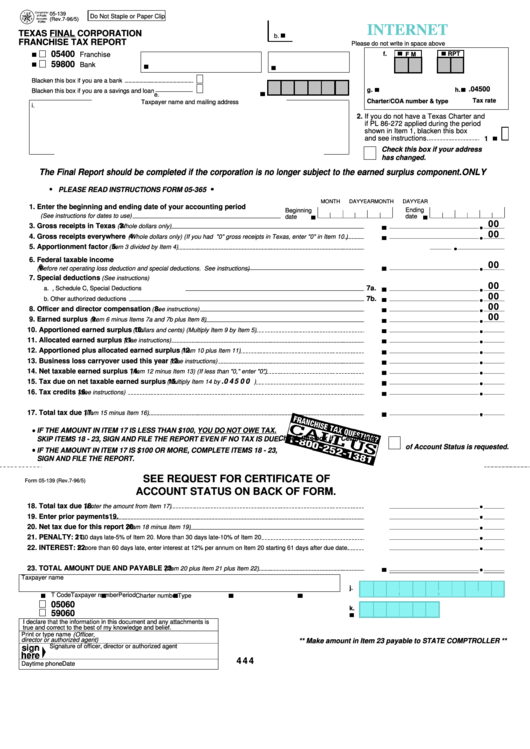

05-139

Do Not Staple or Paper Clip

(Rev.7-96/5)

INTERNET

TEXAS FINAL CORPORATION

b.

FRANCHISE TAX REPORT

Please do not write in space above

05400

f.

RPT

Franchise

F M

a.

c. Taxpayer number

d. REPORT YEAR

59800

Bank

Blacken this box if you are a bank

.04500

g.

h.

Blacken this box if you are a savings and loan

e.

Tax rate

Charter/COA number & type

Taxpayer name and mailing address

i.

2.

If you do not have a Texas Charter and

if PL 86-272 applied during the period

shown in Item 1, blacken this box

and see instructions.

1

Check this box if your address

has changed.

The Final Report should be completed

ONLY

if the corporation is no longer subject to the earned surplus component.

PLEASE READ INSTRUCTIONS FORM 05-365

MONTH

DAY

YEAR

MONTH

DAY

YEAR

1. Enter the beginning and ending date of your accounting period

Ending

Beginning

(See instructions for dates to use)

date

date

00

3. Gross receipts in Texas

3.

(Whole dollars only)

00

4. Gross receipts everywhere

4.

(Whole dollars only) (If you had "0" gross receipts in Texas, enter "0" in Item 10.)

5. Apportionment factor

5.

(Item 3 divided by Item 4)

6. Federal taxable income

00

6.

(Before net operating loss deduction and special deductions. See instructions)

7. Special deductions

(See instructions)

00

7a.

a. I.R.S. Form 1120, Schedule C, Special Deductions

00

7b.

b. Other authorized deductions

00

8. Officer and director compensation

8.

(See instructions)

00

9. Earned surplus

9.

(Item 6 minus Items 7a and 7b plus Item 8)

10. Apportioned earned surplus

10.

(Dollars and cents) (Multiply Item 9 by Item 5)

11. Allocated earned surplus

11.

(See instructions)

12. Apportioned plus allocated earned surplus

12.

(Item 10 plus Item 11)

13. Business loss carryover used this year

13.

(See instructions)

14. Net taxable earned surplus

14.

(Item 12 minus Item 13) (If less than "0," enter "0")

.04500

15. Tax due on net taxable earned surplus

15.

(Multiply Item 14 by

)

16. Tax credits

16.

(See instructions)

17. Total tax due

17.

(Item 15 minus Item 16)

IF THE AMOUNT IN ITEM 17 IS LESS THAN $100, YOU DO NOT OWE TAX.

Check this box if a Certificate

SKIP ITEMS 18 - 23, SIGN AND FILE THE REPORT EVEN IF NO TAX IS DUE.

of Account Status is requested.

IF THE AMOUNT IN ITEM 17 IS $100 OR MORE, COMPLETE ITEMS 18 - 23,

SIGN AND FILE THE REPORT.

SEE REQUEST FOR CERTIFICATE OF

Form 05-139 (Rev.7-96/5)

ACCOUNT STATUS ON BACK OF FORM.

18. Total tax due

18.

(Enter the amount from Item 17)

19. Enter prior payments

19.

20. Net tax due for this report

20.

(Item 18 minus Item 19)

21. PENALTY:

21.

1-30 days late-5% of Item 20. More than 30 days late-10% of Item 20

22. INTEREST:

22.

If more than 60 days late, enter interest at 12% per annum on Item 20 starting 61 days after due date.

23. TOTAL AMOUNT DUE AND PAYABLE

23.

(Item 20 plus Item 21 plus Item 22)

Taxpayer name

j.

,

,

T Code

Taxpayer number

Period

Charter number

Type

05060

k.

59060

I declare that the information in this document and any attachments is

true and correct to the best of my knowledge and belief.

Print or type name

(Officer,

director or authorized agent)

** Make amount in Item 23 payable to STATE COMPTROLLER **

Signature of officer, director or authorized agent

444

Daytime phone

Date

1

1