Form 70-015b - Iowa Department Of Revenue

ADVERTISEMENT

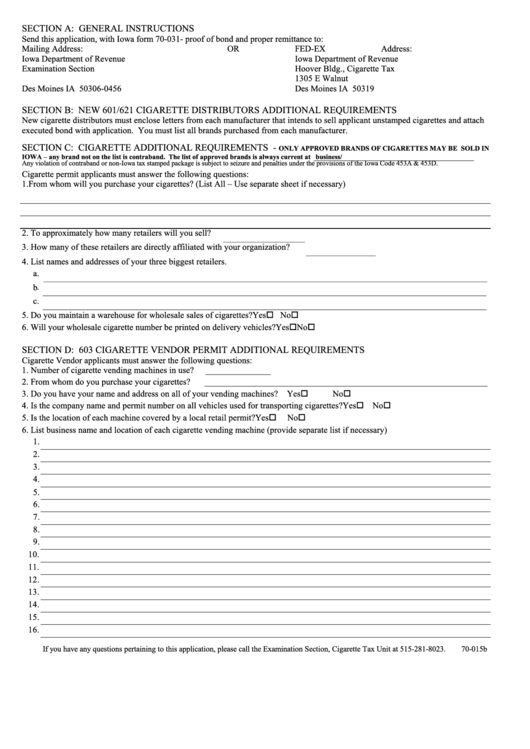

SECTION A: GENERAL INSTRUCTIONS

Send this application, with Iowa form 70-031- proof of bond and proper remittance to:

Mailing Address:

OR

FED-EX Address:

Iowa Department of Revenue

Iowa Department of Revenue

Examination Section

Hoover Bldg., Cigarette Tax

P.O. Box 10456

1305 E Walnut

Des Moines IA 50306-0456

Des Moines IA 50319

SECTION B: NEW 601/621 CIGARETTE DISTRIBUTORS ADDITIONAL REQUIREMENTS

New cigarette distributors must enclose letters from each manufacturer that intends to sell applicant unstamped cigarettes and attach

executed bond with application. You must list all brands purchased from each manufacturer.

SECTION C: CIGARETTE ADDITIONAL REQUIREMENTS -

ONLY APPROVED BRANDS OF CIGARETTES MAY BE SOLD IN

IOWA – any brand not on the list is contraband. The list of approved brands is always current at

Any violation of contraband or non-Iowa tax stamped package is subject to seizure and penalties under the provisions of the Iowa Code 453A & 453D.

Cigarette permit applicants must answer the following questions:

1. From whom will you purchase your cigarettes? (List All – Use separate sheet if necessary)

2. To approximately how many retailers will you sell?

___________________________

3. How many of these retailers are directly affiliated with your organization?

_______________________

4. List names and addresses of your three biggest retailers.

a.

___________________________________________________________________________________________________________________________________________________

b.

___________________________________________________________________________________________________________________________________________________

c.

___________________________________________________________________________________________________________________________________________________

5. Do you maintain a warehouse for wholesale sales of cigarettes?

Yes

No

6. Will your wholesale cigarette number be printed on delivery vehicles? Yes

No

SECTION D: 603 CIGARETTE VENDOR PERMIT ADDITIONAL REQUIREMENTS

Cigarette Vendor applicants must answer the following questions:

1. Number of cigarette vending machines in use?

_______________

2. From whom do you purchase your cigarettes?

_________________________________________________________________

3. Do you have your name and address on all of your vending machines? Yes

No

4. Is the company name and permit number on all vehicles used for transporting cigarettes?

Yes

No

5. Is the location of each machine covered by a local retail permit?

Yes

No

6. List business name and location of each cigarette vending machine (provide separate list if necessary)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

If you have any questions pertaining to this application, please call the Examination Section, Cigarette Tax Unit at 515-281-8023.

70-015b

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1