Schedule Tc-42 Draft - Methane Credit - South Carolina Department Of Revenue

ADVERTISEMENT

1350

1350

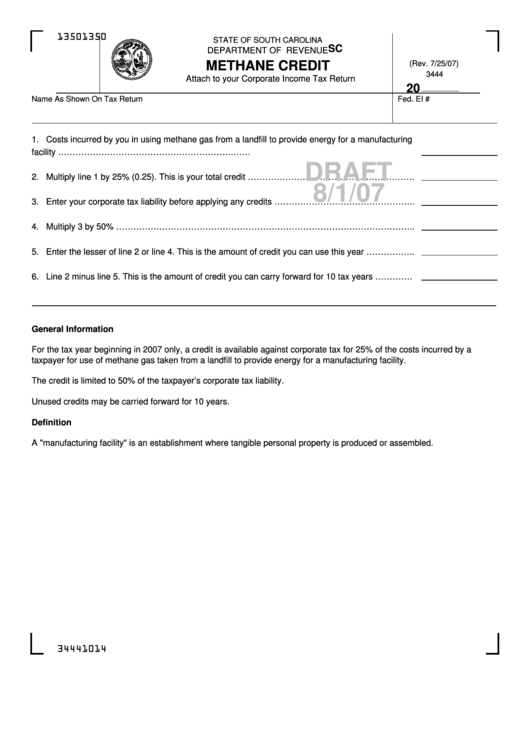

STATE OF SOUTH CAROLINA

SC SCH.TC-42

DEPARTMENT OF REVENUE

METHANE CREDIT

(Rev. 7/25/07)

3444

Attach to your Corporate Income Tax Return

20

Name As Shown On Tax Return

Fed. EI #

1. Costs incurred by you in using methane gas from a landfill to provide energy for a manufacturing

facility …………………………………………………….……..............................................................

DRAFT

2. Multiply line 1 by 25% (0.25). This is your total credit ………………………………………………….

8/1/07

3. Enter your corporate tax liability before applying any credits ………………………………………….

4. Multiply 3 by 50% …………………………………………………………………………………………..

5. Enter the lesser of line 2 or line 4. This is the amount of credit you can use this year ……………..

6. Line 2 minus line 5. This is the amount of credit you can carry forward for 10 tax years ………….

General Information

For the tax year beginning in 2007 only, a credit is available against corporate tax for 25% of the costs incurred by a

taxpayer for use of methane gas taken from a landfill to provide energy for a manufacturing facility.

The credit is limited to 50% of the taxpayer’s corporate tax liability.

Unused credits may be carried forward for 10 years.

Definition

A "manufacturing facility" is an establishment where tangible personal property is produced or assembled.

34441014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1