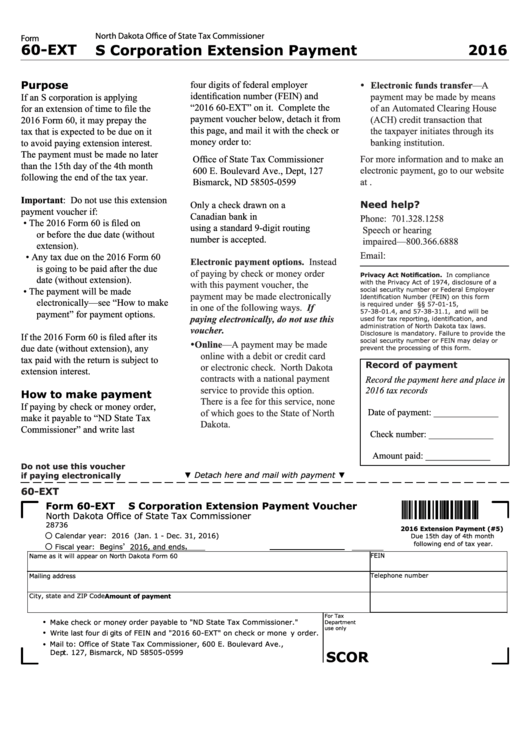

North Dakota Office of State Tax Commissioner

Form

60-EXT

S Corporation Extension Payment

2016

four digits of federal employer

Purpose

Electronic funds transfer—A

identification number (FEIN) and

payment may be made by means

If an S corporation is applying

“2016 60-EXT” on it. Complete the

of an Automated Clearing House

for an extension of time to file the

payment voucher below, detach it from

(ACH) credit transaction that

2016 Form 60, it may prepay the

this page, and mail it with the check or

the taxpayer initiates through its

tax that is expected to be due on it

money order to:

banking institution.

to avoid paying extension interest.

The payment must be made no later

Office of State Tax Commissioner

For more information and to make an

than the 15th day of the 4th month

electronic payment, go to our website

600 E. Boulevard Ave., Dept, 127

following the end of the tax year.

at

Bismarck, ND 58505-0599

Important: Do not use this extension

Need help?

Only a check drawn on a U.S. or

payment voucher if:

Canadian bank in U.S. dollars and

Phone: 701.328.1258

• The 2016 Form 60 is filed on

using a standard 9-digit routing

Speech or hearing

or before the due date (without

number is accepted.

impaired—800.366.6888

extension).

Email: individualtax@nd.gov

• Any tax due on the 2016 Form 60

Electronic payment options. Instead

is going to be paid after the due

of paying by check or money order

Privacy Act Notification. In compliance

date (without extension).

with this payment voucher, the

with the Privacy Act of 1974, disclosure of a

• The payment will be made

social security number or Federal Employer

payment may be made electronically

Identification Number (FEIN) on this form

electronically—see “How to make

is required under N.D.C.C. §§ 57-01-15,

in one of the following ways. If

payment” for payment options.

57-38-01.4, and 57-38-31.1, and will be

paying electronically, do not use this

used for tax reporting, identification, and

administration of North Dakota tax laws.

voucher.

Disclosure is mandatory. Failure to provide the

If the 2016 Form 60 is filed after its

social security number or FEIN may delay or

Online—A payment may be made

due date (without extension), any

prevent the processing of this form.

online with a debit or credit card

tax paid with the return is subject to

Record of payment

or electronic check. North Dakota

extension interest.

contracts with a national payment

Record the payment here and place in

service to provide this option.

2016 tax records

How to make payment

There is a fee for this service, none

If paying by check or money order,

Date of payment: ______________

of which goes to the State of North

make it payable to “ND State Tax

Dakota.

Commissioner” and write last

Check number: ______________

Amount paid: ______________

Do not use this voucher

▼ Detach here and mail with payment ▼

if paying electronically

60-EXT

Form 60-EXT

S Corporation Extension Payment Voucher

North Dakota Office of State Tax Commissioner

28736

2016 Extension Payment (#5)

Calendar year: 2016 (Jan. 1 - Dec. 31, 2016)

Due 15th day of 4th month

,

following end of tax year.

,

Fiscal year: Begins

2016, and ends

FEIN

Name as it will appear on North Dakota Form 60

Telephone number

Mailing address

City, state and ZIP Code

Amount of payment

For Tax

•

Make check or money order payable to "ND State Tax Commissioner."

Department

use only

•

Write last four digits of FEIN and "2016 60-EXT" on check or money order.

•

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

SCOR

Dept. 127, Bismarck, ND 58505-0599

1

1