Senior Citizen Property Tax Exemption Application Instructions - New York City Department Of Finance Property Division Page 2

ADVERTISEMENT

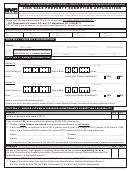

Senior Citizen Property Tax Exemption Application

Page 2

q Proof of age of owner(s), such as:

C H E C K L I S T B E F O R E S U B M I T T I N G

u copy of birth certificate (if applicant's name is different

Y O U R A P P L I C AT I O N

from that on birth certificate, also attach proof of name

Avoid a delay in the processing of your application. Check

change);

(3) to make sure that you do the following before submitting

u copy of driver's license;

your application to the Property Division:

u copy of passport.

q Read the requirements to make sure you are eligible

q Copy of death certificate, when one of the individuals listed

q File this application between July 15 and March 15 only

on the deed/proprietary lease is deceased.

q Complete the application in its entirety

q Copy of marriage certificate.

q Have all property owners and spouses of owners applying

q Proof of income for the last calendar year prior to applying,

for the exemption sign the application

such as:

q Have a non-relative witness the signatures

u copy of complete and signed federal income tax return

q List a telephone number where you can be reached and the

for the preceding calendar year, including all schedules;

name and daytime telephone number of a relative or friend

u Social Security statement;

q Cooperative apartment owners, have an officer of the co-op

u pension fund statement;

board complete the certification, Section 4, on page 6

u IRA distribution.

q Copies of bills, receipts and insurance company statements

Attach the following:

q Copy of most recent deed, (recorded or unrecorded) or if

fully documenting your claimed deductions for unreim-

bursed medical and/or unreimbursed prescription expenses

co-op owner, you must submit copy of the page(s) of your

not reimbursed, or not paid for by insurance, including

proprietary lease, which shows the names of the grantor

charges not covered due to a deductible provision of your

and grantee and the number of shares in your unit. If a

insurance coverage, for the last calendar year prior to

proprietary lease is unavailable, you must submit a copy of

applying.

your stock certificate, (front and back), showing the names

of all owners.

S P E C I F I C

I N S T R U C T I O N S

SECTION 1 - OWNERSHIP/PERSONAL INFORMATION

vivorship.

Question 1 - OWNER(S) OF PROPERTY

Life Estate refers to a title held during the term of the

List all owners appearing on the deed/proprietary lease

owner's life and which terminates upon death.

and living spouses, Social Security Numbers and dates of

Trust refers to a relationship in which an independent

birth. (Attach a separate sheet, if necessary.)

party (trustee) holds legal title to property for the benefi-

Question 4 - PERSONAL STATUS

ciaries of the trust who hold the equitable title during the

Check the box that applies to the applicant's legal status.

life of the trust.

If any applicant is married, widowed, legally separated or

divorced, attach proof of legal status, such as a copy of a

SECTION 2 - INCOME STATEMENT FOR THE LAST

marriage certificate, death certificate, separation decree or

CALENDAR YEAR

divorce settlement.

If you attach a copy of your federal return, you do not

Question 5 - DEED/PROPRIETARY LEASE STATUS

have to complete this section unless either of the follow-

Check the box that describes the deed/proprietary lease

ing is true: 1) you did not itemize medical and prescrip-

status.

tion expenses which you wish to claim for this exemption;

2) you are a recipient of a Veterans Administration disabil-

Joint tenants refers to joint ownership with the right to

ity pension which is excluded from the definition of

automatic succession to the title upon death of one

income for this exemption.

owner.

Income is the combined income of all owners. If either

Tenants in Common refers to ownership by 2 or more

the husband or the wife has title, include the combined

persons each of whom has an undivided fractional inter-

income of both spouses. Income includes, but is not lim-

est in the whole of the property without the right to sur-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4