F

1998

1998

4 0

4 0

1998

1998

1998

4 0

4 0

4 0

O

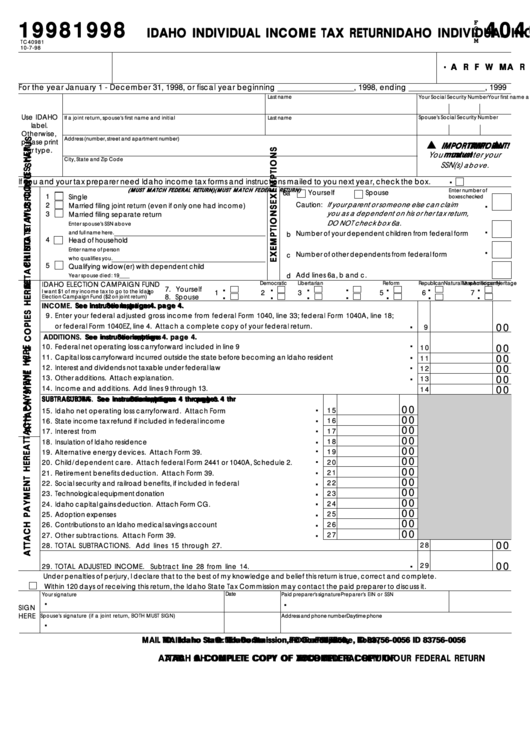

IDAHO INDIVIDUAL INCOME TAX RETURN

IDAHO INDIVIDUAL INCOME TAX RETURN

IDAHO INDIVIDUAL INCOME TAX RETURN

IDAHO INDIVIDUAL INCOME TAX RETURN

IDAHO INDIVIDUAL INCOME TAX RETURN

R

M

TC40981

10-7-98

.

A R F W M

A R F W M

A R F W M

A R F W M

A R F W M

For the year January 1 - December 31, 1998, or fiscal year beginning ___________________, 1998, ending ___________________, 1999

Your first name and initial

Last name

Your Social Security Number

Use IDAHO

Last name

Spouse's Social Security Number

If a joint return, spouse's first name and initial

label.

Otherwise,

Address (number, street and apartment number)

please print

IMPOR

IMPOR

IMPOR

IMPOR

IMPORT T T T T ANT!

ANT!

ANT!

ANT!

ANT!

or type.

You m m m m m ust

ust

ust

ust enter your

ust

City, State and Zip Code

SSN(s)

above.

.

If you and your tax preparer need Idaho income tax forms and instructions mailed to you next year, check the box.

(MUST MATCH FEDERAL RETURN)

(MUST MATCH FEDERAL RETURN)

(MUST MATCH FEDERAL RETURN)

(MUST MATCH FEDERAL RETURN)

(MUST MATCH FEDERAL RETURN)

Enter number of

Yourself

Spouse

6a

1

Single

boxes checked

.

Caution: If your parent or someone else can claim

2

Married filing joint return (even if only one had income)

you as a dependent on his or her tax return,

3

Married filing separate return

DO NOT check box 6a .

Enter spouse's SSN above

.

and full name here.

Number of your dependent children from federal form ......

b

4

Head of household

.

Enter name of person

Number of other dependents from federal form .................

c

who qualifies you.

5

Qualifying widow(er) with dependent child

Add lines 6a, b and c. ...........................................................

d

Year spouse died: 19____

.

.

.

. .

.

. .

. .

American Heritage

Democratic

Libertarian

Natural Law

Reform

Republican

No specific party

IDAHO ELECTION CAMPAIGN FUND

7. Yourself

.

.

.

.

I want $1 of my income tax to go to the Idaho

1

2

3

4

5

6

7

Election Campaign Fund ($2 on joint return)

8. Spouse

INCOME.

INCOME.

INCOME.

INCOME.

INCOME. See instr

See instr

See instr

See instr

See instructions

uctions

uctions

uctions

uctions, , , , , page 4.

page 4.

page 4.

page 4.

page 4.

9 .

