Schedule Tc-46 Draft - Bank Tax Credit For S Corporation Shareholders - South Carolina Department Of Revenue

ADVERTISEMENT

1350

1350

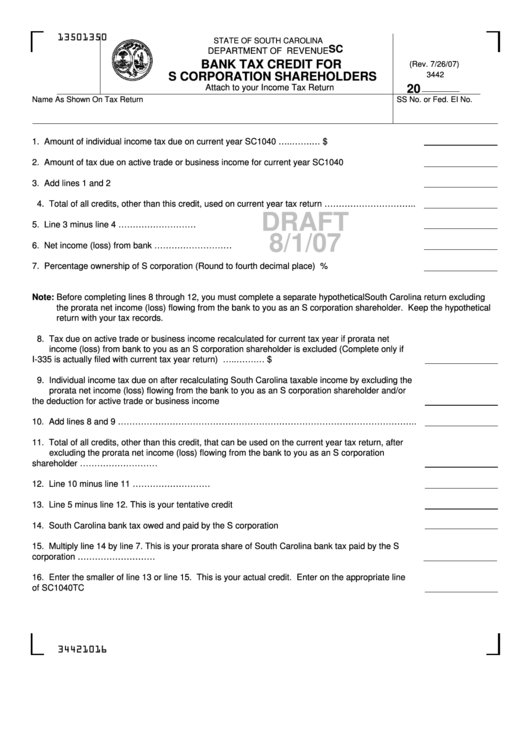

STATE OF SOUTH CAROLINA

SC SCH.TC-46

DEPARTMENT OF REVENUE

BANK TAX CREDIT FOR

(Rev. 7/26/07)

3442

S CORPORATION SHAREHOLDERS

Attach to your Income Tax Return

20

Name As Shown On Tax Return

SS No. or Fed. EI No.

1. Amount of individual income tax due on current year SC1040 …..…….…..................................... $

2. Amount of tax due on active trade or business income for current year SC1040 ...........................

3. Add lines 1 and 2 ...........................................................................................................................

4. Total of all credits, other than this credit, used on current year tax return …………………………..

DRAFT

5. Line 3 minus line 4 ……………………….........................................................................................

8/1/07

6. Net income (loss) from bank ………………………..........................................................................

7. Percentage ownership of S corporation (Round to fourth decimal place) ......................................

%

Note: Before completing lines 8 through 12, you must complete a separate hypothetical South Carolina return excluding

the prorata net income (loss) flowing from the bank to you as an S corporation shareholder. Keep the hypothetical

return with your tax records.

8. Tax due on active trade or business income recalculated for current tax year if prorata net

income (loss) from bank to you as an S corporation shareholder is excluded (Complete only if

I-335 is actually filed with current tax year return) ..........................…..…….….............................. $

9. Individual income tax due on after recalculating South Carolina taxable income by excluding the

prorata net income (loss) flowing from the bank to you as an S corporation shareholder and/or

the deduction for active trade or business income .........................................................................

10. Add lines 8 and 9 …………………………………………………………………………………………..

11. Total of all credits, other than this credit, that can be used on the current year tax return, after

excluding the prorata net income (loss) flowing from the bank to you as an S corporation

shareholder ………………………....................................................................................................

12. Line 10 minus line 11 ……………………….....................................................................................

13. Line 5 minus line 12. This is your tentative credit ...........................................................................

14. South Carolina bank tax owed and paid by the S corporation ........................................................

15. Multiply line 14 by line 7. This is your prorata share of South Carolina bank tax paid by the S

corporation ……………………….....................................................................................................

16. Enter the smaller of line 13 or line 15. This is your actual credit. Enter on the appropriate line

of SC1040TC .................................................................................................................................

34421016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2