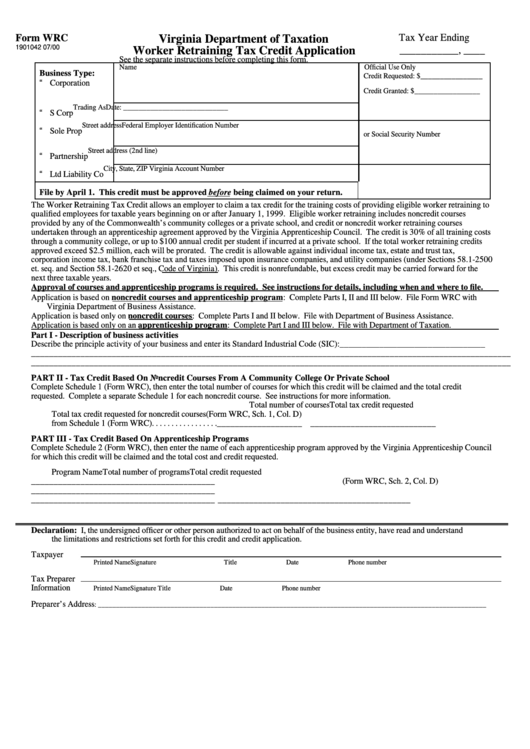

Form Wrc - Virginia Department Of Taxation Worker Retraining Tax Credit Application

ADVERTISEMENT

Form WRC

Tax Year Ending

Virginia Department of Taxation

1901042 07/00

Worker Retraining Tax Credit Application

___________, ____

See the separate instructions before completing this form.

Name

Official Use Only

Business Type:

Credit Requested: $________________

“ Corporation

Credit Granted: $_________________

Trading As

Date: ___________________________

“ S Corp

Street address

Federal Employer Identification Number

“ Sole Prop

or Social Security Number

Street address (2nd line)

“ Partnership

City, State, ZIP

Virginia Account Number

“ Ltd Liability Co

File by April 1. This credit must be approved before being claimed on your return.

The Worker Retraining Tax Credit allows an employer to claim a tax credit for the training costs of providing eligible worker retraining to

qualified employees for taxable years beginning on or after January 1, 1999. Eligible worker retraining includes noncredit courses

provided by any of the Commonwealth’ s community colleges or a private school, and credit or noncredit worker retraining courses

undertaken through an apprenticeship agreement approved by the Virginia Apprenticeship Council. The credit is 30% of all training costs

through a community college, or up to $100 annual credit per student if incurred at a private school. If the total worker retraining credits

approved exceed $2.5 million, each will be prorated. The credit is allowable against individual income tax, estate and trust tax,

corporation income tax, bank franchise tax and taxes imposed upon insurance companies, and utility companies (under Sections 58.1-2500

et. seq. and Section 58.1-2620 et seq., Code of Virginia). This credit is nonrefundable, but excess credit may be carried forward for the

next three taxable years.

Approval of courses and apprenticeship programs is required. See instructions for details, including when and where to file.

Application is based on noncredit courses and apprenticeship program: Complete Parts I, II and III below. File Form WRC with

Virginia Department of Business Assistance.

Application is based only on noncredit courses: Complete Parts I and II below. File with Department of Business Assistance.

Application is based only on an apprenticeship program: Complete Part I and III below. File with Department of Taxation.

Part I - Description of business activities

Describe the principle activity of your business and enter its Standard Industrial Code (SIC):_________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

PART II - Tax Credit Based On Noncredit Courses From A Community College Or Private School

Complete Schedule 1 (Form WRC), then enter the total number of courses for which this credit will be claimed and the total credit

requested. Complete a separate Schedule 1 for each noncredit course. See instructions for more information.

Total number of courses

Total tax credit requested

Total tax credit requested for noncredit courses

(Form WRC, Sch. 1, Col. D)

from Schedule 1 (Form WRC). . . . . . . . . . . . . . . . .

___________________ ____________________________

PART III - Tax Credit Based On Apprenticeship Programs

Complete Schedule 2 (Form WRC), then enter the name of each apprenticeship program approved by the Virginia Apprenticeship Council

for which this credit will be claimed and the total cost and credit requested.

Program Name

Total number of programs Total credit requested

_________________________________________

(Form WRC, Sch. 2, Col. D)

_________________________________________

_________________________________________ _____________________

______________________

Declaration: I, the undersigned officer or other person authorized to act on behalf of the business entity, have read and understand

the limitations and restrictions set forth for this credit and credit application.

Taxpayer

Printed Name

Signature

Title

Date

Phone number

Tax Preparer

Information

Printed Name

Signature

Title

Date

Phone number

Preparer’ s Address

: ___________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1