Rehabilitation Of Historic Properties Tax Credit Worksheet - 2002 - Maine Department Of Revenue

ADVERTISEMENT

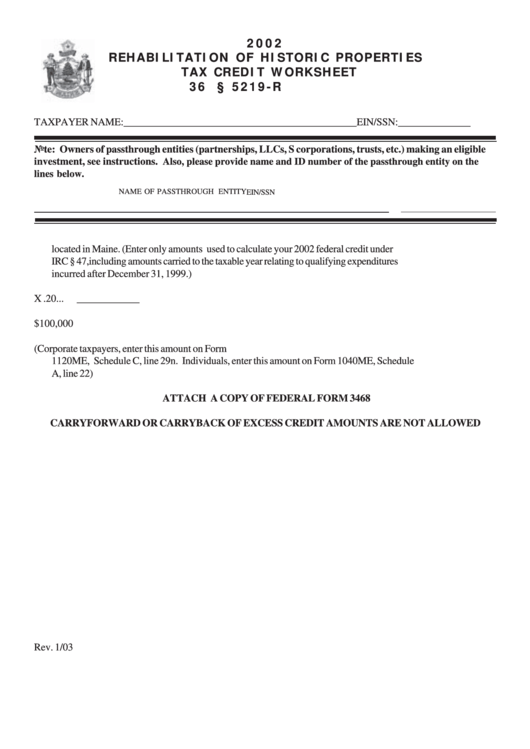

2002

REHABILITATION OF HISTORIC PROPERTIES

TAX CREDIT WORKSHEET

36 M.R.S.A. § 5219-R

TAXPAYER NAME:_____________________________________________

EIN/SSN:______________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the passthrough entity on the

lines below.

NAME OF PASSTHROUGH ENTITY

EIN/SSN

1. Enter 2002 qualified rehabilitation expenditures with respect to certified historic structures

located in Maine. (Enter only amounts used to calculate your 2002 federal credit under

IRC § 47,including amounts carried to the taxable year relating to qualifying expenditures

incurred after December 31, 1999.) .................................................................................

____________

2. Line 1 X .20 ....................................................................................................................

____________

3. Credit limitation ................................................................................................................

$100,000

4. Enter the lesser of line 2 or line 3. (Corporate taxpayers, enter this amount on Form

1120ME, Schedule C, line 29n. Individuals, enter this amount on Form 1040ME, Schedule

A, line 22) .......................................................................................................................

____________

ATTACH A COPY OF FEDERAL FORM 3468

CARRYFORWARD OR CARRYBACK OF EXCESS CREDIT AMOUNTS ARE NOT ALLOWED

Rev. 1/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1