Form 760c - Underpayment Of Virginia Estimated Tax By Individuals, Estates And Trusts - 2006

ADVERTISEMENT

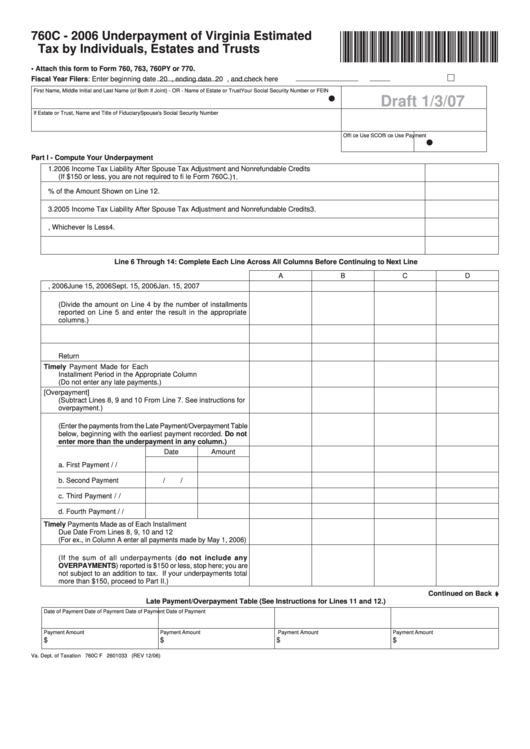

760C - 2006

Underpayment of Virginia Estimated

Tax by Individuals, Estates and Trusts

•

Attach this form to Form 760, 763, 760PY or 770.

Fiscal Year Filers: Enter beginning date

20

, ending date

20

, and check here

First Name, Middle Initial and Last Name (of Both If Joint) - OR - Name of Estate or Trust

Your Social Security Number or FEIN

c

Draft 1/3/07

If Estate or Trust, Name and Title of Fiduciary

Spouse's Social Security Number

Offi ce Use SC

Offi ce Use Payment

c

Part I - Compute Your Underpayment

1. 2006 Income Tax Liability After Spouse Tax Adjustment and Nonrefundable Credits

(If $150 or less, you are not required to fi le Form 760C.)

1.

2. Enter 90% of the Amount Shown on Line 1

2.

3. 2005 Income Tax Liability After Spouse Tax Adjustment and Nonrefundable Credits

3.

4. Enter the Amount From Line 2 or Line 3, Whichever Is Less

4.

5. Enter the Number of Installment Periods for Which You Were Liable to Make Payments

5.

Line 6 Through 14: Complete Each Line Across All Columns Before Continuing to Next Line

A

B

C

D

6. Due Dates of Installment Payments

May 1, 2006

June 15, 2006

Sept. 15, 2006

Jan. 15, 2007

7. Tax Liability

(Divide the amount on Line 4 by the number of installments

reported on Line 5 and enter the result in the appropriate

columns.)

8. Enter the Income Tax Withheld for Each Installment Period

9. Enter the Overpayment Credit From Your 2005 Income Tax

Return

10. Enter the Amount of Any Timely Payment Made for Each

Installment Period in the Appropriate Column

(Do not enter any late payments.)

11. Underpayment or [Overpayment]

(Subtract Lines 8, 9 and 10 From Line 7. See instructions for

overpayment.)

12. Other Payments

(Enter the payments from the Late Payment/Overpayment Table

below, beginning with the earliest payment recorded. Do not

enter more than the underpayment in any column.)

Date

Amount

a. First Payment

/

/

b. Second Payment

/

/

c. Third Payment

/

/

d. Fourth Payment

/

/

13. Enter the Total Timely Payments Made as of Each Installment

Due Date From Lines 8, 9, 10 and 12

(For ex., in Column A enter all payments made by May 1, 2006)

14. Subtract Line 13 From Line 7

(If the sum of all underpayments (do not include any

OVERPAYMENTS) reported is $150 or less, stop here; you are

not subject to an addition to tax. If your underpayments total

more than $150, proceed to Part II.)

Continued on Back g

Late Payment/Overpayment Table (See Instructions for Lines 11 and 12.)

Date of Payment

Date of Payment

Date of Payment

Date of Payment

Payment Amount

Payment Amount

Payment Amount

Payment Amount

$

$

$

$

Va. Dept. of Taxation 760C F 2601033 (REV 12/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2