Form St- 3 Motor Fuel Instructions

ADVERTISEMENT

-

ST

3 Motor Fuel Instructions

Form

(Rev. 03/23/17)

Georgia Department of Revenue

Sales and Use Tax Return

P.O. Box 105408

Atlanta, Georgia 30348-5408

Instructions

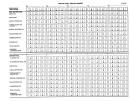

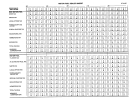

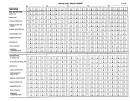

This form is for motor fuel distributors only. Motor fuel distributors are required to file this form with the Form ST-3 Sales and Use Tax

Return to account for pre-paid local sales taxes for on-road fuel sales and use. Do not report off-road fuel sales or use on this form. Report

off-road fuel sales and use on the Off-Road Fuel Worksheet.

To determine taxable sales/use, multiply taxable gallons by the average retail sales price for the fuel type being reported. (The average

retail sales price is printed at the top of Form ST-3 Motor Fuel.) To determine the county tax rate, find the total rate reported for the county

on the sales and use tax rate chart; subtract the 4% state rate; and subtract the TSPLOST tax, if applicable. (For example, the sales and

use tax rate chart shows a total rate of 8% for Hancock County. To find the tax rate for pre-paid motor fuel, subtract the 4% state rate and

the 1% TSPLOST. The resulting tax rate for pre-paid motor fuel is 3%.) To calculate the tax amount, multiply the taxable sales/use by the

tax rate in the applicable jurisdiction.

Report City of Atlanta sales/use on the line appropriate for the fuel type (line 1, 2, 3, 4, or 5) AND on a separate line with the appropriate

county (Fulton or DeKalb) and rate. Example: 45,000 gallons of gasoline were delivered to City of Atlanta retail locations in Fulton County.

The taxpayer must report these sale(s) on line 1. Separately, on a blank line (line 6, for example) the taxpayer must fill in the jurisdiction

(Fulton County), the jurisdiction code (060), the fuel type (1), the taxable gallons (45,000), the average retail sales price, the taxable

sales/use, the tax rate, and the tax amount.

After entering taxable sales and tax amount, add the local tax amounts. Record the sum on Form ST-3 Sales and Use Tax Return, Part A

and Part D, on the lines for Pre-paid Local Sales/Use Tax.

If more lines are needed to report sales, use Form ST-3 Motor Fuel Addendum.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1