Alternative To 1040 Form - City Of Norwalk - 2004

ADVERTISEMENT

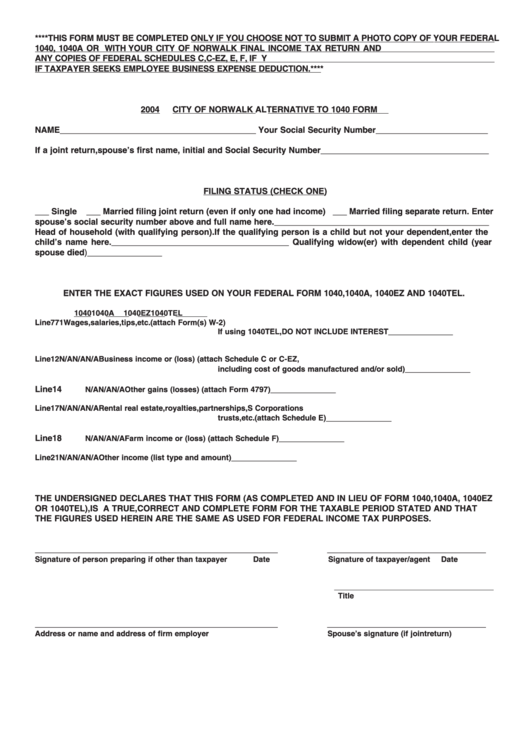

****THIS FORM MUST BE COMPLETED ONLY IF YOU CHOOSE NOT TO SUBMIT A PHOTO COPY OF YOUR FEDERAL

1040, 1040A OR 1040EZ. IT IS FILED ALONG WITH YOUR CITY OF NORWALK FINAL INCOME TAX RETURN AND

ANY COPIES OF FEDERAL SCHEDULES C, C-EZ, E, F, IF APPLICABLE. SCHEDULES A AND 2106 ARE NECESSARY

IF TAXPAYER SEEKS EMPLOYEE BUSINESS EXPENSE DEDUCTION.****

2004

CITY OF NORWALK

ALTERNATIVE TO 1040 FORM

NAME__________________________________________ Your Social Security Number________________________

If a joint return, spouse’s first name, initial and Social Security Number ____________________________________

FILING STATUS (CHECK ONE)

___ Single

___ Married filing joint return (even if only one had income) ___ Married filing separate return. Enter

spouse’s social security number above and full name here. ______________________________________________

Head of household (with qualifying person). If the qualifying person is a child but not your dependent, enter the

child’s name here.______________________________________ Qualifying widow(er) with dependent child (year

spouse died)________________

ENTER THE EXACT FIGURES USED ON YOUR FEDERAL FORM 1040, 1040A, 1040EZ AND 1040TEL.

1040

1040A

1040EZ

1040TEL

Line

7

7

1

Wages, salaries, tips, etc. (attach Form(s) W-2)

If using 1040TEL, DO NOT INCLUDE INTEREST

_______________

Line

12

N/A

N/A

N/A

Business income or (loss) (attach Schedule C or C-EZ,

______________

including cost of goods manufactured and/or sold)

Line

14

______________

N/A

N/A

N/A

Other gains (losses) (attach Form 4797)

Line

17

N/A

N/A

N/A

Rental real estate, royalties, partnerships, S Corporations

______________

trusts, etc. (attach Schedule E)

Line

18

______________

N/A

N/A

N/A

Farm income or (loss) (attach Schedule F)

______________

Line

21

N/A

N/A

N/A

Other income (list type and amount)

THE UNDERSIGNED DECLARES THAT THIS FORM (AS COMPLETED AND IN LIEU OF FORM 1040, 1040A, 1040EZ

OR 1040TEL), IS A TRUE, CORRECT AND COMPLETE FORM FOR THE TAXABLE PERIOD STATED AND THAT

THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES.

____________________________________________________

__________________________________

Signature of person preparing if other than taxpayer

Date

Signature of taxpayer/agent

Date

_____________________________________

Title

____________________________________________________

__________________________________

Address or name and address of firm employer

Spouse’s signature (if joint return)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1