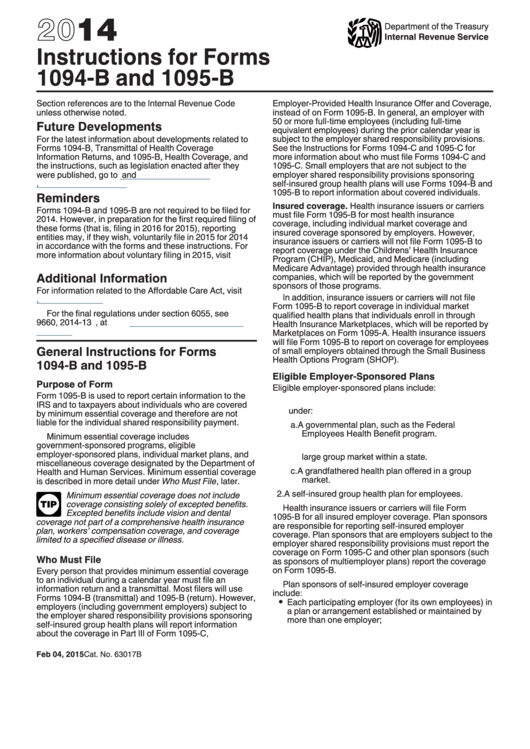

Instructions For Forms 1094-B And 1095-B - 2014

ADVERTISEMENT

2014

Department of the Treasury

Internal Revenue Service

Instructions for Forms

1094-B and 1095-B

Section references are to the Internal Revenue Code

Employer-Provided Health Insurance Offer and Coverage,

unless otherwise noted.

instead of on Form 1095-B. In general, an employer with

50 or more full-time employees (including full-time

Future Developments

equivalent employees) during the prior calendar year is

For the latest information about developments related to

subject to the employer shared responsibility provisions.

Forms 1094-B, Transmittal of Health Coverage

See the Instructions for Forms 1094-C and 1095-C for

Information Returns, and 1095-B, Health Coverage, and

more information about who must file Forms 1094-C and

the instructions, such as legislation enacted after they

1095-C. Small employers that are not subject to the

were published, go to

and

employer shared responsibility provisions sponsoring

self-insured group health plans will use Forms 1094-B and

1095-B to report information about covered individuals.

Reminders

Insured coverage. Health insurance issuers or carriers

Forms 1094-B and 1095-B are not required to be filed for

must file Form 1095-B for most health insurance

2014. However, in preparation for the first required filing of

coverage, including individual market coverage and

these forms (that is, filing in 2016 for 2015), reporting

insured coverage sponsored by employers. However,

entities may, if they wish, voluntarily file in 2015 for 2014

insurance issuers or carriers will not file Form 1095-B to

in accordance with the forms and these instructions. For

report coverage under the Childrens’ Health Insurance

more information about voluntary filing in 2015, visit

Program (CHIP), Medicaid, and Medicare (including

IRS.gov.

Medicare Advantage) provided through health insurance

Additional Information

companies, which will be reported by the government

sponsors of those programs.

For information related to the Affordable Care Act, visit

In addition, insurance issuers or carriers will not file

Form 1095-B to report coverage in individual market

For the final regulations under section 6055, see T.D.

qualified health plans that individuals enroll in through

9660, 2014-13 I.R.B., at

Health Insurance Marketplaces, which will be reported by

ar08.html

Marketplaces on Form 1095-A. Health insurance issuers

will file Form 1095-B to report on coverage for employees

General Instructions for Forms

of small employers obtained through the Small Business

Health Options Program (SHOP).

1094-B and 1095-B

Eligible Employer-Sponsored Plans

Purpose of Form

Eligible employer-sponsored plans include:

Form 1095-B is used to report certain information to the

1. Group health insurance coverage for employees

IRS and to taxpayers about individuals who are covered

under:

by minimum essential coverage and therefore are not

liable for the individual shared responsibility payment.

a. A governmental plan, such as the Federal

Employees Health Benefit program.

Minimum essential coverage includes

government-sponsored programs, eligible

b. An insured plan or coverage offered in the small or

employer-sponsored plans, individual market plans, and

large group market within a state.

miscellaneous coverage designated by the Department of

c. A grandfathered health plan offered in a group

Health and Human Services. Minimum essential coverage

market.

is described in more detail under Who Must File, later.

2. A self-insured group health plan for employees.

Minimum essential coverage does not include

coverage consisting solely of excepted benefits.

Health insurance issuers or carriers will file Form

TIP

Excepted benefits include vision and dental

1095-B for all insured employer coverage. Plan sponsors

coverage not part of a comprehensive health insurance

are responsible for reporting self-insured employer

plan, workers’ compensation coverage, and coverage

coverage. Plan sponsors that are employers subject to the

limited to a specified disease or illness.

employer shared responsibility provisions must report the

coverage on Form 1095-C and other plan sponsors (such

Who Must File

as sponsors of multiemployer plans) report the coverage

on Form 1095-B.

Every person that provides minimum essential coverage

to an individual during a calendar year must file an

Plan sponsors of self-insured employer coverage

information return and a transmittal. Most filers will use

include:

Forms 1094-B (transmittal) and 1095-B (return). However,

Each participating employer (for its own employees) in

employers (including government employers) subject to

a plan or arrangement established or maintained by

the employer shared responsibility provisions sponsoring

more than one employer;

self-insured group health plans will report information

about the coverage in Part III of Form 1095-C,

Feb 04, 2015

Cat. No. 63017B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4