Instructions For Form 104cr

ADVERTISEMENT

21

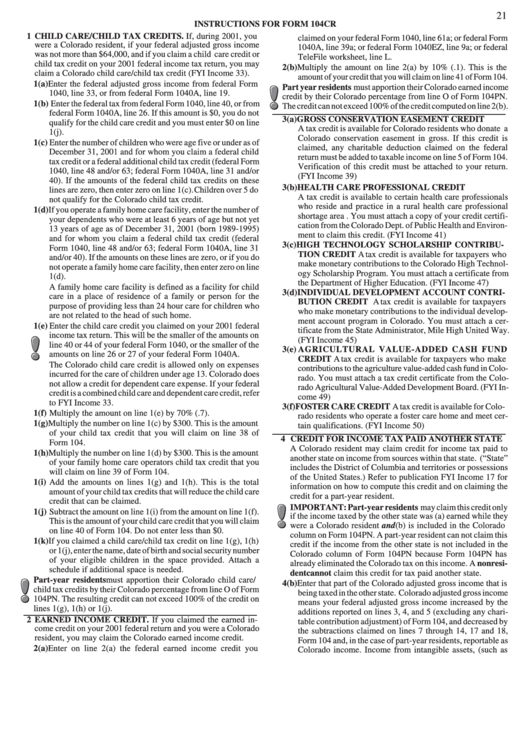

INSTRUCTIONS FOR FORM 104CR

1 CHILD CARE/CHILD TAX CREDITS. If, during 2001, you

claimed on your federal Form 1040, line 61a; or federal Form

were a Colorado resident, if your federal adjusted gross income

1040A, line 39a; or federal Form 1040EZ, line 9a; or federal

was not more than $64,000, and if you claim a child care credit or

TeleFile worksheet, line L.

child tax credit on your 2001 federal income tax return, you may

2(b)Multiply the amount on line 2(a) by 10% (.1). This is the

claim a Colorado child care/child tax credit (FYI Income 33).

amount of your credit that you will claim on line 41 of Form 104.

1(a) Enter the federal adjusted gross income from federal Form

Part year residents must apportion their Colorado earned income

1040, line 33, or from federal Form 1040A, line 19.

credit by their Colorado percentage from line O of Form 104PN.

1(b) Enter the federal tax from federal Form 1040, line 40, or from

The credit can not exceed 100% of the credit computed on line 2(b).

federal Form 1040A, line 26. If this amount is $0, you do not

3(a) GROSS CONSERVATION EASEMENT CREDIT

qualify for the child care credit and you must enter $0 on line

A tax credit is available for Colorado residents who donate a

1(j).

Colorado conservation easement in gross. If this credit is

1(c) Enter the number of children who were age five or under as of

claimed, any charitable deduction claimed on the federal

December 31, 2001 and for whom you claim a federal child

return must be added to taxable income on line 5 of Form 104.

tax credit or a federal additional child tax credit (federal Form

Verification of this credit must be attached to your return.

1040, line 48 and/or 63; federal Form 1040A, line 31 and/or

(FYI Income 39)

40). If the amounts of the federal child tax credits on these

3(b)HEALTH CARE PROFESSIONAL CREDIT

lines are zero, then enter zero on line 1(c). Children over 5 do

A tax credit is available to certain health care professionals

not qualify for the Colorado child tax credit.

who reside and practice in a rural health care professional

1(d)If you operate a family home care facility, enter the number of

shortage area . You must attach a copy of your credit certifi-

your dependents who were at least 6 years of age but not yet

cation from the Colorado Dept. of Public Health and Environ-

13 years of age as of December 31, 2001 (born 1989-1995)

ment to claim this credit. (FYI Income 41)

and for whom you claim a federal child tax credit (federal

3(c) HIGH TECHNOLOGY SCHOLARSHIP CONTRIBU-

Form 1040, line 48 and/or 63; federal Form 1040A, line 31

TION CREDIT A tax credit is available for taxpayers who

and/or 40). If the amounts on these lines are zero, or if you do

make monetary contributions to the Colorado High Technol-

not operate a family home care facility, then enter zero on line

ogy Scholarship Program. You must attach a certificate from

1(d).

