F I N A N C E

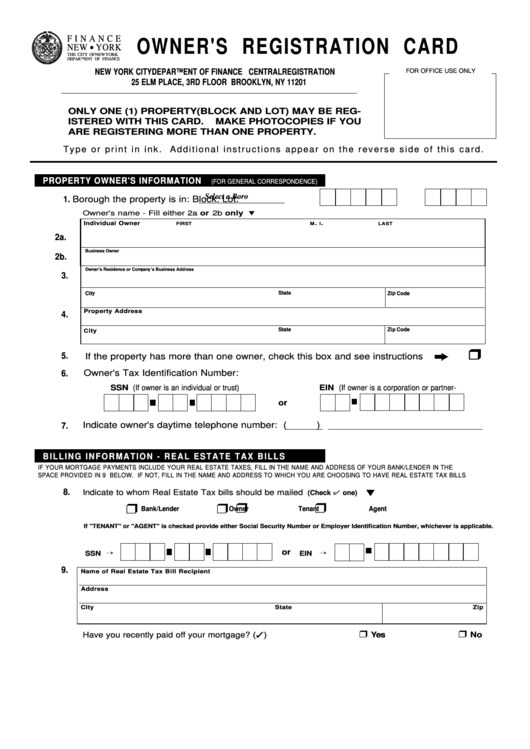

OWNER'S REGISTRATION CARD

NEW YORK

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

NEW YORK CITY DEPARTMENT OF FINANCE CENTRAL REGISTRATION

FOR OFFICE USE ONLY

25 ELM PLACE, 3RD FLOOR BROOKLYN, NY 11201

ONLY ONE (1) PROPERTY (BLOCK AND LOT) MAY BE REG-

ISTERED WITH THIS CARD.

MAKE PHOTOCOPIES IF YOU

ARE REGISTERING MORE THAN ONE PROPERTY.

Ty p e o r p r i n t i n i n k . A d d i t i o n a l i n s t r u c t i o n s a p p e a r o n t h e r e v e r s e s i d e o f t h i s c a r d .

PROPERTY OWNER'S INFORMATION

(FOR GENERAL CORRESPONDENCE)

Select a Boro

1.

Borough the property is in:

Block:

Lot:

Owner's name - Fill either 2a or 2b only

Individual Owner

.

.

FIRST

M

I

LAST

2a.

Business Owner

2b.

Owner's Residence or Company's Business Address

3.

State

City

Zip Code

Property Address

4.

State

Zip Code

C

ity

M

5.

If the property has more than one owner, check this box and see instructions

Owner's Tax Identification Number:

6.

SSN (If owner is an individual or trust)

EIN (If owner is a corporation or partner-

or

Indicate owner's daytime telephone number: (

)

7.

B I L L I N G I N F O R M AT I O N - R E A L E S TAT E TA X B I L L S

IF YOUR MORTGAGE PAYMENTS INCLUDE YOUR REAL ESTATE TAXES, FILL IN THE NAME AND ADDRESS OF YOUR BANK/LENDER IN THE

SPACE PROVIDED IN 9 BELOW. IF NOT, FILL IN THE NAME AND ADDRESS TO WHICH YOU ARE CHOOSING TO HAVE REAL ESTATE TAX BILLS

8.

Indicate to whom Real Estate Tax bills should be mailed

(Check

one)

Bank/Lender

Owner

Tenant

Agent

If "TENANT" or "AGENT" is checked provide either Social Security Number or Employer Identification Number, whichever is applicable.

or

SSN

EIN

9.

Name of Real Estate Tax Bill Recipient

Address

City

State

Zip Code

Have you recently paid off your mortgage? ( )

Yes

No

1

1 2

2