Form 506 Draft - Investment/new Jobs Credit - 2016

ADVERTISEMENT

Barcode

Draft

Placeholder

State of Oklahoma

9/29/16

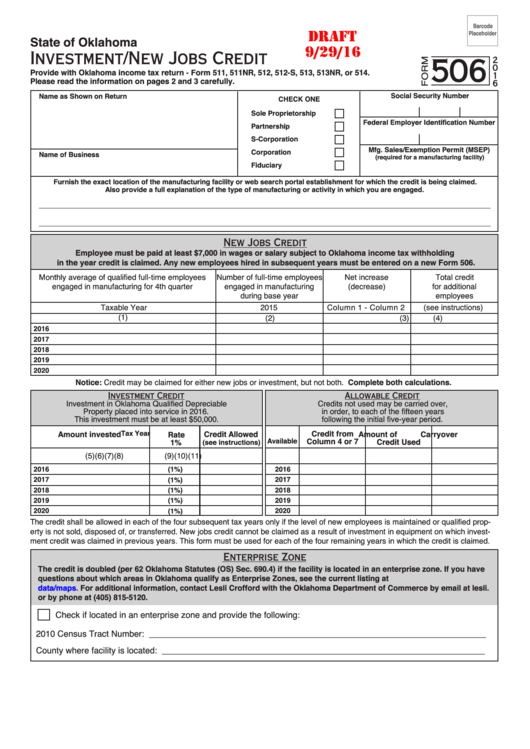

Investment/New Jobs Credit

506

2

0

Provide with Oklahoma income tax return - Form 511, 511NR, 512, 512-S, 513, 513NR, or 514.

1

Please read the information on pages 2 and 3 carefully.

6

Social Security Number

Name as Shown on Return

CHECK ONE

Sole Proprietorship

Federal Employer Identification Number

Partnership

S-Corporation

Mfg. Sales/Exemption Permit (MSEP)

Corporation

Name of Business

(required for a manufacturing facility)

Fiduciary

Furnish the exact location of the manufacturing facility or web search portal establishment for which the credit is being claimed.

Also provide a full explanation of the type of manufacturing or activity in which you are engaged.

New Jobs Credit

Employee must be paid at least $7,000 in wages or salary subject to Oklahoma income tax withholding

in the year credit is claimed. Any new employees hired in subsequent years must be entered on a new Form 506.

Monthly average of qualified full-time employees

Number of full-time employees

Net increase

Total credit

engaged in manufacturing for 4th quarter

engaged in manufacturing

(decrease)

for additional

during base year

employees

2015

(see instructions)

Taxable Year

Column 1 - Column 2

(1)

(2)

(3)

(4)

2016

2017

2018

2019

2020

Notice: Credit may be claimed for either new jobs or investment, but not both. Complete both calculations.

Investment Credit

Allowable Credit

Investment in Oklahoma Qualified Depreciable

Credits not used may be carried over,

Property placed into service in 2016.

in order, to each of the fifteen years

This investment must be at least $50,000.

following the initial five-year period.

Credit from

Amount invested

Credit Allowed

Tax Year

Amount of

Rate

Carryover

Column 4 or 7

Available

Credit Used

1%

(see instructions)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

2016

2016

(1%)

2017

(1%)

2017

2018

(1%)

2018

2019

(1%)

2019

2020

2020

(1%)

The credit shall be allowed in each of the four subsequent tax years only if the level of new employees is maintained or qualified prop-

erty is not sold, disposed of, or transferred. New jobs credit cannot be claimed as a result of investment in equipment on which invest-

ment credit was claimed in previous years. This form must be used for each of the four remaining years in which the credit is claimed.

Enterprise Zone

The credit is doubled (per 62 Oklahoma Statutes (OS) Sec. 690.4) if the facility is located in an enterprise zone. If you have

questions about which areas in Oklahoma qualify as Enterprise Zones, see the current listing at

data/maps. For additional information, contact Lesli Crofford with the Oklahoma Department of Commerce by email at lesli.

crofford@commerce.ok.gov or by phone at (405) 815-5120.

Check if located in an enterprise zone and provide the following:

2010 Census Tract Number: _______________________________________________________________________

County where facility is located: ____________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3