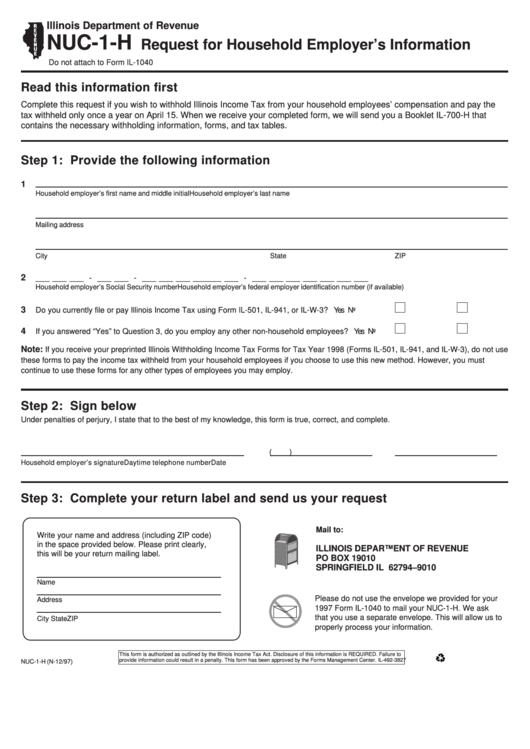

Illinois Department of Revenue

NUC-1-H

Request for Household Employer’s Information

Do not attach to Form IL-1040

Read this information first

Complete this request if you wish to withhold Illinois Income Tax from your household employees’ compensation and pay the

tax withheld only once a year on April 15. When we receive your completed form, we will send you a Booklet IL-700-H that

contains the necessary withholding information, forms, and tax tables.

Step 1: Provide the following information

1

Household employer’s first name and middle initial

Household employer’s last name

Mailing address

City

State

ZIP

2

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Household employer’s Social Security number

Household employer’s federal employer identification number (if available)

3

Do you currently file or pay Illinois Income Tax using Form IL-501, IL-941, or IL-W-3?

Yes

No

4

If you answered “Yes” to Question 3, do you employ any other non-household employees?

Yes

No

Note:

If you receive your preprinted Illinois Withholding Income Tax Forms for Tax Year 1998 (Forms IL-501, IL-941, and IL-W-3), do not use

these forms to pay the income tax withheld from your household employees if you choose to use this new method. However, you must

continue to use these forms for any other types of employees you may employ.

Step 2: Sign below

Under penalties of perjury, I state that to the best of my knowledge, this form is true, correct, and complete.

(

)

Household employer’s signature

Daytime telephone number

Date

Step 3: Complete your return label and send us your request

Mail to:

Write your name and address (including ZIP code)

in the space provided below. Please print clearly,

ILLINOIS DEPARTMENT OF REVENUE

this will be your return mailing label.

PO BOX 19010

SPRINGFIELD IL 62794–9010

Name

Please do not use the envelope we provided for your

Address

1997 Form IL-1040 to mail your NUC-1-H. We ask

that you use a separate envelope. This will allow us to

City

State

ZIP

properly process your information.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3827

NUC-1-H (N-12/97)

1

1