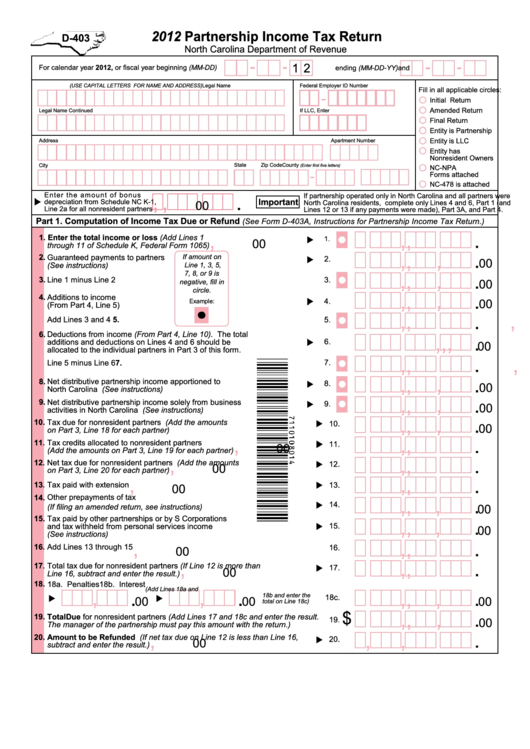

Form D-403 Draft - Partnership Income Tax Return - 2012

ADVERTISEMENT

2012 Partnership Income Tax Return

D-403

North Carolina Department of Revenue

1 2

For calendar year 2012, or fiscal year beginning (MM-DD)

and

ending (MM-DD-YY)

Legal Name

(USE CAPITAL LETTERS FOR NAME AND ADDRESS)

Federal Employer ID Number

Fill in all applicable circles:

Initial Return

Amended Return

Legal Name Continued

If LLC, Enter N.C. Secretary of State ID

Final Return

Entity is Partnership

Entity is LLC

Address

Apartment Number

Entity has

Nonresident Owners

City

State

Zip Code

County

(Enter first five letters)

NC-NPA

Forms attached

NC-478 is attached

,

,

.

Enter the amount of bonus

If partnership operated only in North Carolina and all partners were

Important

depreciation from Schedule NC K-1,

00

North Carolina residents, complete only Lines 4 and 6, Part 1 (and

Line 2a for all nonresident partners

Lines 12 or 13 if any payments were made), Part 3A, and Part 4.

Part 1. Computation of Income Tax Due or Refund

(See Form D-403A, Instructions for Partnership Income Tax Return.)

,

,

,

.

1. Enter the total income or loss (Add Lines 1

1.

00

through 11 of Schedule K, Federal Form 1065)

.

,

,

,

2.

Guaranteed payments to partners

If amount on

2.

00

(See instructions)

Line 1, 3, 5,

,

,

,

.

7, 8, or 9 is

3.

Line 1 minus Line 2

3.

00

negative, fill in

circle.

,

,

,

.

4.

Additions to income

4.

00

Example:

(From Part 4, Line 5)

,

,

,

.

5.

Add Lines 3 and 4

5.

00

6.

Deductions from income (From Part 4, Line 10). The total

,

,

,

.

6.

additions and deductions on Lines 4 and 6 should be

00

allocated to the individual partners in Part 3 of this form.

,

,

,

.

7.

7.

Line 5 minus Line 6

00

,

,

,

.

8.

Net distributive partnership income apportioned to

8.

00

North Carolina (See instructions)

,

,

,

.

9.

Net distributive partnership income solely from business

9.

00

activities in North Carolina (See instructions)

,

,

,

.

10.

Tax due for nonresident partners (Add the amounts

10.

00

on Part 3, Line 18 for each partner)

,

,

,

.

11

Tax credits allocated to nonresident partners

.

11.

00

(Add the amounts on Part 3, Line 19 for each partner)

,

,

,

.

12

Net tax due for nonresident partners (Add the amounts

.

12.

00

on Part 3, Line 20 for each partner)

,

,

,

.

13

Tax paid with extension

13.

.

00

14.

Other prepayments of tax

,

,

,

.

14.

00

(If filing an amended return, see instructions)

15.

Tax paid by other partnerships or by S Corporations

,

,

,

.

15.

and tax withheld from personal services income

00

(See instructions)

,

,

,

.

16

Add Lines 13 through 15

16.

.

00

,

,

,

.

17

Total tax due for nonresident partners (If Line 12 is more than

.

17.

00

Line 16, subtract and enter the result.)

18. 18a. Penalties

18b. Interest

,

,

.

.

.

(Add Lines 18a and

,

,

,

18b and enter the

18c.

00

00

00

total on Line 18c)

.

,

,

,

$

19.

Total Due for nonresident partners (Add Lines 17 and 18c and enter the result.

19

00

.

The manager of the partnership must pay this amount with the return.)

.

,

,

,

20. Amount to be Refunded (If net tax due on Line 12 is less than Line 16,

20.

00

subtract and enter the result.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4