft) . . . . . .

¼

7 Other income (loss). Attach schedule . . . . .

8 Charitable contributions . . . . . . . . . . . . . . . .

9 Expense deduction for recovery property

(R&TC Sections 17267.2, 17267.6,

17268, and IRC Section 179).

Attach schedule . . . . . . . . . . . . . . . . . . . . . .

10 Deductions related to portfolio income.

Attach schedule . . . . . . . . . . . . . . . . . . . . . .

11 Other deductions. Attach schedule . . . . . . .

K156504103

Schedule K-1 (565) 2004 Side 1

1

1 2

2