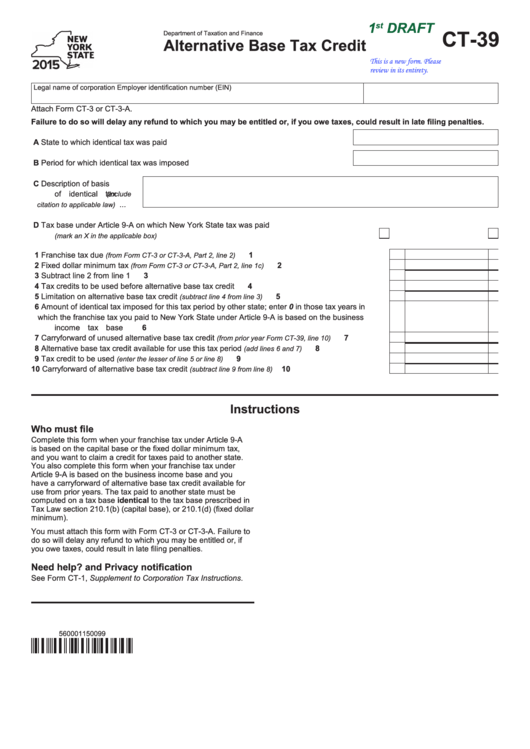

Form Ct-39 - Alternative Base Tax Credit - 2015

ADVERTISEMENT

1

DRAFT

st

CT-39

Department of Taxation and Finance

Alternative Base Tax Credit

This is a new form. Please

review in its entirety.

Legal name of corporation

Employer identification number (EIN)

Attach Form CT-3 or CT-3-A.

Failure to do so will delay any refund to which you may be entitled or, if you owe taxes, could result in late filing penalties.

A State to which identical tax was paid .................................................................................

B Period for which identical tax was imposed .......................................................................

C Description of basis

of identical tax

(include

...

citation to applicable law)

D Tax base under Article 9-A on which New York State tax was paid

................................................................................ Capital base

Fixed dollar minimum

(mark an X in the applicable box)

1 Franchise tax due

1

...................................................................

(from Form CT-3 or CT-3-A, Part 2, line 2)

2 Fixed dollar minimum tax

......................................................

2

(from Form CT-3 or CT-3-A, Part 2, line 1c)

3 Subtract line 2 from line 1 ...................................................................................................................

3

4 Tax credits to be used before alternative base tax credit ....................................................................

4

5 Limitation on alternative base tax credit

.......................................................

5

(subtract line 4 from line 3)

6 Amount of identical tax imposed for this tax period by other state; enter 0 in those tax years in

which the franchise tax you paid to New York State under Article 9-A is based on the business

income tax base ..............................................................................................................................

6

7 Carryforward of unused alternative base tax credit

.......................

7

(from prior year Form CT-39, line 10)

8 Alternative base tax credit available for use this tax period

....................................

8

(add lines 6 and 7)

9 Tax credit to be used

.........................................................................

9

(enter the lesser of line 5 or line 8)

10 Carryforward of alternative base tax credit

.................................................. 10

(subtract line 9 from line 8)

Instructions

Who must file

Complete this form when your franchise tax under Article 9-A

is based on the capital base or the fixed dollar minimum tax,

and you want to claim a credit for taxes paid to another state.

You also complete this form when your franchise tax under

Article 9-A is based on the business income base and you

have a carryforward of alternative base tax credit available for

use from prior years. The tax paid to another state must be

computed on a tax base identical to the tax base prescribed in

Tax Law section 210.1(b) (capital base), or 210.1(d) (fixed dollar

minimum).

You must attach this form with Form CT-3 or CT-3-A. Failure to

do so will delay any refund to which you may be entitled or, if

you owe taxes, could result in late filing penalties.

Need help? and Privacy notification

See Form CT-1, Supplement to Corporation Tax Instructions.

560001150099

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1