1998

1998

F

40EZ

40EZ

1998

1998

1998

40EZ

40EZ

40EZ

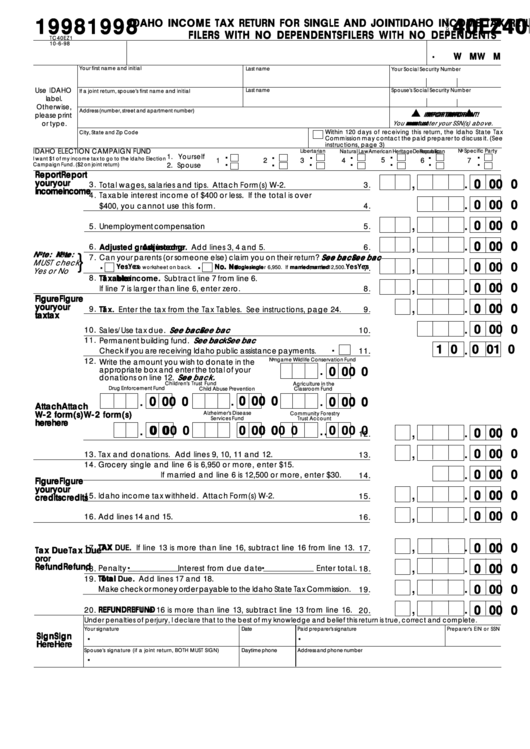

IDAHO INCOME TAX RETURN FOR SINGLE AND JOINT

IDAHO INCOME TAX RETURN FOR SINGLE AND JOINT

IDAHO INCOME TAX RETURN FOR SINGLE AND JOINT

IDAHO INCOME TAX RETURN FOR SINGLE AND JOINT

IDAHO INCOME TAX RETURN FOR SINGLE AND JOINT

O

R

FILERS WITH NO DEPENDENTS

FILERS WITH NO DEPENDENTS

FILERS WITH NO DEPENDENTS

FILERS WITH NO DEPENDENTS

FILERS WITH NO DEPENDENTS

M

TC40EZ1

10-6-98

.

W

W

M

M

W

W

W

M

M

M

Your first name and initial

Last name

Your Social Security Number

Use IDAHO

Last name

Spouse's Social Security Number

If a joint return, spouse's first name and initial

label.

Otherwise,

Address (number, street and apartment number)

IMPOR

IMPOR

IMPORT T T T T ANT!

ANT!

ANT!

ANT!

please print

IMPOR

IMPOR

ANT!

or type.

You m m m m m ust

ust

ust

ust

ust enter your SSN(s) above.

Within 120 days of receiving this return, the Idaho State Tax

City, State and Zip Code

Commission may contact the paid preparer to discuss it. (See

instructions, page 3)

. .

. .

. .

. .

. .

. .

. .

IDAHO ELECTION CAMPAIGN FUND

Libertarian

No Specific Party

American Heritage

Democratic

Natural Law

Reform

Republican

1. Yourself

I want $1 of my income tax to go to the Idaho Election

2

3

4

5

6

1

7

Campaign Fund. ($2 on joint return)

2. Spouse

Report

Report

Report

Report

Report

,

.

your

your

your

0 0

0 0

0 0

0 0

0 0

your

your

3 .

Total wages, salaries and tips. Attach Form(s) W-2.

3 .

income

income

income

income

income

4 .

Taxable interest income of $400 or less. If the total is over

.

0 0

0 0

0 0

0 0

0 0

$400, you cannot use this form.

4 .

,

.

0 0

0 0

0 0

0 0

0 0

5 .

Unemployment compensation

5 .

,

.

0 0

0 0

0 0

0 0

0 0

6 .

Adjusted gr

Adjusted gr

Adjusted gross income.

oss income.

oss income.

oss income. Add lines 3, 4 and 5.

6 .

Adjusted gr

Adjusted gr

oss income.

Note:

Note:

Note:

Note: You

Note:

}

7 .

See bac

See bac

See back. k. k. k. k.

Can your parents (or someone else) claim you on their return? See bac

See bac

.

