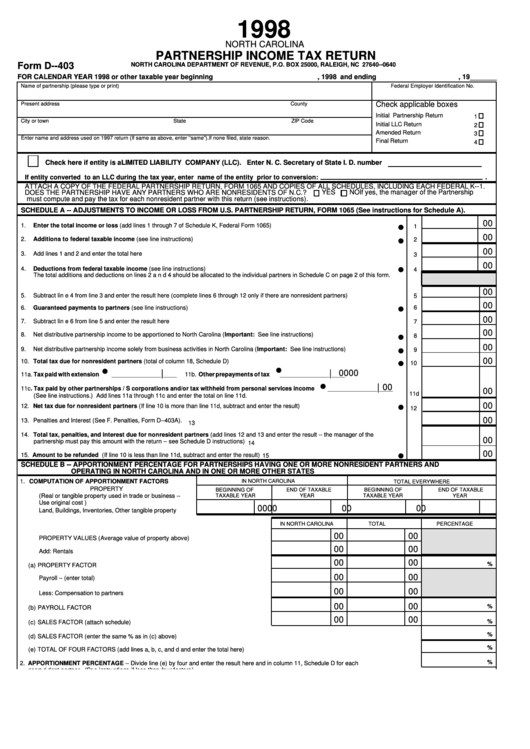

1998

NORTH CAROLINA

PARTNERSHIP INCOME TAX RETURN

Form D--403

NORTH CAROLINA DEPARTMENT OF REVENUE, P.O. BOX 25000, RALEIGH, NC 27640--0640

FOR CALENDAR YEAR 1998 or other taxable year beginning

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

, 1998 and ending

. . . . . . . . . . . . . . . . . . . . .

, 19_______

Name of partnership (please type or print)

Federal Employer Identification No.

Check applicable boxes

Present address

County

Initial Partnership Return

1

City or town

State

ZIP Code

Initial LLC Return

2

Amended Return

3

Enter name and address used on 1997 return (If same as above, enter ‘ ‘ same” ). If none filed, state reason.

Final Return

4

Check here if entity is a LIMITED LIABILITY COMPANY (LLC). Enter N. C. Secretary of State I. D. number

If entity converted to an LLC during the tax year, enter name of the entity prior to conversion:

.

ATTACH A COPY OF THE FEDERAL PARTNERSHIP RETURN, FORM 1065 AND COPIES OF ALL SCHEDULES, INCLUDING EACH FEDERAL K--1.

YES

NO

If yes, the manager of the Partnership

DOES THE PARTNERSHIP HAVE ANY PARTNERS WHO ARE NONRESIDENTS OF N.C.?

must compute and pay the tax for each nonresident partner with this return (see instructions).

SCHEDULE A -- ADJUSTMENTS TO INCOME OR LOSS FROM U.S. PARTNERSHIP RETURN, FORM 1065 (See instructions for Schedule A).

00

1.

Enter the total income or loss (add lines 1 through 7 of Schedule K, Federal Form 1065) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

1

00

2.

Additions to federal taxable income (see line instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

D

00

3.

Add lines 1 and 2 and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4.

Deductions from federal taxable income (see line instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

4

The total additions and deductions on lines 2 and 4 should be allocated to the individual partners in Schedule C on page 2 of this form.

00

5.

Subtract line 4 from line 3 and enter the result here (complete lines 6 through 12 only if there are nonresident partners) . . . . . . . . . . . . . . .

5

00

6.

Guaranteed payments to partners (see line instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

D

00

7.

Subtract line 6 from line 5 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8.

Net distributive partnership income to be apportioned to North Carolina (Important: See line instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

8

D

00

9.

Net distributive partnership income solely from business activities in North Carolina (Important: See line instructions) . . . . . . . . . . . . . . . .

D

9

00

10. Total tax due for nonresident partners (total of column 18, Schedule D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

10

D

D

|

|

00

00

11a. Tax paid with extension

_______________

____

11b. Other prepayments of tax

_______________

____

|

00

D

11c. Tax paid by other partnerships / S corporations and/or tax withheld from personal services income

_______________

____

00

11d

(See line instructions.) Add lines 11a through 11c and enter the total on line 11d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12. Net tax due for nonresident partners (If line 10 is more than line 11d, subtract and enter the result). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

12

00

13. Penalties and Interest (See F. Penalties, Form D--403A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. Total tax, penalties, and interest due for nonresident partners (add lines 12 and 13 and enter the result -- the manager of the

00

partnership must pay this amount with the return -- see Schedule D instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

15. Amount to be refunded (If line 10 is less than line 11d, subtract and enter the result) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

15

SCHEDULE B -- APPORTIONMENT PERCENTAGE FOR PARTNERSHIPS HAVING ONE OR MORE NONRESIDENT PARTNERS AND

OPERATING IN NORTH CAROLINA AND IN ONE OR MORE OTHER STATES

1. COMPUTATION OF APPORTIONMENT FACTORS

IN NORTH CAROLINA

TOTAL EVERYWHERE

PROPERTY

BEGINNING OF

END OF TAXABLE

BEGINNING OF

END OF TAXABLE

(Real or tangible property used in trade or business --

TAXABLE YEAR

YEAR

TAXABLE YEAR

YEAR

Use original cost )

00

00

00

00

Land, Buildings, Inventories, Other tangible property . . . . .

IN NORTH CAROLINA

TOTAL

PERCENTAGE

00

00

PROPERTY VALUES (Average value of property above) . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Add: Rentals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

%

(a) PROPERTY FACTOR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Payroll -- (enter total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Less: Compensation to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

%

(b) PAYROLL FACTOR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

%

(c) SALES FACTOR (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(d) SALES FACTOR (enter the same % as in (c) above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

(e) TOTAL OF FOUR FACTORS (add lines a, b, c, and d and enter the total here) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

2. APPORTIONMENT PERCENTAGE -- Divide line (e) by four and enter the result here and in column 11, Schedule D for each . . . . . . . . . . . . . . . . . . .

nonresident partner. (See instructions if less than four factors)

1

1 2

2