Enter your federal adjusted gross income from federal Form 1040, line 33; federal Form 1040A, line 18;

.

or federal Form 1040EZ, line 4. Attach a complete copy of your federal return.

0 0

9

ADDITIONS.

ADDITIONS.

ADDITIONS. See instr

See instr

See instr

See instructions

uctions

uctions

uctions, , , , , page 4.

page 4.

page 4.

page 4.

ADDITIONS.

ADDITIONS.

See instr

uctions

page 4.

.

10.

Federal net operating loss carryforward included in line 9 ........................................................................................

0 0

1 0

.

11.

Capital loss carryforward incurred outside the state before becoming an Idaho resident ......................................

0 0

1 1

.

12.

Interest and dividends not taxable under federal law ................................................................................................

0 0

1 2

.

13.

Other additions. Attach explanation. .........................................................................................................................

0 0

1 3

14.

Income and additions. Add lines 9 through 13.

0 0

1 4

SUBTRA

SUBTRA

CTIONS.

CTIONS.

See instr

See instr

uctions

uctions

uctions, , , , , pages 4 thr

pages 4 thr

pages 4 thr

ough 6.

ough 6.

SUBTRA

SUBTRACTIONS.

SUBTRA

CTIONS.

CTIONS. See instr

See instr

See instructions

uctions

pages 4 thr

pages 4 through 6.

ough 6.

ough 6.

.

0 0

1 5

15.

Idaho net operating loss carryforward. Attach Form 56. .......................................

.

0 0

1 6

16.

State income tax refund if included in federal income .............................................

.

0 0

1 7

17.

Interest from U.S. Government ..................................................................................

.

0 0

18.

Insulation of Idaho residence ......................................................................................

1 8

.

0 0

1 9

19.

Alternative energy devices. Attach Form 39. ..........................................................

.

0 0

2 0

20.

Child/dependent care. Attach federal Form 2441 or 1040A, Schedule 2. ...........

.

0 0

2 1

21.

Retirement benefits deduction. Attach Form 39. ....................................................

.

0 0

2 2

22.

Social security and railroad benefits, if included in federal income ........................

.

0 0

2 3

23.

Technological equipment donation .............................................................................

.

0 0

24.

Idaho capital gains deduction. Attach Form CG. .....................................................

2 4

.

0 0

2 5

25.

Adoption expenses ......................................................................................................

.

0 0

2 6

26.

Contributions to an Idaho medical savings account .................................................

.

0 0

2 7

27.

Other subtractions. Attach Form 39. .......................................................................

0 0

2 8

28.

TOTAL SUBTRACTIONS. Add lines 15 through 27.

.

0 0

2 9

29.

TOTAL ADJUSTED INCOME. Subtract line 28 from line 14.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Within 120 days of receiving this return, the Idaho State Tax Commission may contact the paid preparer to discuss it.

Date

Your signature

Paid preparer's signature

Preparer's EIN or SSN

.

.

SIGN

HERE

Spouse's signature (if a joint return, BOTH MUST SIGN)

Daytime phone

Address and phone number

.

MAIL

MAIL

MAIL T T T T T O: Idaho Sta

O: Idaho Sta

O: Idaho Sta

O: Idaho State te te te te T T T T T ax Commission,

ax Commission,

ax Commission,

PO Bo

PO Bo

x 56,

x 56,

Boise,

Boise,

ID 83756-0056

ID 83756-0056

MAIL

MAIL

O: Idaho Sta

ax Commission,

ax Commission, PO Bo

PO Bo

PO Box 56,

x 56,

x 56, Boise,

Boise,

Boise, ID 83756-0056

ID 83756-0056

ID 83756-0056

A A A A A TT TT TT TT TTA A A A A CH

CH

CH

CH A COMPLETE COPY OF

A COMPLETE COPY OF

A COMPLETE COPY OF Y Y Y Y Y OUR FEDERAL RETURN

A COMPLETE COPY OF

OUR FEDERAL RETURN

OUR FEDERAL RETURN

OUR FEDERAL RETURN

CH

A COMPLETE COPY OF

OUR FEDERAL RETURN

1

1 2

2