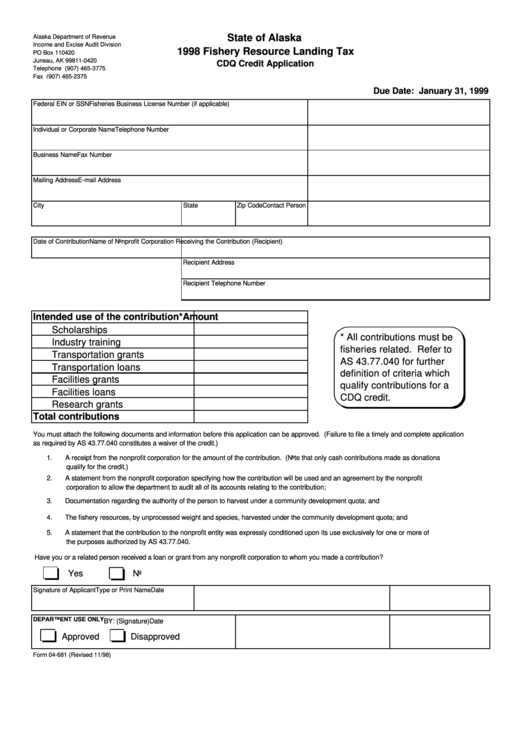

State of Alaska

Alaska Department of Revenue

Income and Excise Audit Division

1998 Fishery Resource Landing Tax

PO Box 110420

Juneau, AK 99811-0420

CDQ Credit Application

Telephone (907) 465-3775

Fax (907) 465-2375

Due Date: January 31, 1999

Federal EIN or SSN

Fisheries Business License Number (if applicable)

Individual or Corporate Name

Telephone Number

Business Name

Fax Number

Mailing Address

E-mail Address

City

State

Zip Code

Contact Person

Date of Contribution

Name of Nonprofit Corporation Receiving the Contribution (Recipient)

Recipient Address

Recipient Telephone Number

Intended use of the contribution*

Amount

Scholarships

* All contributions must be

Industry training

fisheries related. Refer to

Transportation grants

AS 43.77.040 for further

Transportation loans

definition of criteria which

Facilities grants

qualify contributions for a

Facilities loans

CDQ credit.

Research grants

Total contributions

You must attach the following documents and information before this application can be approved. (Failure to file a timely and complete application

as required by AS 43.77.040 constitutes a waiver of the credit.)

1.

A receipt from the nonprofit corporation for the amount of the contribution. (Note that only cash contributions made as donations

qualify for the credit.)

2.

A statement from the nonprofit corporation specifying how the contribution will be used and an agreement by the nonprofit

corporation to allow the department to audit all of its accounts relating to the contribution;

3.

Documentation regarding the authority of the person to harvest under a community development quota; and

4.

The fishery resources, by unprocessed weight and species, harvested under the community development quota; and

5.

A statement that the contribution to the nonprofit entity was expressly conditioned upon its use exclusively for one or more of

the purposes authorized by AS 43.77.040.

Have you or a related person received a loan or grant from any nonprofit corporation to whom you made a contribution?

Yes

No

Signature of Applicant

Type or Print Name

Date

DEPARTMENT USE ONLY

BY: (Signature)

Date

Approved

Disapproved

Form 04-681 (Revised 11/98)

1

1