Senior Citizen Property Tax Exemption Application Instructions - New York City Department Of Finance Property Division Page 4

ADVERTISEMENT

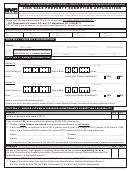

NEW YORK CITY DEPARTMENT OF FINANCE

FORM

THIRD PARTY NOTIFICATION FOR

EA-923

F I N A N C E

REAL PROPERTY TAXES APPLICATION

NEW

YORK

l

CLIP AND RETURN TO NEW YORK CITY DEPARTMENT OF FINANCE, CENTRAL REGISTRATION UNIT, 25 ELM PLACE, 3RD FL., BROOKLYN, NY 11201

WHEN MUST I APPLY?

Dear Taxpayer:

You can apply any time during the year, but allow 60

If you are a senior citizen, aged 65 years or older, or if

days for the application to be processed. However, if

you suffer from a physical or developmental disability,

you would like a third party to receive a copy of the

you may designate an adult third party to receive

July 1st Real Estate Tax bill which is often mailed out

copies of your real estate tax bills and notices of

unpaid taxes.

in June, please make certain to file your application

by April 1.

The New York City Department of Finance is pleased

to offer the benefits of the third party notification pro-

gram to eligible taxpayers free of charge by authority

WHOM MAY I CHOOSE AS MY THIRD PARTY?

of state law. Although you can apply any time during

the year, you must allow at least 60 days for the appli-

Any adult who consents to your designation, such as

cation to be processed. In order to request that dupli-

a friend or a relative.

cate tax bills and statements of unpaid taxes be mailed

to third party designees in time for the July 1st real

estate tax billing period, eligible property owners must

HOW DOES A THIRD PARTY

file a completed application by preceeding April 1st.

DESIGNEE SHOW CONSENT?

For more details, please refer to the eligibility require-

By signing your application form in the appropriate

ments and follow the application instructions provided

blank.

below.

Sincerely yours,

MUST I APPLY EACH YEAR?

No. Once you apply, the duplicate notices will be sent

to your designee unless you advise the Central

Rudolph W. Giuliani

Registration Unit (25 Elm Place, 3rd Floor, Brooklyn,

Mayor

NY 11201) that the practice should stop.

HOW DO I APPLY?

Under state law, senior citizens and disabled home-

owners may designate an adult third party to receive

Complete For m EA-923 (Request for Mailing of

Duplicate Tax Bills or Statements of Unpaid Taxes to

copies of real estate tax bills and notices of unpaid

a Third Party) and mail it to the following address.

taxes. The law's intent is to help these taxpayers

New York City Department of Finance

avoid losing their homes for nonpayment of taxes.

Central Registration Unit

25 Elm Place, 3rd Floor

WHO IS ELIGIBLE?

Brooklyn, NY 11201

Owner-occupants of 1-, 2-, or 3-family residential real

ARE THERE FINANCIAL RISKS INVOLVED IN

property who are either:

AGREEING TO BE A THIRD PARTY DESIGNEE?

(a) at least 65 years of age, or

No. Both the law and the form of the duplicate tax

(b) disabled by a physical or mental impairment

bill and notice include a statement advising the third

which substantially limits one or more of their

party that he or she is under no legal obligation with

major life activities.

respect to the bill or notice.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4