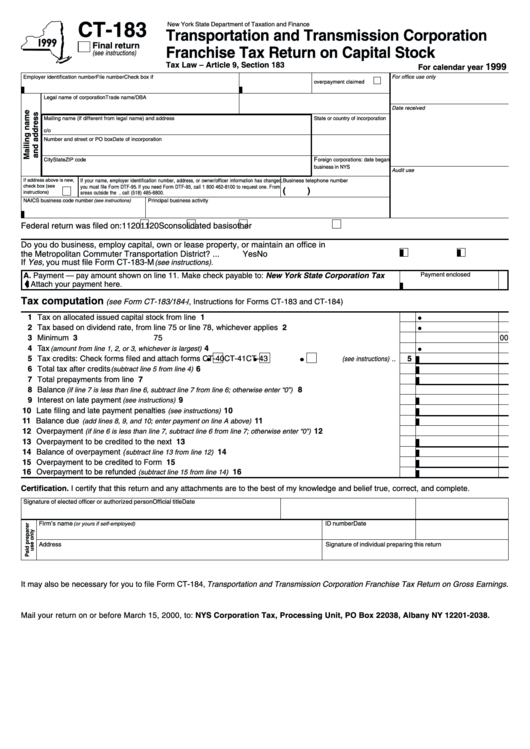

CT-183

New York State Department of Taxation and Finance

Transportation and Transmission Corporation

Final return

Franchise Tax Return on Capital Stock

(see instructions)

Tax Law – Article 9, Section 183

1999

For calendar year

For office use only

Employer identification number

File number

Check box if

overpayment claimed

Legal name of corporation

Trade name/DBA

Date received

Mailing name (if different from legal name) and address

State or country of incorporation

c/o

Number and street or PO box

Date of incorporation

F

City

State

ZIP code

oreign corporations: date began

business in NYS

Audit use

If address above is new,

If your name, employer identification number, address, or owner/officer information has changed,

Business telephone number

check box (see

you must file Form DTF-95 . If you need Form DTF-95, call 1 800 462-8100 to request one. From

(

)

instructions)

areas outside the U.S. and outside Canada, call (518) 485-6800.

NAICS business code number

(see instructions)

Principal business activity

Federal return was filed on:

1120

1120S

consolidated basis

other

Do you do business, employ capital, own or lease property, or maintain an office in

the Metropolitan Commuter Transportation District? ................................................................................

Yes

No

If Yes, you must file Form CT-183-M

(see instructions).

A. Payment — pay amount shown on line 11. Make check payable to: New York State Corporation Tax

Payment enclosed

........

Attach your payment here.

Tax computation

(see Form CT-183/184- I, Instructions for Forms CT-183 and CT-184)

1 Tax on allocated issued capital stock from line 56 .......................................................................................

1

2 Tax based on dividend rate, from line 75 or line 78, whichever applies ......................................................

2

3 Minimum tax ................................................................................................................................................

3

75 00

4 Tax

........................................................................................

4

(amount from line 1, 2, or 3, whichever is largest)

5 Tax credits: Check forms filed and attach forms

CT-40

CT-41

CT-43

5

(see instructions) ..

6 Total tax after credits

............................................................................................

6

(subtract line 5 from line 4)

7 Total prepayments from line 82 ...................................................................................................................

7

8 Balance

.............................................

8

(if line 7 is less than line 6, subtract line 7 from line 6; otherwise enter “0”)

9 Interest on late payment

....................................................................................................

9

(see instructions)

10 Late filing and late payment penalties

............................................................................... 10

(see instructions)

11 Balance due

.................................................................

11

(add lines 8, 9, and 10; enter payment on line A above)

12 Overpayment

..................................... 12

(if line 6 is less than line 7, subtract line 6 from line 7; otherwise enter “0”)

13 Overpayment to be credited to the next period ........................................................................................... 13

14 Balance of overpayment (

.................................................................................. 14

subtract line 13 from line 12)

15 Overpayment to be credited to Form CT-183-M .......................................................................................... 15

16 Overpayment to be refunded

........................................................................... 16

(subtract line 15 from line 14)

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature of elected officer or authorized person

Official title

Date

Firm’s name

ID number

Date

(or yours if self-employed)

Address

Signature of individual preparing this return

It may also be necessary for you to file Form CT-184, Transportation and Transmission Corporation Franchise Tax Return on Gross Earnings.

Mail your return on or before March 15, 2000, to: NYS Corporation Tax, Processing Unit, PO Box 22038, Albany NY 12201-2038.

1

1 2

2 3

3 4

4