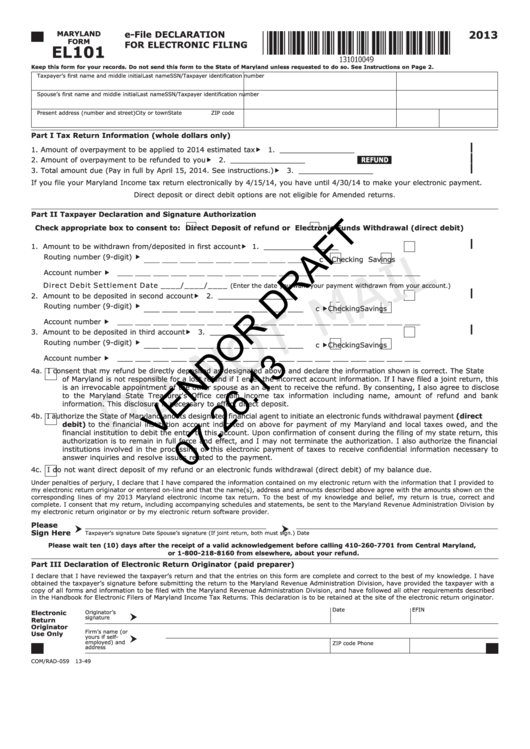

Maryland Form El101 Draft - E-File Declaration For Electronic Filing - 2013

ADVERTISEMENT

2013

e-File DECLARATION

MARYLAND

FORM

FOR ELECTRONIC FILING

EL101

Keep this form for your records. Do not send this form to the State of Maryland unless requested to do so. See Instructions on Page 2.

Taxpayer’s first name and middle initial

Last name

SSN/Taxpayer identification number

Spouse’s first name and middle initial

Last name

SSN/Taxpayer identification number

Present address (number and street)

City or town

State

ZIP code

Part I

Tax Return Information (whole dollars only)

|

1. Amount of overpayment to be applied to 2014 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. _________________

|

2. Amount of overpayment to be refunded to you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REFUND

2. _________________

|

3. Total amount due (Pay in full by April 15, 2014. See instructions.) . . . . . . . . . . . . . . . . . . . . . . .

3. _________________

If you file your Maryland Income tax return electronically by 4/15/14, you have until 4/30/14 to make your electronic payment.

Direct deposit or direct debit options are not eligible for Amended returns.

Part II

Taxpayer Declaration and Signature Authorization

Check appropriate box to consent to:

Direct Deposit of refund or

Electronic Funds Withdrawal (direct debit)

|

1. Amount to be withdrawn from/deposited in first account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _________________

Routing number (9-digit) _ _ _ _ _ _ _ _ _

c

Checking

Savings

Account number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Direct Debit Settlement Date ____/____/____

(Enter the date you want your payment withdrawn from your account.)

|

2. Amount to be deposited in second account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. _________________

Routing number (9-digit) _ _ _ _ _ _ _ _ _

c

Checking

Savings

Account number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

|

3. Amount to be deposited in third account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. _________________

Routing number (9-digit) _ _ _ _ _ _ _ _ _

c

Checking

Savings

Account number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4a.

I consent that my refund be directly deposited as designated above and declare the information shown is correct. The State

of Maryland is not responsible for a lost refund if I enter the incorrect account information. If I have filed a joint return, this

is an irrevocable appointment of the other spouse as an agent to receive the refund. By consenting, I also agree to disclose

to the Maryland State Treasurer's Office certain income tax information including name, amount of refund and bank

information. This disclosure is necessary to effect direct deposit.

4b.

I authorize the State of Maryland and its designated financial agent to initiate an electronic funds withdrawal payment (direct

debit) to the financial institution account indicated on above for payment of my Maryland and local taxes owed, and the

financial institution to debit the entry to this account. Upon confirmation of consent during the filing of my state return, this

authorization is to remain in full force and effect, and I may not terminate the authorization. I also authorize the financial

institutions involved in the processing of this electronic payment of taxes to receive confidential information necessary to

answer inquiries and resolve issues related to the payment.

4c.

I do not want direct deposit of my refund or an electronic funds withdrawal (direct debit) of my balance due.

Under penalties of perjury, I declare that I have compared the information contained on my electronic return with the information that I provided to

my electronic return originator or entered on-line and that the name(s), address and amounts described above agree with the amounts shown on the

corresponding lines of my 2013 Maryland electronic income tax return. To the best of my knowledge and belief, my return is true, correct and

complete. I consent that my return, including accompanying schedules and statements, be sent to the Maryland Revenue Administration Division by

my electronic return originator or by my electronic return software provider.

Please

Sign Here

Taxpayer’s signature

Date

Spouse’s signature (If joint return, both must sign.)

Date

Please wait ten (10) days after the receipt of a valid acknowledgement before calling 410-260-7701 from Central Maryland,

or 1-800-218-8160 from elsewhere, about your refund.

Part III Declaration of Electronic Return Originator (paid preparer)

I declare that I have reviewed the taxpayer’s return and that the entries on this form are complete and correct to the best of my knowledge. I have

obtained the taxpayer’s signature before submitting the return to the Maryland Revenue Administration Division, have provided the taxpayer with a

copy of all forms and information to be filed with the Maryland Revenue Administration Division, and have followed all other requirements described

in the Handbook for Electronic Filers of Maryland Income Tax Returns. This declaration is to be retained at the site of the electronic return originator.

Date

EFIN

Electronic

Originator’s

signature

Return

Originator

Firm’s name (or

Use Only

yours if self-

employed) and

ZIP code

Phone

address

COM/RAD-059

13-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2