Form 504 Draft - Schedule K-1 - Fiduciary Modified Schedule K-1 Beneficiary'S Information - 2007

ADVERTISEMENT

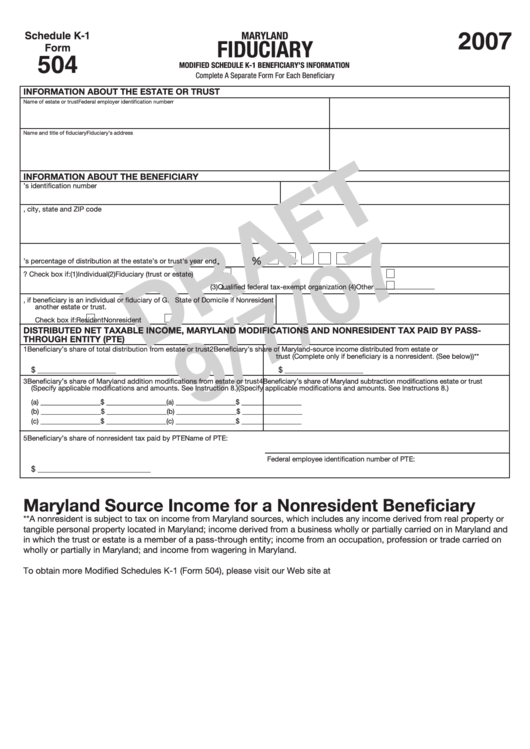

Schedule K-1

MARYLAND

2007

FIDUCIARY

Form

504

MODIFIED SCHEDULE K-1 BENEFICIARY’S INFORMATION

Complete A Separate Form For Each Beneficiary

INFORMATION ABOUT THE ESTATE OR TRUST

Name of estate or trust

Federal employer identification numberr

Name and title of fiduciary

Fiduciary’s address

INFORMATION ABOUT THE BENEFICIARY

A. Name of beneficiary

B. Beneficiary’s identification number

C. Address, city, state and ZIP code

.

%

D. Beneficiary’s percentage of distribution at the estate’s or trust’s year end

E. What type of entity is this beneficiary? Check box if:

(1)

Individual

(2)

Fiduciary (trust or estate)

Other _ _ __ _ _ __ _ __ _ __ _ __ _ __ _ _ __ _ __

(3)

Qualified federal tax-exempt organization

(4)

F. Resident status of beneficiary, if beneficiary is an individual or fiduciary of

G. State of Domicile if Nonresident

another estate or trust.

Check box if:

Resident

Nonresident

DISTRIBUTED NET TAXABLE INCOME, MARYLAND MODIFICATIONS AND NONRESIDENT TAX PAID BY PASS-

THROUGH ENTITY (PTE)

1 Beneficiary’s share of total distribution from estate or trust

2 Beneficiary’s share of Maryland-source income distributed from estate or

trust (Complete only if beneficiary is a nonresident. (See below))**

$

$

_ _ _ _ _ _ _ _ ___ ____ ________ __________ ___

_ __ _ __ _ __ _ __ _ _ __ _ __ _ __ _ __ _ __ _ _ __ _ __ _

3 Beneficiary’s share of Maryland addition modifications from estate or trust 4 Beneficiary’s share of Maryland subtraction modifications estate or trust

(Specify applicable modifications and amounts. See Instruction 8.)

(Specify applicable modifications and amounts. See Instructions 8.)

(a) _________________

$ _________________

(a) _________________

$ _________________

(b) _________________

$ _________________

(b) _________________

$ _________________

(c) _________________

$ _________________

(c) _________________

$ _________________

5 Beneficiary’s share of nonresident tax paid by PTE

Name of PTE:

Federal employee identification number of PTE:

$

________________________________

Maryland Source Income for a Nonresident Beneficiary

**A nonresident is subject to tax on income from Maryland sources, which includes any income derived from real property or

tangible personal property located in Maryland; income derived from a business wholly or partially carried on in Maryland and

in which the trust or estate is a member of a pass-through entity; income from an occupation, profession or trade carried on

wholly or partially in Maryland; and income from wagering in Maryland.

To obtain more Modified Schedules K-1 (Form 504), please visit our Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1