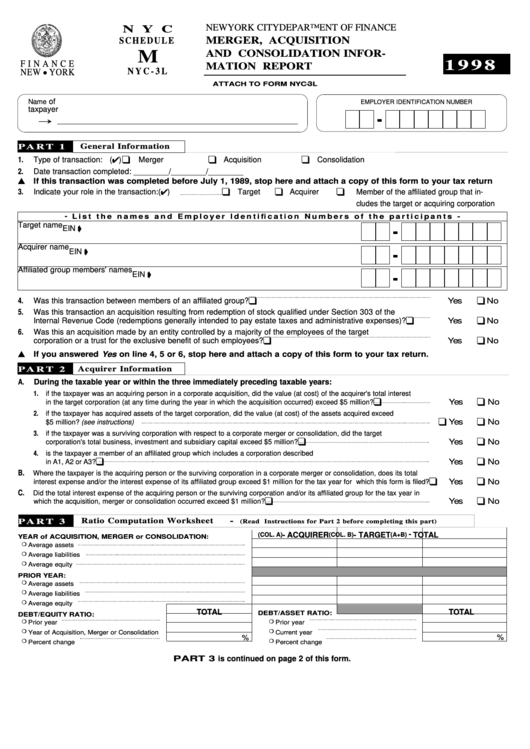

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

S C H E D U L E

MERGER, ACQUISITION

AND CONSOLIDATION INFOR-

M

1 9 9 8

F I N A N C E

MATION REPORT

N Y C - 3 L

NEW

YORK

l

3

ATTACH TO FORM NYC-

L

of

Name

EMPLOYER IDENTIFICATION NUMBER

taxpayer

Õ

General Infor mation

P A R T 1

q

q

q

1.

Type of transaction: (4)

Merger

Acquisition

Consolidation

....................................................................

2.

Date transaction completed: ________/________/________

s

If this transaction was completed before July 1, 1989, stop here and attach a copy of this form to your tax return

q

q

q

3.

Indicate your role in the transaction: (4)

Target

Acquirer

Member of the affiliated group that in-

cludes the target or acquiring corporation

-

L i s t t h e n a m e s a n d E m p l o y e r I d e n t i f i c a t i o n N u m b e r s o f t h e p a r t i c i p a n t s -

Target name

EIN ç

Acquirer name

EIN ç

Affiliated group members' names

EIN ç

q

q

4.

Was this transaction between members of an affiliated group?

Yes

No

5.

Was this transaction an acquisition resulting from redemption of stock qualified under Section 303 of the

q

q

Internal Revenue Code (redemptions generally intended to pay estate taxes and administrative expenses)?

Yes

No

6.

Was this an acquisition made by an entity controlled by a majority of the employees of the target

q

q

corporation or a trust for the exclusive benefit of such employees?

Yes

No

s

If you answered Yes on line 4, 5 or 6, stop here and attach a copy of this form to your tax return.

Acquirer Infor mation

P A R T 2

A

During the taxable year or within the three immediately preceding taxable years:

.

1.

if the taxpayer was an acquiring person in a corporate acquisition, did the value (at cost) of the acquirer's total interest

q

q

Yes

No

in the target corporation (at any time during the year in which the acquisition occurred) exceed $5 million?

2.

if the taxpayer has acquired assets of the target corporation, did the value (at cost) of the assets acquired exceed

q

q

Yes

No

$5 million? (see instructions)

3.

if the taxpayer was a surviving corporation with respect to a corporate merger or consolidation, did the target

q

q

Yes

No

corporation's total business, investment and subsidiary capital exceed $5 million?

4.

is the taxpayer a member of an affiliated group which includes a corporation described

q

q

Yes

No

in A1, A2 or A3?

B.

Where the taxpayer is the acquiring person or the surviving corporation in a corporate merger or consolidation, does its total

q

q

Yes

No

interest expense and/or the interest expense of its affiliated group exceed $1 million for the tax year for which this form is filed?

C.

Did the total interest expense of the acquiring person or the surviving corporation and/or its affiliated group for the tax year in

q

q

Yes

No

which the acquisition, merger or consolidation occurred exceed $1 million?

Ratio Computation Worksheet

-

P A R T 3

(Read Instr uctions for Par t 2 before completing this par t)

- TOTAL

(COL. A)

- ACQUIRER

(COL. B)

- TARGET

(A+B)

YEAR of ACQUISITION, MERGER or CONSOLIDATION:

m

Average assets

m

Average liabilities

m

Average equity

PRIOR YEAR:

m

Average assets

m

Average liabilities

m

Average equity

TOTAL

TOTAL

DEBT/ASSET RATIO:

DEBT/EQUITY RATIO:

m

m

Prior year

Prior year

m

m

Year of Acquisition, Merger or Consolidation

Current year

%

%

m

m

Percent change

Percent change

PART 3 is continued on page 2 of this form.

1

1 2

2