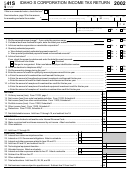

Form 512-X - Amended Corporation Income Tax Return - 2002

ADVERTISEMENT

Tax Year _______

State of Oklahoma

512-X

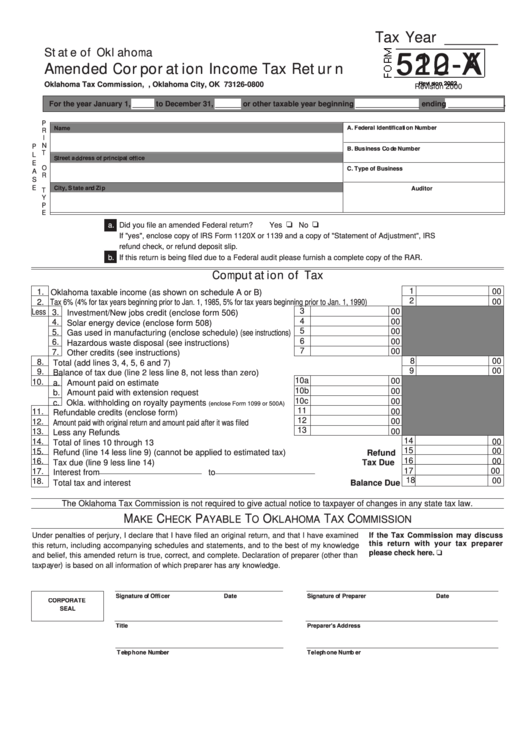

520-A

Amended Corporation Income Tax Return

Oklahoma Tax Commission, P.O. Box 26800, Oklahoma City, OK 73126-0800

Revision 2002

Revision 2000

For the year January 1, _____ to December 31, ______ or other taxable year beginning _______________ ending _____________.

P

Name

A. Federal Identification Number

R

I

N

P

B. Business Code Number

T

L

Street address of principal office

E

O

C. Type of Business

A

R

S

City, State and Zip

E

Auditor

T

Y

P

E

a.

Did you file an amended Federal return?

Yes

No

If "yes", enclose copy of IRS Form 1120X or 1139 and a copy of "Statement of Adjustment", IRS

refund check, or refund deposit slip.

b.

If this return is being filed due to a Federal audit please furnish a complete copy of the RAR.

Computation of Tax

1

00

1.

Oklahoma taxable income (as shown on schedule A or B)

...............................................................

2

00

2.

Tax 6% (4% for tax years beginning prior to Jan. 1, 1985, 5% for tax years beginning prior to Jan. 1, 1990)

............

3

00

Less

3.

Investment/New jobs credit (enclose form 506)

........................

4

00

4.

Solar energy device (enclose form 508)

....................................

5

00

5.

Gas used in manufacturing (enclose schedule) (see instructions)

6

00

6.

Hazardous waste disposal (see instructions)

............................

7

00

7.

Other credits (see instructions)

....................................................

8

00

8.

Total (add lines 3, 4, 5, 6 and 7)

.............................................................................................................

9

00

9.

Balance of tax due (line 2 less line 8, not less than zero)

..................................................................

10a

00

10.

a. Amount paid on estimate

...............................................................

10b

00

b. Amount paid with extension request

............................................

10c

00

c. Okla. withholding on royalty payments

(enclose Form 1099 or 500A)

11

00

11.

Refundable credits (enclose form)

......................................................

12

12.

00

Amount paid with original return and amount paid after it was filed

...................

13

13.

00

Less any Refunds

..................................................................................

14

14.

00

Total of lines 10 through 13

.....................................................................................................................

15

00

15.

Refund (line 14 less line 9) (cannot be applied to estimated tax)

.....................................

Refund

16

00

16.

Tax due (line 9 less line 14)

Tax Due

...................................................................................................

17

00

17.

Interest from

to

.....................................

18

00

18.

Total tax and interest

Balance Due

......................................................................................................

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

M

C

P

T

O

T

C

AKE

HECK

AYABLE

O

KLAHOMA

AX

OMMISSION

Under penalties of perjury, I declare that I have filed an original return, and that I have examined

If the Tax Commission may discuss

this return with your tax preparer

this return, including accompanying schedules and statements, and to the best of my knowledge

please check here.

and belief, this amended return is true, correct, and complete. Declaration of preparer (other than

taxpayer) is based on all information of which preparer has any knowledge.

Signature of Officer

Date

Signature of Preparer

Date

CORPORATE

SEAL

Title

Preparer's Address

Telephone Number

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4