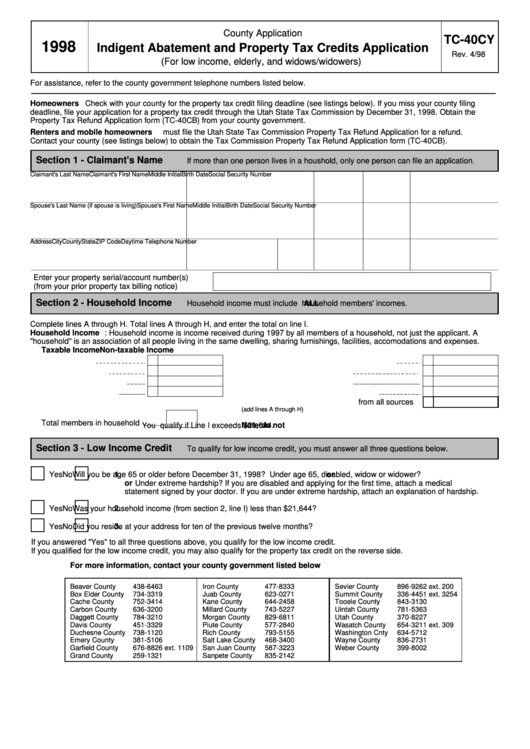

County Application

TC-40CY

1998

Indigent Abatement and Property Tax Credits Application

Rev. 4/98

(For low income, elderly, and widows/widowers)

For assistance, refer to the county government telephone numbers listed below.

Homeowners

Check with your county for the property tax credit filing deadline (see listings below). If you miss your county filing

deadline, file your application for a property tax credit through the Utah State Tax Commission by December 31, 1998. Obtain the

Property Tax Refund Application form (TC-40CB) from your county government.

Renters and mobile homeowners

must file the Utah State Tax Commission Property Tax Refund Application for a refund.

Contact your county (see listings below) to obtain the Tax Commission Property Tax Refund Application form (TC-40CB).

Section 1 - Claimant's Name

If more than one person lives in a houshold, only one person can file an application.

Claimant's Last Name

Claimant's First Name

Middle Initial

Birth Date

Social Security Number

Spouse's Last Name (if spouse is living)

Spouse's First Name

Middle Initial

Birth Date

Social Security Number

Address

City

County

State

ZIP Code

Daytime Telephone Number

Enter your property serial/account number(s)

(from your prior property tax billing notice)

Section 2 - Household Income

Household income must include

ALL

household members' incomes.

Complete lines A through H. Total lines A through H, and enter the total on line I.

Household Income

: Household income is income received during 1997 by all members of a household, not just the applicant. A

"household" is an association of all people living in the same dwelling, sharing furnishings, facilities, accomodations and expenses.

Taxable Income

Non-taxable Income

A. Wages/salaries

A

E. Social Security/other government programs

E

B. Pensions/annuities

B

F. Capital gains/pensions/annuities

F

C. Interest/dividends/trusts

C

G. Interest/dividends/trust income

G

D. Alimony/other income

D

H. Loss carryforwards/rental depreciation

H

I. Total 1997 household income

from all sources

I

(add lines A through H)

Total members in household

Note:

You

do not

qualify if Line I exceeds $21,644.

Section 3 - Low Income Credit

To qualify for low income credit, you must answer all three questions below.

Yes

No

1.

Will you be age 65 or older before December 31, 1998?

or

Under age 65, disabled, widow or widower?

or

Under extreme hardship? If you are disabled and applying for the first time, attach a medical

statement signed by your doctor. If you are under extreme hardship, attach an explanation of hardship.

Yes

No

2.

Was your household income (from section 2, line I) less than $21,644?

Yes

No

3.

Did you reside at your address for ten of the previous twelve months?

If you answered "Yes" to all three questions above, you qualify for the low income credit.

If you qualified for the low income credit, you may also qualify for the property tax credit on the reverse side.

For more information, contact your county government listed below

Beaver County

438-6463

Iron County

477-8333

Sevier County

896-9262 ext. 200

Box Elder County

734-3319

Juab County

623-0271

Summit County

336-4451 ext. 3254

Cache County

752-3414

Kane County

644-2458

Tooele County

843-3130

Carbon County

636-3200

Millard County

743-5227

Uintah County

781-5363

Daggett County

784-3210

Morgan County

829-6811

Utah County

370-8227

Davis County

451-3329

Piute County

577-2840

Wasatch County

654-3211 ext. 309

Duchesne County

738-1120

Rich County

793-5155

Washington Cnty

634-5712

Emery County

381-5106

Salt Lake County

468-3400

Wayne County

836-2731

Garfield County

676-8826 ext. 1109

San Juan County

587-3223

Weber County

399-8002

Grand County

259-1321

Sanpete County

835-2142

40CY.FRM Rev. 4/98

1

1 2

2