.

MUST check

,

.

0 0

0 0

0 0

0 0

0 0

Yes

Yes

Yes

Yes

Yes.

No.

No.

No.

No.

No.

Do worksheet on back.

7 .

If single

single

single

single

single, enter 6,950. If married

married

married

married

married, enter 12,500.

Yes or No

8 .

T T T T T axa

axa

axa

ble income.

ble income.

axa

axable income.

ble income.

ble income. Subtract line 7 from line 6.

,

.

0 0

0 0

0 0

0 0

0 0

If line 7 is larger than line 6, enter zero.

8 .

Figure

Figure

Figure

Figure

Figure

,

.

your

your

your

0 0

0 0

your

your

0 0

0 0

0 0

9 .

T T T T T ax.

ax.

ax.

ax.

ax. Enter the tax from the Tax Tables. See instructions, page 24.

9 .

tax

tax

tax

tax

tax

.

0 0

0 0

0 0

0 0

0 0

10.

See bac

See bac

See back. k. k. k. k.

Sales/Use tax due. See bac

See bac

10.

11.

Permanent building fund. See bac

See bac

See bac

See bac

See back. k. k. k. k.

.

.

1 0

1 0

1 0

1 0

1 0

0 0

0 0

0 0

0 0

0 0

Check if you are receiving Idaho public assistance payments.

11.

Nongame Wildlife Conservation Fund

12.

Write the amount you wish to donate in the

.

appropriate box and enter the total of your

0 0

0 0

0 0

0 0

0 0

See back.

See back.

donations on line 12. See back.

See back.

See back.

Children's Trust Fund

Agriculture in the

Drug Enforcement Fund

Child Abuse Prevention

Classroom Fund

.

.

.

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

Attach

Attach

Attach

Attach

Attach

W-2 form(s)

W-2 form(s)

Alzheimer's Disease

W-2 form(s)

W-2 form(s)

W-2 form(s)

Community Forestry

U.S. Olympic Fund

Services Fund

Trust Account

here

here

here

here

here

.

.

.

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

,

.

0 0

0 0

0 0

0 0

0 0

12.

,

.

0 0

0 0

0 0

0 0

0 0

Tax and donations. Add lines 9, 10, 11 and 12.

13.

13.

14.

Grocery credit.

If single and line 6 is 6,950 or more, enter $15.

.

0 0

0 0

0 0

0 0

0 0

If married and line 6 is 12,500 or more, enter $30.

14.

Figure

Figure

Figure

Figure

Figure

your

your

your

your

your

,

.

0 0

0 0

0 0

0 0

0 0

15.

Idaho income tax withheld. Attach Form(s) W-2.

15.

credits

credits

credits

credits

credits

,

.

0 0

0 0

0 0

0 0

0 0

16.

Add lines 14 and 15.

16.

,

.

0 0

0 0

0 0

0 0

0 0

17.

T T T T T AX DUE.

AX DUE.

AX DUE.

AX DUE.

AX DUE. If line 13 is more than line 16, subtract line 16 from line 13.

17.

Tax Due

Tax Due

Tax Due

Tax Due

Tax Due

or or or or or

.

.

,

.

Refund

Refund

Refund

Refund

Refund

0 0

0 0

0 0

0 0

0 0

18.

Penalty

Interest from due date

Enter total.

18.

19.

T T T T T otal Due.

otal Due.

otal Due.

otal Due. Add lines 17 and 18.

otal Due.

,

.

0 0

0 0

0 0

0 0

0 0

Make check or money order payable to the Idaho State Tax Commission.

19.

,

.

0 0

0 0

0 0

0 0

0 0

REFUND

REFUND

REFUND. If line 16 is more than line 13, subtract line 13 from line 16.

20.

REFUND

REFUND

20.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Your signature

Date

Paid preparer's signature

Preparer's EIN or SSN

.

.

Sign

Sign

Sign

Sign

Sign

Here

Here

Here

Here

Here

Spouse's signature (if a joint return, BOTH MUST SIGN)

Daytime phone

Address and phone number

.

1

1 2

2