Instructions For Form Ftb 8453 - California Individual Income Tax Declaration For E-File

ADVERTISEMENT

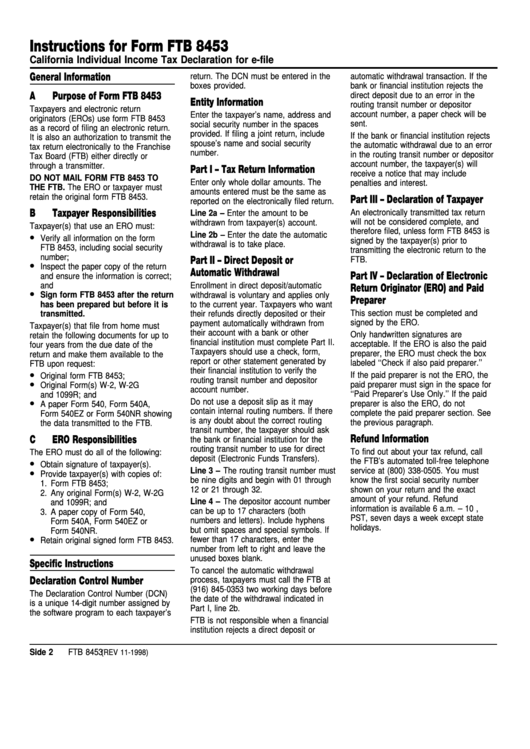

Instructions for Form FTB 8453

California Individual Income Tax Declaration for e-file

General Information

return. The DCN must be entered in the

automatic withdrawal transaction. If the

boxes provided.

bank or financial institution rejects the

A Purpose of Form FTB 8453

direct deposit due to an error in the

Entity Information

routing transit number or depositor

Taxpayers and electronic return

account number, a paper check will be

Enter the taxpayer’s name, address and

originators (EROs) use form FTB 8453

sent.

social security number in the spaces

as a record of filing an electronic return.

provided. If filing a joint return, include

If the bank or financial institution rejects

It is also an authorization to transmit the

spouse’s name and social security

the automatic withdrawal due to an error

tax return electronically to the Franchise

number.

in the routing transit number or depositor

Tax Board (FTB) either directly or

account number, the taxpayer(s) will

through a transmitter.

Part I – Tax Return Information

receive a notice that may include

DO NOT MAIL FORM FTB 8453 TO

Enter only whole dollar amounts. The

penalties and interest.

THE FTB. The ERO or taxpayer must

amounts entered must be the same as

retain the original form FTB 8453.

Part III – Declaration of Taxpayer

reported on the electronically filed return.

B Taxpayer Responsibilities

An electronically transmitted tax return

Line 2a – Enter the amount to be

will not be considered complete, and

withdrawn from taxpayer(s) account.

Taxpayer(s) that use an ERO must:

therefore filed, unless form FTB 8453 is

•

Line 2b – Enter the date the automatic

Verify all information on the form

signed by the taxpayer(s) prior to

withdrawal is to take place.

FTB 8453, including social security

transmitting the electronic return to the

number;

Part II – Direct Deposit or

FTB.

•

Inspect the paper copy of the return

Automatic Withdrawal

Part IV – Declaration of Electronic

and ensure the information is correct;

and

Enrollment in direct deposit/automatic

Return Originator (ERO) and Paid

•

Sign form FTB 8453 after the return

withdrawal is voluntary and applies only

Preparer

has been prepared but before it is

to the current year. Taxpayers who want

This section must be completed and

transmitted.

their refunds directly deposited or their

signed by the ERO.

payment automatically withdrawn from

Taxpayer(s) that file from home must

their account with a bank or other

Only handwritten signatures are

retain the following documents for up to

financial institution must complete Part II.

acceptable. If the ERO is also the paid

four years from the due date of the

Taxpayers should use a check, form,

preparer, the ERO must check the box

return and make them available to the

report or other statement generated by

labeled ‘‘Check if also paid preparer.’’

FTB upon request:

their financial institution to verify the

•

If the paid preparer is not the ERO, the

Original form FTB 8453;

routing transit number and depositor

•

paid preparer must sign in the space for

Original Form(s) W-2, W-2G

account number.

‘‘Paid Preparer’s Use Only.’’ If the paid

and 1099R; and

•

Do not use a deposit slip as it may

preparer is also the ERO, do not

A paper Form 540, Form 540A,

contain internal routing numbers. If there

complete the paid preparer section. See

Form 540EZ or Form 540NR showing

is any doubt about the correct routing

the previous paragraph.

the data transmitted to the FTB.

transit number, the taxpayer should ask

Refund Information

C ERO Responsibilities

the bank or financial institution for the

routing transit number to use for direct

To find out about your tax refund, call

The ERO must do all of the following:

deposit (Electronic Funds Transfers).

•

the FTB’s automated toll-free telephone

Obtain signature of taxpayer(s).

•

Line 3 – The routing transit number must

service at (800) 338-0505. You must

Provide taxpayer(s) with copies of:

be nine digits and begin with 01 through

know the first social security number

1. Form FTB 8453;

12 or 21 through 32.

shown on your return and the exact

2. Any original Form(s) W-2, W-2G

amount of your refund. Refund

Line 4 – The depositor account number

and 1099R; and

information is available 6 a.m. – 10 p.m.,

can be up to 17 characters (both

3. A paper copy of Form 540,

PST, seven days a week except state

numbers and letters). Include hyphens

Form 540A, Form 540EZ or

holidays.

but omit spaces and special symbols. If

Form 540NR.

•

fewer than 17 characters, enter the

Retain original signed form FTB 8453.

number from left to right and leave the

unused boxes blank.

Specific Instructions

To cancel the automatic withdrawal

Declaration Control Number

process, taxpayers must call the FTB at

(916) 845-0353 two working days before

The Declaration Control Number (DCN)

the date of the withdrawal indicated in

is a unique 14-digit number assigned by

Part I, line 2b.

the software program to each taxpayer’s

FTB is not responsible when a financial

institution rejects a direct deposit or

Side 2 FTB 8453

(REV 11-1998)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1