the Department of Higher Education. (FYI Income 47)

A family home care facility is defined as a facility for child

3(d)INDIVIDUAL DEVELOPMENT ACCOUNT CONTRI-

care in a place of residence of a family or person for the

BUTION CREDIT A tax credit is available for taxpayers

purpose of providing less than 24 hour care for children who

who make monetary contributions to the individual develop-

are not related to the head of such home.

ment account program in Colorado. You must attach a cer-

1(e) Enter the child care credit you claimed on your 2001 federal

tificate from the State Administrator, Mile High United Way.

income tax return. This will be the smaller of the amounts on

(FYI Income 45)

line 40 or 44 of your federal Form 1040, or the smaller of the

3(e) AGRICULTURAL VALUE-ADDED CASH FUND

amounts on line 26 or 27 of your federal Form 1040A.

CREDIT A tax credit is available for taxpayers who make

The Colorado child care credit is allowed only on expenses

contributions to the agriculture value-added cash fund in Colo-

incurred for the care of children under age 13. Colorado does

rado. You must attach a tax credit certificate from the Colo-

not allow a credit for dependent care expense. If your federal

rado Agricultural Value-Added Development Board. (FYI In-

credit is a combined child care and dependent care credit, refer

come 49)

to FYI Income 33.

3(f) FOSTER CARE CREDIT A tax credit is available for Colo-

1(f) Multiply the amount on line 1(e) by 70% (.7).

rado residents who operate a foster care home and meet cer-

1(g) Multiply the number on line 1(c) by $300. This is the amount

tain qualifications. (FYI Income 50)

of your child tax credit that you will claim on line 38 of

4 CREDIT FOR INCOME TAX PAID ANOTHER STATE

Form 104.

A Colorado resident may claim credit for income tax paid to

1(h)Multiply the number on line 1(d) by $300. This is the amount

another state on income from sources within that state. (“State”

of your family home care operators child tax credit that you

includes the District of Columbia and territories or possessions

will claim on line 39 of Form 104.

of the United States.) Refer to publication FYI Income 17 for

1(i) Add the amounts on lines 1(g) and 1(h). This is the total

information on how to compute this credit and on claiming the

amount of your child tax credits that will reduce the child care

credit for a part-year resident.

credit that can be claimed.

IMPORTANT: Part-year residents may claim this credit only

1(j) Subtract the amount on line 1(i) from the amount on line 1(f).

if the income taxed by the other state was (a) earned while they

This is the amount of your child care credit that you will claim

were a Colorado resident and (b) is included in the Colorado

on line 40 of Form 104. Do not enter less than $0.

column on Form 104PN. A part-year resident can not claim this

1(k)If you claimed a child care/child tax credit on line 1(g), 1(h)

credit if the income from the other state is not included in the

or 1(j), enter the name, date of birth and social security number

Colorado column of Form 104PN because Form 104PN has

of your eligible children in the space provided. Attach a

already eliminated the Colorado tax on this income. A nonresi-

schedule if additional space is needed.

dent cannot claim this credit for tax paid another state.

Part-year residents must apportion their Colorado child care/

4(b)Enter that part of the Colorado adjusted gross income that is

child tax credits by their Colorado percentage from line O of Form

being taxed in the other state. Colorado adjusted gross income

104PN. The resulting credit can not exceed 100% of the credit on

means your federal adjusted gross income increased by the

lines 1(g), 1(h) or 1(j).

additions reported on lines 3, 4, and 5 (excluding any chari-

2 EARNED INCOME CREDIT. If you claimed the earned in-

table contribution adjustment) of Form 104, and decreased by

come credit on your 2001 federal return and you were a Colorado

the subtractions claimed on lines 7 through 14, 17 and 18,

resident, you may claim the Colorado earned income credit.

Form 104 and, in the case of part-year residents, reportable as

2(a) Enter on line 2(a) the federal earned income credit you

Colorado income. Income from intangible assets, (such as

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2