Instructions For The Farmland Preservation Credit For Corporate Farm Owners, Estates And Trusts (Form C-8022)

ADVERTISEMENT

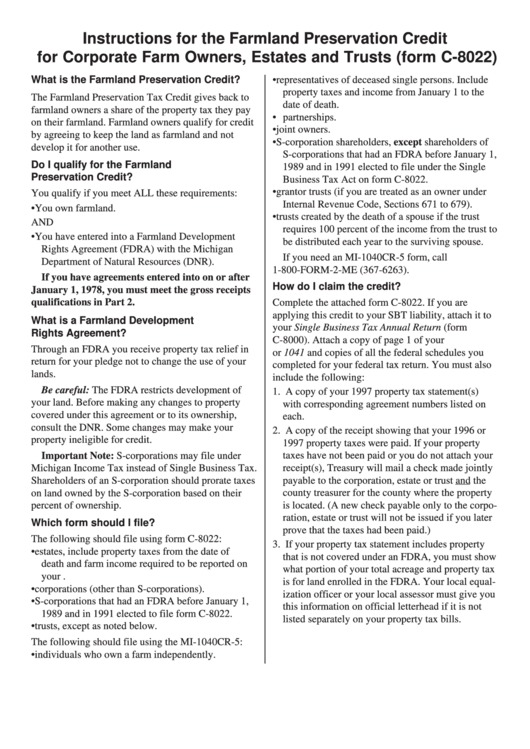

Instructions for the Farmland Preservation Credit

for Corporate Farm Owners, Estates and Trusts (form C-8022)

What is the Farmland Preservation Credit?

• representatives of deceased single persons. Include

property taxes and income from January 1 to the

The Farmland Preservation Tax Credit gives back to

date of death.

farmland owners a share of the property tax they pay

• partnerships.

on their farmland. Farmland owners qualify for credit

• joint owners.

by agreeing to keep the land as farmland and not

• S-corporation shareholders, except shareholders of

develop it for another use.

S-corporations that had an FDRA before January 1,

Do I qualify for the Farmland

1989 and in 1991 elected to file under the Single

Preservation Credit?

Business Tax Act on form C-8022.

• grantor trusts (if you are treated as an owner under

You qualify if you meet ALL these requirements:

Internal Revenue Code, Sections 671 to 679).

• You own farmland.

• trusts created by the death of a spouse if the trust

AND

requires 100 percent of the income from the trust to

• You have entered into a Farmland Development

be distributed each year to the surviving spouse.

Rights Agreement (FDRA) with the Michigan

If you need an MI-1040CR-5 form, call

Department of Natural Resources (DNR).

1-800-FORM-2-ME (367-6263).

If you have agreements entered into on or after

How do I claim the credit?

January 1, 1978, you must meet the gross receipts

qualifications in Part 2.

Complete the attached form C-8022. If you are

applying this credit to your SBT liability, attach it to

What is a Farmland Development

your Single Business Tax Annual Return (form

Rights Agreement?

C-8000). Attach a copy of page 1 of your U.S. 1120

Through an FDRA you receive property tax relief in

or 1041 and copies of all the federal schedules you

return for your pledge not to change the use of your

completed for your federal tax return. You must also

lands.

include the following:

Be careful: The FDRA restricts development of

1. A copy of your 1997 property tax statement(s)

your land. Before making any changes to property

with corresponding agreement numbers listed on

covered under this agreement or to its ownership,

each.

consult the DNR. Some changes may make your

2. A copy of the receipt showing that your 1996 or

property ineligible for credit.

1997 property taxes were paid. If your property

taxes have not been paid or you do not attach your

Important Note: S-corporations may file under

Michigan Income Tax instead of Single Business Tax.

receipt(s), Treasury will mail a check made jointly

Shareholders of an S-corporation should prorate taxes

payable to the corporation, estate or trust and the

on land owned by the S-corporation based on their

county treasurer for the county where the property

is located. (A new check payable only to the corpo-

percent of ownership.

ration, estate or trust will not be issued if you later

Which form should I file?

prove that the taxes had been paid.)

The following should file using form C-8022:

3. If your property tax statement includes property

• estates, include property taxes from the date of

that is not covered under an FDRA, you must show

death and farm income required to be reported on

what portion of your total acreage and property tax

your U.S. 1041.

is for land enrolled in the FDRA. Your local equal-

• corporations (other than S-corporations).

ization officer or your local assessor must give you

• S-corporations that had an FDRA before January 1,

this information on official letterhead if it is not

1989 and in 1991 elected to file form C-8022.

listed separately on your property tax bills.

• trusts, except as noted below.

The following should file using the MI-1040CR-5:

• individuals who own a farm independently.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4