Instructions For Form Mi-2210, Underpayment Of Estimated Income Tax

ADVERTISEMENT

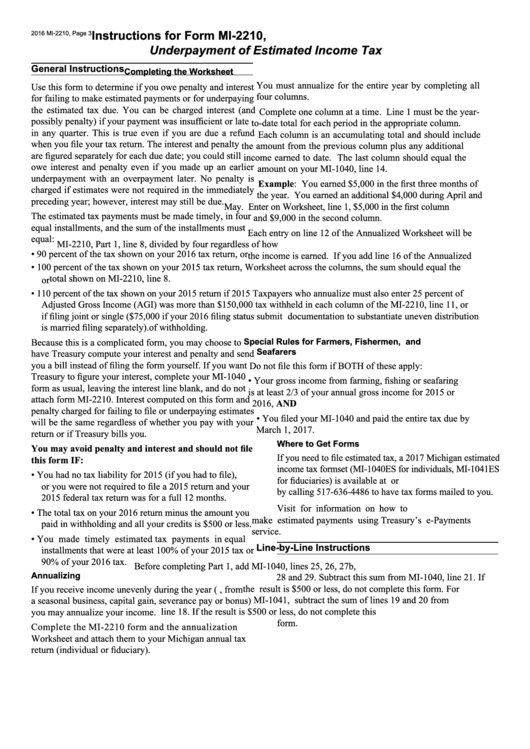

Instructions for Form MI-2210,

2016 MI-2210, Page 3

Underpayment of Estimated Income Tax

General Instructions

Completing the Worksheet

You must annualize for the entire year by completing all

Use this form to determine if you owe penalty and interest

four columns.

for failing to make estimated payments or for underpaying

the estimated tax due. You can be charged interest (and

Complete one column at a time. Line 1 must be the year-

possibly penalty) if your payment was insufficient or late

to-date total for each period in the appropriate column.

in any quarter. This is true even if you are due a refund

Each column is an accumulating total and should include

when you file your tax return. The interest and penalty

the amount from the previous column plus any additional

are figured separately for each due date; you could still

income earned to date. The last column should equal the

owe interest and penalty even if you made up an earlier

amount on your MI-1040, line 14.

underpayment with an overpayment later. No penalty is

Example: You earned $5,000 in the first three months of

charged if estimates were not required in the immediately

the year. You earned an additional $4,000 during April and

preceding year; however, interest may still be due.

May. Enter on Worksheet, line 1, $5,000 in the first column

The estimated tax payments must be made timely, in four

and $9,000 in the second column.

equal installments, and the sum of the installments must

Each entry on line 12 of the Annualized Worksheet will be

equal:

MI-2210, Part 1, line 8, divided by four regardless of how

• 90 percent of the tax shown on your 2016 tax return, or

the income is earned. If you add line 16 of the Annualized

• 100 percent of the tax shown on your 2015 tax return,

Worksheet across the columns, the sum should equal the

total shown on MI-2210, line 8.

or

• 110 percent of the tax shown on your 2015 return if 2015

Taxpayers who annualize must also enter 25 percent of

Adjusted Gross Income (AGI) was more than $150,000

tax withheld in each column of the MI-2210, line 11, or

if filing joint or single ($75,000 if your 2016 filing status

submit documentation to substantiate uneven distribution

is married filing separately).

of withholding.

Because this is a complicated form, you may choose to

Special Rules for Farmers, Fishermen, and

Seafarers

have Treasury compute your interest and penalty and send

you a bill instead of filing the form yourself. If you want

Do not file this form if BOTH of these apply:

Treasury to figure your interest, complete your MI-1040

• Your gross income from farming, fishing or seafaring

form as usual, leaving the interest line blank, and do not

is at least 2/3 of your annual gross income for 2015 or

attach form MI-2210. Interest computed on this form and

2016, AND

penalty charged for failing to file or underpaying estimates

• You filed your MI-1040 and paid the entire tax due by

will be the same regardless of whether you pay with your

March 1, 2017.

return or if Treasury bills you.

Where to Get Forms

You may avoid penalty and interest and should not file

If you need to file estimated tax, a 2017 Michigan estimated

this form IF:

income tax formset (MI-1040ES for individuals, MI-1041ES

• You had no tax liability for 2015 (if you had to file),

for fiduciaries) is available at or

or you were not required to file a 2015 return and your

by calling 517-636-4486 to have tax forms mailed to you.

2015 federal tax return was for a full 12 months.

Visit for information on how to

• The total tax on your 2016 return minus the amount you

make estimated payments using Treasury’s e-Payments

paid in withholding and all your credits is $500 or less.

service.

• You made timely estimated tax payments in equal

Line-by-Line Instructions

installments that were at least 100% of your 2015 tax or

90% of your 2016 tax.

Before completing Part 1, add MI-1040, lines 25, 26, 27b,

Annualizing

28 and 29. Subtract this sum from MI-1040, line 21. If

the result is $500 or less, do not complete this form. For

If you receive income unevenly during the year (e.g., from

MI-1041, subtract the sum of lines 19 and 20 from

a seasonal business, capital gain, severance pay or bonus)

line 18. If the result is $500 or less, do not complete this

you may annualize your income.

form.

Complete the MI-2210 form and the annualization

Worksheet and attach them to your Michigan annual tax

return (individual or fiduciary).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2