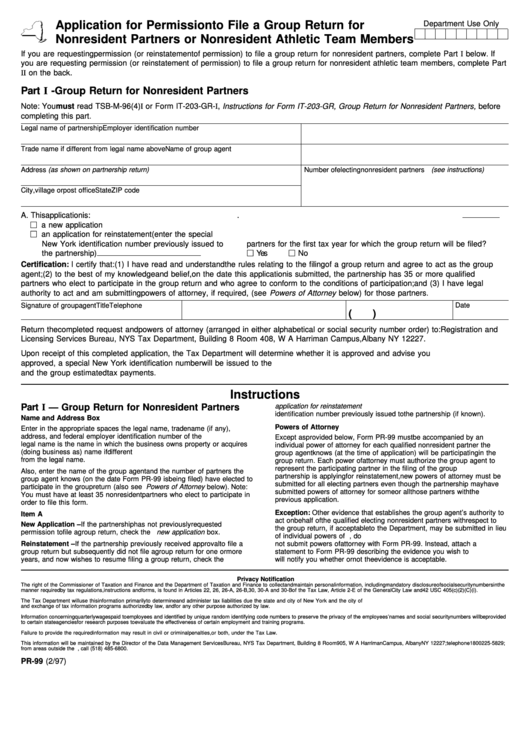

Application for Permission to File a Group Return for

Department Use Only

Nonresident Partners or Nonresident Athletic Team Members

If you are requesting permission (or reinstatement of permission) to file a group return for nonresident partners, complete Part I below. If

you are requesting permission (or reinstatement of permission) to file a group return for nonresident athletic team members, complete Part

II on the back.

Part I - Group Return for Nonresident Partners

Note: You must read TSB-M-96(4)I or Form IT-203-GR-I, Instructions for Form IT-203-GR, Group Return for Nonresident Partners, before

completing this part.

Legal name of partnership

Employer identification number

Trade name if different from legal name above

Name of group agent

Address (as shown on partnership return)

Number of electing nonresident partners (see instructions)

City, village or post office

State

ZIP code

A. This application is:

B. Enter the first tax year for which the group return will be filed

.

a new application

an application for reinstatement (enter the special

C. Were any individual estimated tax payments made by the electing

New York identification number previously issued to

partners for the first tax year for which the group return will be filed?

the partnership

)

Yes

No

Certification: I certify that: (1) I have read and understand the rules relating to the filing of a group return and agree to act as the group

agent; (2) to the best of my knowledge and belief, on the date this application is submitted, the partnership has 35 or more qualified

partners who elect to participate in the group return and who agree to conform to the conditions of participation; and (3) I have legal

authority to act and am submitting powers of attorney, if required, (see Powers of Attorney below) for those partners.

Signature of group agent

Title

Telephone

Date

(

)

Return the completed request and powers of attorney (arranged in either alphabetical or social security number order) to: Registration and

Licensing Services Bureau, NYS Tax Department, Building 8 Room 408, W A Harriman Campus, Albany NY 12227.

Upon receipt of this completed application, the Tax Department will determine whether it is approved and advise you accordingly. If

approved, a special New York identification number will be issued to the partnership. That number must be used for filing the group return

and the group estimated tax payments.

Instructions

application for reinstatement box. Also enter the special New York

Part I — Group Return for Nonresident Partners

identification number previously issued to the partnership (if known).

Name and Address Box

Powers of Attorney

Enter in the appropriate spaces the legal name, trade name (if any),

address, and federal employer identification number of the partnership. The

Except as provided below, Form PR-99 must be accompanied by an

legal name is the name in which the business owns property or acquires

individual power of attorney for each qualified nonresident partner the

debt. Enter the trade name or d/b/a (doing business as) name if different

group agent knows (at the time of application) will be participating in the

from the legal name.

group return. Each power of attorney must authorize the group agent to

represent the participating partner in the filing of the group return. If the

Also, enter the name of the group agent and the number of partners the

partnership is applying for reinstatement, new powers of attorney must be

group agent knows (on the date Form PR-99 is being filed) have elected to

submitted for all electing partners even though the partnership may have

participate in the group return (also see Powers of Attorney below). Note:

submitted powers of attorney for some or all those partners with the

You must have at least 35 nonresident partners who elect to participate in

previous application.

order to file this form.

Exception: Other evidence that establishes the group agent’s authority to

Item A

act on behalf of the qualified electing nonresident partners with respect to

New Application – If the partnership has not previously requested

the group return, if acceptable to the Department, may be submitted in lieu

permission to file a group return, check the new application box.

of individual powers of attorney. If you wish to submit other evidence, do

Reinstatement – If the partnership previously received approval to file a

not submit powers of attorney with Form PR-99. Instead, attach a

group return but subsequently did not file a group return for one or more

statement to Form PR-99 describing the evidence you wish to submit. We

years, and now wishes to resume filing a group return, check the

will notify you whether or not the evidence is acceptable.

Privacy Notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal information, including mandatory disclosure of social security numbers in the

manner required by tax regulations, instructions and forms, is found in Articles 22, 26, 26-A, 26-B, 30, 30-A and 30-B of the Tax Law, Article 2-E of the General City Law and 42 USC 405(c)(2)(C)(i).

The Tax Department will use this information primarily to determine and administer tax liabilities due the state and city of New York and the city of Yonkers. We will also use this information for certain tax offset

and exchange of tax information programs authorized by law, and for any other purpose authorized by law.

Information concerning quarterly wages paid to employees and identified by unique random identifying code numbers to preserve the privacy of the employees’ names and social security numbers will be provided

to certain state agencies for research purposes to evaluate the effectiveness of certain employment and training programs.

Failure to provide the required information may result in civil or criminal penalties, or both, under the Tax Law.

This information will be maintained by the Director of the Data Management Services Bureau, NYS Tax Department, Building 8 Room 905, W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829;

from areas outside the U.S. and Canada, call (518) 485-6800.

PR-99 (2/97)

1

1 2

2