Form Dp-145 - Legacy And Succession Tax Return General Instructions

ADVERTISEMENT

FORM

Legacy and Succession Tax Return

DP-145

General Instructions

Instructions

Words appearing in bold print are defined in the Glossary of Terms on Page 2 of the instructions.

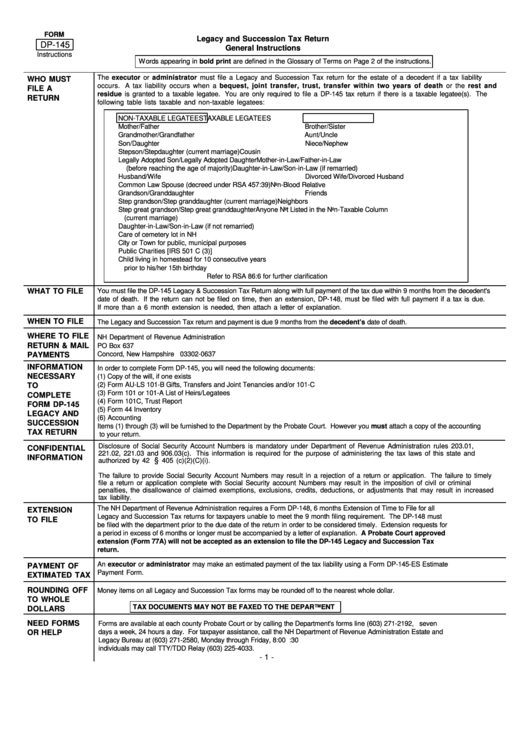

The executor or administrator must file a Legacy and Succession Tax return for the estate of a decedent if a tax liability

WHO MUST

occurs. A tax liability occurs when a bequest, joint transfer, trust, transfer within two years of death or the rest and

FILE A

residue is granted to a taxable legatee. You are only required to file a DP-145 tax return if there is a taxable legatee(s). The

RETURN

following table lists taxable and non-taxable legatees:

NON-TAXABLE LEGATEES

TAXABLE LEGATEES

Mother/Father

Brother/Sister

Grandmother/Grandfather

Aunt/Uncle

Son/Daughter

Niece/Nephew

Stepson/Stepdaughter (current marriage)

Cousin

Legally Adopted Son/Legally Adopted Daughter

Mother-in-Law/Father-in-Law

(before reaching the age of majority)

Daughter-in-Law/Son-in-Law (if remarried)

Husband/Wife

Divorced Wife/Divorced Husband

Common Law Spouse (decreed under RSA 457:39)

Non-Blood Relative

Grandson/Granddaughter

Friends

Step grandson/Step granddaughter (current marriage)

Neighbors

Step great grandson/Step great granddaughter

Anyone Not Listed in the Non-Taxable Column

(current marriage)

Daughter-in-Law/Son-in-Law (if not remarried)

Care of cemetery lot in NH

City or Town for public, municipal purposes

Public Charities [IRS 501 C (3)]

Child living in homestead for 10 consecutive years

prior to his/her 15th birthday

Refer to RSA 86:6 for further clarification

WHAT TO FILE

You must file the DP-145 Legacy & Succession Tax Return along with full payment of the tax due within 9 months from the decedent's

date of death. If the return can not be filed on time, then an extension, DP-148, must be filed with full payment if a tax is due.

If more than a 6 month extension is needed, then attach a letter of explanation.

WHEN TO FILE

The Legacy and Succession Tax return and payment is due 9 months from the decedent's date of death.

WHERE TO FILE

NH Department of Revenue Administration

RETURN & MAIL

PO Box 637

PAYMENTS

Concord, New Hampshire 03302-0637

INFORMATION

In order to complete Form DP-145, you will need the following documents:

NECESSARY

(1) Copy of the will, if one exists

(2) Form AU-LS 101-B Gifts, Transfers and Joint Tenancies and/or 101-C

TO

(3) Form 101 or 101-A List of Heirs/Legatees

COMPLETE

(4) Form 101C, Trust Report

FORM DP-145

(5) Form 44 Inventory

LEGACY AND

(6) Accounting

SUCCESSION

Items (1) through (3) will be furnished to the Department by the Probate Court. However you must attach a copy of the accounting

TAX RETURN

to your return.

Disclosure of Social Security Account Numbers is mandatory under Department of Revenue Administration rules 203.01,

CONFIDENTIAL

221.02, 221.03 and 906.03(c). This information is required for the purpose of administering the tax laws of this state and

INFORMATION

§

authorized by 42 U.S.C.S.

405 (c)(2)(C)(i).

The failure to provide Social Security Account Numbers may result in a rejection of a return or application. The failure to timely

file a return or application complete with Social Security account Numbers may result in the imposition of civil or criminal

penalties, the disallowance of claimed exemptions, exclusions, credits, deductions, or adjustments that may result in increased

tax liability.

The NH Department of Revenue Administration requires a Form DP-148, 6 months Extension of Time to File for all

EXTENSION

Legacy and Succession Tax returns for taxpayers unable to meet the 9 month filing requirement. The DP-148 must

TO FILE

be filed with the department prior to the due date of the return in order to be considered timely. Extension requests for

a period in excess of 6 months or longer must be accompanied by a letter of explanation. A Probate Court approved

extension (Form 77A) will not be accepted as an extension to file the DP-145 Legacy and Succession Tax

return.

An executor or administrator may make an estimated payment of the tax liability using a Form DP-145-ES Estimate

PAYMENT OF

Payment Form.

EXTIMATED TAX

ROUNDING OFF

Money items on all Legacy and Succession Tax forms may be rounded off to the nearest whole dollar.

TO WHOLE

TAX DOCUMENTS MAY NOT BE FAXED TO THE DEPARTMENT

DOLLARS

NEED FORMS

Forms are available at each county Probate Court or by calling the Department's forms line (603) 271-2192, seven

OR HELP

days a week, 24 hours a day. For taxpayer assistance, call the NH Department of Revenue Administration Estate and

Legacy Bureau at (603) 271-2580, Monday through Friday, 8:00 a.m. to 4:30 p.m. Hearing and/or speech impaired

individuals may call TTY/TDD Relay (603) 225-4033.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5