Senior Citizen Property Tax Exemption Application Instructions - New York City Department Of Finance Property Division Page 3

ADVERTISEMENT

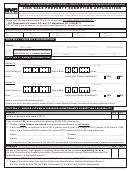

Senior Citizen Property Tax Exemption Application

Page 3

ited to, Social Security and retirement benefits, interest,

WHEN AND WHERE TO FILE

dividends, IRA distributions, net rental income, salary or

You must file this application with all required documents

earnings and net income from self-employment. Income

between July 15 and March 15. If filing by mail, the appli-

also includes all monies received from any foreign hold-

cation must be postmarked by March 15.

ings, including but not limited to securities, interest from

Mail or bring your application to the Assessment Office in

bank accounts, sale of real estate and income from busi-

the borough in which the property is located. The

nesses. Do not include Veteran’s Administration disability

addresses are listed below.

pension benefits or gifts and inheritances or money

earned through employment in the federal Foster

MANHATTAN

Municipal Building

Grandparent Program.

One Centre Street , Rm. 910

New York, NY 10007

SECTION 3 - INCOME-PRODUCING PROPERTY

BROOKLYN

Municipal Building

If part of your residence is rented or if you own other

210 Joralemon Street

income-producing property, complete this section or

Room 200

attach a copy of Schedule E, Supplemental Income & Loss

Brooklyn, NY 11201

from your federal tax return.

On page 6, question 3, enter the whole dollar amount of

BRONX

1932 Arthur Avenue

the gross income from the property and the various

Room 701

expenses for the entire building. If you have more than

Bronx, NY 10457

one rental property, attach a separate Income and Expense

QUEENS

144-06 94th Avenue

Statement. On the line for major repairs, include items

2nd Floor

such as roofing, windows, plumbing and electric wiring.

Jamaica, NY 11435

RENEWAL

STATEN ISLAND

350 St. Marks Place

Staten Island, NY 10301

If your exemption is approved, annual applications are not

necessary as long as the renewal notice (to be sent to you

The Department of Finance is pleased to announce the fol-

by mail) is completed and returned by the closing date.

lowing customer service initiative to provide an applicant

Renewal notices are sent every other year.

with proof of filing. Upon receipt of an application, the

department will time-stamp a copy of the application.

CHANGE OF OWNERSHIP

Please note that the department can only provide this service

You must notify the Borough Assessment Office in writ-

when a copy is provided by the applicant. Where an applica-

ing of any change in the ownership. If available, you

tion has been mailed, a self-addressed stamped envelope

must also be provided in addition to the copy.

should also include the name of the party to whom the

property was sold and their telephone number.

All applicants are strongly encouraged to retain for their per-

sonal records a copy of all applications, documents and

renewal forms that are submitted to department offices.

N E E D

H E L P ?

If you need help in completing this form, visit any of the borough offices listed above or call:

MANHATTAN .....................................(212) 669-4896

BROOKLYN .............................. (718) 802-3560

BRONX ..............................................(718) 579-6879

QUEENS.................................. (718) 298-7099

STATEN ISLAND .............................. (718) 390-5295

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4