Form 4 (Final Draft) - Application For Extension Of Time To File Michigan Tax Returns - 2007

ADVERTISEMENT

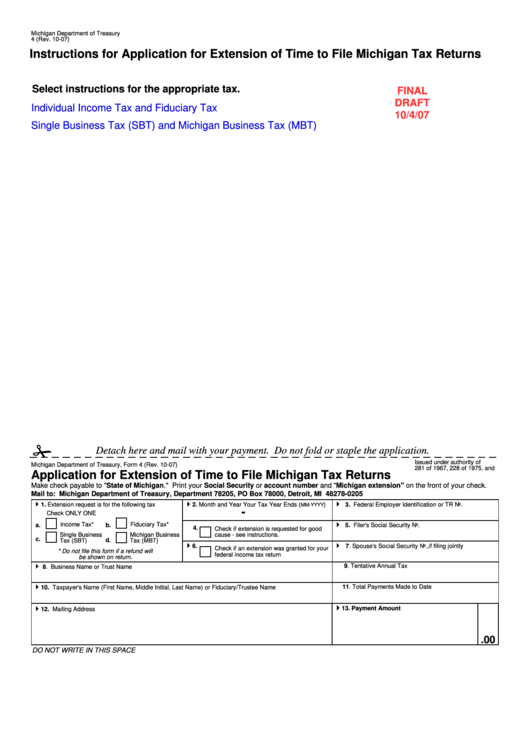

Michigan Department of Treasury

4 (Rev. 10-07)

Instructions for Application for Extension of Time to File Michigan Tax Returns

Select instructions for the appropriate tax.

FINAL

DRAFT

Individual Income Tax and Fiduciary Tax

10/4/07

Single Business Tax (SBT) and Michigan Business Tax (MBT)

Detach here and mail with your payment. Do not fold or staple the application.

Issued under authority of P.A.

Michigan Department of Treasury, Form 4 (Rev. 10-07)

281 of 1967, 228 of 1975, and

Application for Extension of Time to File Michigan Tax Returns

P.A. 36 of 2007.

Make check payable to "State of Michigan." Print your Social Security or account number and "Michigan extension" on the front of your check.

Mail to: Michigan Department of Treasury, Department 78205, PO Box 78000, Detroit, MI 48278-0205

1. Extension request is for the following tax

2. Month and Year Your Tax Year Ends (

)

3. Federal Employer Identification or TR No.

MM-YYYY

-

Check ONLY ONE

Income Tax*

Fiduciary Tax*

a.

b.

5. Filer's Social Security No.

4.

Check if extension is requested for good

Single Business

Michigan Business

cause - see instructions.

c.

d.

Tax (SBT)

Tax (MBT)

6.

7. Spouse's Social Security No., if filing jointly

Check if an extension was granted for your

* Do not file this form if a refund will

federal income tax return

be shown on return.

9. Tentative Annual Tax

8. Business Name or Trust Name

11. Total Payments Made to Date

10. Taxpayer's Name (First Name, Middle Initial, Last Name) or Fiduciary/Trustee Name

13. Payment Amount

12. Mailing Address

.00

DO NOT WRITE IN THIS SPACE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5