Form 8453 General Instructions - 1998

ADVERTISEMENT

2

Form 8453 (1998)

Page

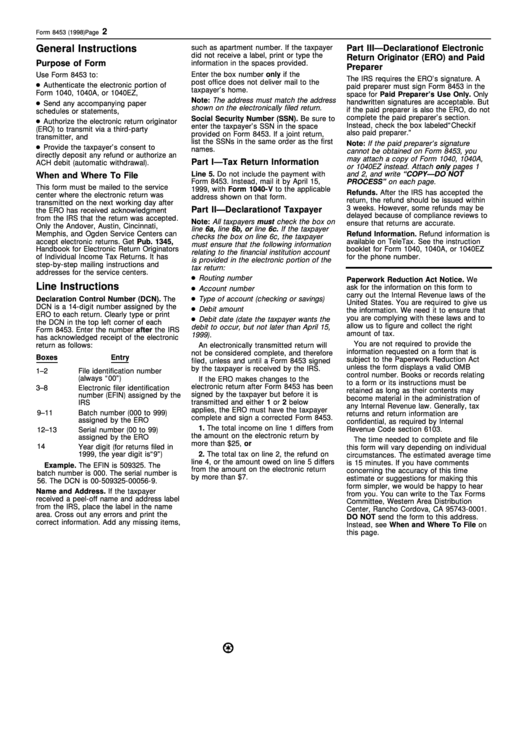

General Instructions

such as apartment number. If the taxpayer

Part III—Declaration of Electronic

did not receive a label, print or type the

Return Originator (ERO) and Paid

Purpose of Form

information in the spaces provided.

Preparer

P.O. Box. Enter the box number only if the

Use Form 8453 to:

The IRS requires the ERO’s signature. A

post office does not deliver mail to the

Authenticate the electronic portion of

paid preparer must sign Form 8453 in the

taxpayer’s home.

Form 1040, 1040A, or 1040EZ,

space for Paid Preparer’s Use Only. Only

Note: The address must match the address

handwritten signatures are acceptable. But

Send any accompanying paper

shown on the electronically filed return.

if the paid preparer is also the ERO, do not

schedules or statements,

complete the paid preparer’s section.

Social Security Number (SSN). Be sure to

Authorize the electronic return originator

Instead, check the box labeled “Check if

enter the taxpayer’s SSN in the space

(ERO) to transmit via a third-party

also paid preparer.”

provided on Form 8453. If a joint return,

transmitter, and

list the SSNs in the same order as the first

Note: If the paid preparer’s signature

Provide the taxpayer’s consent to

names.

cannot be obtained on Form 8453, you

directly deposit any refund or authorize an

may attach a copy of Form 1040, 1040A,

Part I—Tax Return Information

ACH debit (automatic withdrawal).

or 1040EZ instead. Attach only pages 1

Line 5. Do not include the payment with

and 2, and write “COPY—DO NOT

When and Where To File

Form 8453. Instead, mail it by April 15,

PROCESS” on each page.

This form must be mailed to the service

1999, with Form 1040-V to the applicable

Refunds. After the IRS has accepted the

center where the electronic return was

address shown on that form.

return, the refund should be issued within

transmitted on the next working day after

3 weeks. However, some refunds may be

Part II—Declaration of Taxpayer

the ERO has received acknowledgment

delayed because of compliance reviews to

from the IRS that the return was accepted.

Note: All taxpayers must check the box on

ensure that returns are accurate.

Only the Andover, Austin, Cincinnati,

line 6a, line 6b, or line 6c. If the taxpayer

Memphis, and Ogden Service Centers can

Refund Information. Refund information is

checks the box on line 6c, the taxpayer

accept electronic returns. Get Pub. 1345,

available on TeleTax. See the instruction

must ensure that the following information

Handbook for Electronic Return Originators

booklet for Form 1040, 1040A, or 1040EZ

relating to the financial institution account

of Individual Income Tax Returns. It has

for the phone number.

is provided in the electronic portion of the

step-by-step mailing instructions and

tax return:

addresses for the service centers.

Routing number

Paperwork Reduction Act Notice. We

Line Instructions

ask for the information on this form to

Account number

carry out the Internal Revenue laws of the

Declaration Control Number (DCN). The

Type of account (checking or savings)

United States. You are required to give us

DCN is a 14-digit number assigned by the

Debit amount

the information. We need it to ensure that

ERO to each return. Clearly type or print

you are complying with these laws and to

Debit date (date the taxpayer wants the

the DCN in the top left corner of each

allow us to figure and collect the right

debit to occur, but not later than April 15,

Form 8453. Enter the number after the IRS

amount of tax.

1999).

has acknowledged receipt of the electronic

You are not required to provide the

return as follows:

An electronically transmitted return will

information requested on a form that is

not be considered complete, and therefore

Boxes

Entry

subject to the Paperwork Reduction Act

filed, unless and until a Form 8453 signed

unless the form displays a valid OMB

by the taxpayer is received by the IRS.

1–2

File identification number

control number. Books or records relating

(always “00”)

If the ERO makes changes to the

to a form or its instructions must be

electronic return after Form 8453 has been

3–8

Electronic filer identification

retained as long as their contents may

signed by the taxpayer but before it is

number (EFIN) assigned by the

become material in the administration of

IRS

transmitted and either 1 or 2 below

any Internal Revenue law. Generally, tax

applies, the ERO must have the taxpayer

9–11

Batch number (000 to 999)

returns and return information are

complete and sign a corrected Form 8453.

assigned by the ERO

confidential, as required by Internal

1. The total income on line 1 differs from

Revenue Code section 6103.

12–13

Serial number (00 to 99)

the amount on the electronic return by

assigned by the ERO

The time needed to complete and file

more than $25, or

14

Year digit (for returns filed in

this form will vary depending on individual

1999, the year digit is “9”)

2. The total tax on line 2, the refund on

circumstances. The estimated average time

line 4, or the amount owed on line 5 differs

is 15 minutes. If you have comments

Example. The EFIN is 509325. The

from the amount on the electronic return

concerning the accuracy of this time

batch number is 000. The serial number is

by more than $7.

estimate or suggestions for making this

56. The DCN is 00-509325-00056-9.

form simpler, we would be happy to hear

Name and Address. If the taxpayer

from you. You can write to the Tax Forms

received a peel-off name and address label

Committee, Western Area Distribution

from the IRS, place the label in the name

Center, Rancho Cordova, CA 95743-0001.

area. Cross out any errors and print the

DO NOT send the form to this address.

correct information. Add any missing items,

Instead, see When and Where To File on

this page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1