Schedule A-C (Form 41a720a-C) Draft - Apportionment And Allocation - Continuation Sheet - 2016

ADVERTISEMENT

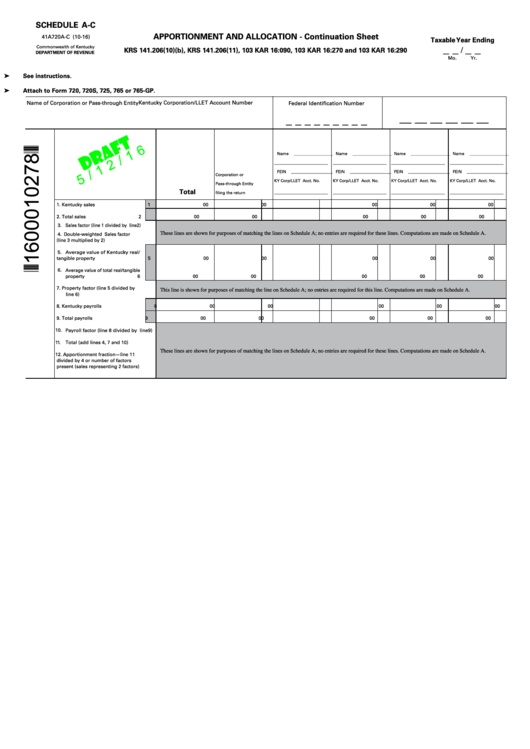

SCHEDULE A-C

APPORTIONMENT AND ALLOCATION - Continuation Sheet

41A720A-C (10-16)

Taxable Year Ending

_ _

_ _

Commonwealth of Kentucky

/

KRS 141.206(10)(b), KRS 141.206(11), 103 KAR 16:090, 103 KAR 16:270 and 103 KAR 16:290

DEPARTMENT OF REVENUE

Mo.

Yr.

➤ See instructions.

➤ Attach to Form 720, 720S, 725, 765 or 765-GP .

Name of Corporation or Pass-through Entity

Kentucky Corporation/LLET Account Number

Federal Identification Number

__ __ __ __ __ __

_ _ _ _ _ _ _ _ _

Name ___________________

Name ___________________

Name ___________________

Name ___________________

__________________________

__________________________

__________________________

__________________________

FEIN ____________________

FEIN ____________________

FEIN ____________________

FEIN ____________________

Corporation or

KY Corp/LLET Acct. No.

KY Corp/LLET Acct. No.

KY Corp/LLET Acct. No.

KY Corp/LLET Acct. No.

Pass-through Entity

Total

filing the return

__________________________

__________________________

__________________________

__________________________

1. Kentucky sales ...............................

1

00

00

00

00

00

00

2. Total sales ......................................

2

00

00

00

00

00

00

3. Sales factor (line 1 divided by line 2)

These lines are shown for purposes of matching the lines on Schedule A; no entries are required for these lines. Computations are made on Schedule A.

4. Double-weighted Sales factor

(line 3 multiplied by 2)

5. Average value of Kentucky real/

tangible property ...........................

5

00

00

00

00

00

00

6. Average value of total real/tangible

property .........................................

6

00

00

00

00

00

00

7. Property factor (line 5 divided by

This line is shown for purposes of matching the line on Schedule A; no entries are required for this line. Computations are made on Schedule A.

line 6)

8. Kentucky payrolls ..........................

8

00

00

00

00

00

00

9. Total payrolls .................................

9

00

00

00

00

00

00

10. Payroll factor (line 8 divided by line 9)

11. Total (add lines 4, 7 and 10)

These lines are shown for purposes of matching the lines on Schedule A; no entries are required for these lines. Computations are made on Schedule A.

12. Apportionment fraction—line 11

divided by 4 or number of factors

present (sales representing 2 factors)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3