Instructions For Form 588 - Nonresident Withholding Waiver Request

ADVERTISEMENT

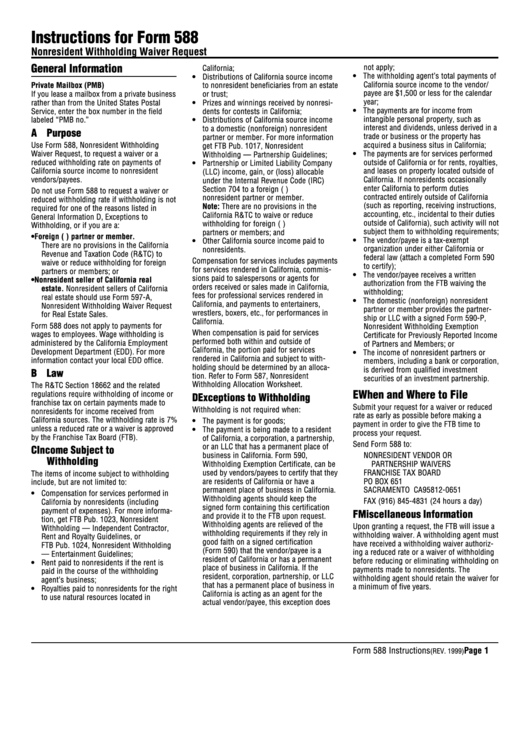

Instructions for Form 588

Nonresident Withholding Waiver Request

General Information

not apply;

California;

• The withholding agent’s total payments of

• Distributions of California source income

California source income to the vendor/

Private Mailbox (PMB)

to nonresident beneficiaries from an estate

payee are $1,500 or less for the calendar

If you lease a mailbox from a private business

or trust;

year;

rather than from the United States Postal

• Prizes and winnings received by nonresi-

• The payments are for income from

Service, enter the box number in the field

dents for contests in California;

intangible personal property, such as

labeled “PMB no.”

• Distributions of California source income

interest and dividends, unless derived in a

to a domestic (nonforeign) nonresident

A Purpose

trade or business or the property has

partner or member. For more information

Use Form 588, Nonresident Withholding

acquired a business situs in California;

get FTB Pub. 1017, Nonresident

Waiver Request, to request a waiver or a

• The payments are for services performed

Withholding — Partnership Guidelines;

reduced withholding rate on payments of

outside of California or for rents, royalties,

• Partnership or Limited Liability Company

California source income to nonresident

and leases on property located outside of

(LLC) income, gain, or (loss) allocable

vendors/payees.

California. If nonresidents occasionally

under the Internal Revenue Code (IRC)

enter California to perform duties

Section 704 to a foreign (non-U.S.)

Do not use Form 588 to request a waiver or

contracted entirely outside of California

nonresident partner or member.

reduced withholding rate if withholding is not

(such as reporting, receiving instructions,

Note: There are no provisions in the

required for one of the reasons listed in

accounting, etc., incidental to their duties

California R&TC to waive or reduce

General Information D, Exceptions to

outside of California), such activity will not

withholding for foreign (non-U.S.)

Withholding, or if you are a:

subject them to withholding requirements;

partners or members; and

• Foreign (non-U.S.) partner or member.

• The vendor/payee is a tax-exempt

• Other California source income paid to

There are no provisions in the California

organization under either California or

nonresidents.

Revenue and Taxation Code (R&TC) to

federal law (attach a completed Form 590

Compensation for services includes payments

waive or reduce withholding for foreign

to certify);

for services rendered in California, commis-

partners or members; or

• The vendor/payee receives a written

sions paid to salespersons or agents for

• Nonresident seller of California real

authorization from the FTB waiving the

orders received or sales made in California,

estate. Nonresident sellers of California

withholding;

fees for professional services rendered in

real estate should use Form 597-A,

• The domestic (nonforeign) nonresident

California, and payments to entertainers,

Nonresident Withholding Waiver Request

partner or member provides the partner-

wrestlers, boxers, etc., for performances in

for Real Estate Sales.

ship or LLC with a signed Form 590-P,

California.

Form 588 does not apply to payments for

Nonresident Withholding Exemption

When compensation is paid for services

wages to employees. Wage withholding is

Certificate for Previously Reported Income

performed both within and outside of

administered by the California Employment

of Partners and Members; or

California, the portion paid for services

Development Department (EDD). For more

• The income of nonresident partners or

rendered in California and subject to with-

information contact your local EDD office.

members, including a bank or corporation,

holding should be determined by an alloca-

is derived from qualified investment

B Law

tion. Refer to Form 587, Nonresident

securities of an investment partnership.

Withholding Allocation Worksheet.

The R&TC Section 18662 and the related

E When and Where to File

regulations require withholding of income or

D Exceptions to Withholding

franchise tax on certain payments made to

Submit your request for a waiver or reduced

Withholding is not required when:

nonresidents for income received from

rate as early as possible before making a

California sources. The withholding rate is 7%

• The payment is for goods;

payment in order to give the FTB time to

unless a reduced rate or a waiver is approved

• The payment is being made to a resident

process your request.

by the Franchise Tax Board (FTB).

of California, a corporation, a partnership,

Send Form 588 to:

or an LLC that has a permanent place of

C Income Subject to

business in California. Form 590,

NONRESIDENT VENDOR OR

Withholding

Withholding Exemption Certificate, can be

PARTNERSHIP WAIVERS

used by vendors/payees to certify that they

FRANCHISE TAX BOARD

The items of income subject to withholding

are residents of California or have a

PO BOX 651

include, but are not limited to:

permanent place of business in California.

SACRAMENTO CA 95812-0651

• Compensation for services performed in

Withholding agents should keep the

FAX (916) 845-4831 (24 hours a day)

California by nonresidents (including

signed form containing this certification

payment of expenses). For more informa-

F Miscellaneous Information

and provide it to the FTB upon request.

tion, get FTB Pub. 1023, Nonresident

Withholding agents are relieved of the

Upon granting a request, the FTB will issue a

Withholding — Independent Contractor,

withholding requirements if they rely in

withholding waiver. A withholding agent must

Rent and Royalty Guidelines, or

good faith on a signed certification

have received a withholding waiver authoriz-

FTB Pub. 1024, Nonresident Withholding

(Form 590) that the vendor/payee is a

ing a reduced rate or a waiver of withholding

— Entertainment Guidelines;

resident of California or has a permanent

before reducing or eliminating withholding on

• Rent paid to nonresidents if the rent is

place of business in California. If the

payments made to nonresidents. The

paid in the course of the withholding

resident, corporation, partnership, or LLC

withholding agent should retain the waiver for

agent’s business;

that has a permanent place of business in

a minimum of five years.

• Royalties paid to nonresidents for the right

California is acting as an agent for the

to use natural resources located in

actual vendor/payee, this exception does

Form 588 Instructions

Page 1

(REV. 1999)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2