Instructions For Form Ftb 3805q - Net Operating Loss (Nol) Computation And Nol And Disaster Loss Limitations - Corporations - 1999

ADVERTISEMENT

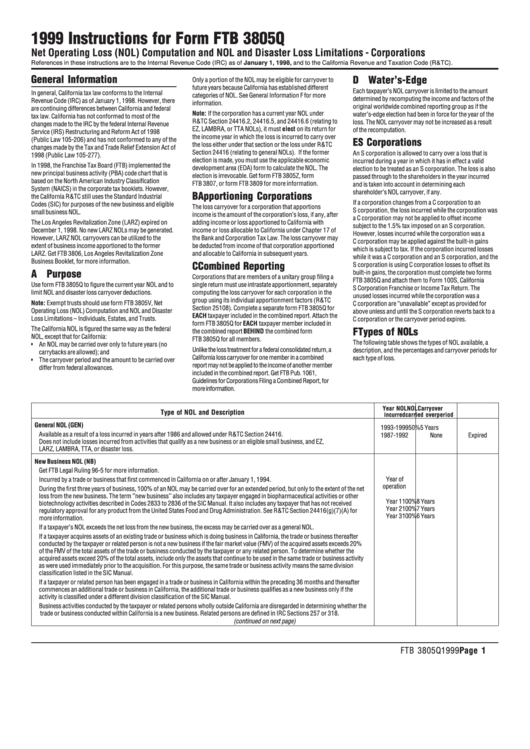

1999 Instructions for Form FTB 3805Q

Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations – Corporations

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

General Information

D Water’s-Edge

Only a portion of the NOL may be eligible for carryover to

future years because California has established different

Each taxpayer’s NOL carryover is limited to the amount

In general, California tax law conforms to the Internal

categories of NOL. See General Information F for more

determined by recomputing the income and factors of the

Revenue Code (IRC) as of January 1, 1998. However, there

information.

original worldwide combined reporting group as if the

are continuing differences between California and federal

Note: If the corporation has a current year NOL under

water’s-edge election had been in force for the year of the

tax law. California has not conformed to most of the

R&TC Section 24416.2, 24416.5, and 24416.6 (relating to

loss. The NOL carryover may not be increased as a result

changes made to the IRC by the federal Internal Revenue

EZ, LAMBRA, or TTA NOLs), it must elect on its return for

of the recomputation.

Service (IRS) Restructuring and Reform Act of 1998

the income year in which the loss is incurred to carry over

(Public Law 105-206) and has not conformed to any of the

E S Corporations

the loss either under that section or the loss under R&TC

changes made by the Tax and Trade Relief Extension Act of

Section 24416 (relating to general NOLs). If the former

An S corporation is allowed to carry over a loss that is

1998 (Public Law 105-277).

election is made, you must use the applicable economic

incurred during a year in which it has in effect a valid

In 1998, the Franchise Tax Board (FTB) implemented the

development area (EDA) form to calculate the NOL. The

election to be treated as an S corporation. The loss is also

new principal business activity (PBA) code chart that is

election is irrevocable. Get form FTB 3805Z, form

passed through to the shareholders in the year incurred

based on the North American Industry Classification

FTB 3807, or form FTB 3809 for more information.

and is taken into account in determining each

System (NAICS) in the corporate tax booklets. However,

shareholder’s NOL carryover, if any.

B Apportioning Corporations

the California R&TC still uses the Standard Industrial

If a corporation changes from a C corporation to an

Codes (SIC) for purposes of the new business and eligible

The loss carryover for a corporation that apportions

S corporation, the loss incurred while the corporation was

small business NOL.

income is the amount of the corporation’s loss, if any, after

a C corporation may not be applied to offset income

The Los Angeles Revitalization Zone (LARZ) expired on

adding income or loss apportioned to California with

subject to the 1.5% tax imposed on an S corporation.

December 1, 1998. No new LARZ NOLs may be generated.

income or loss allocable to California under Chapter 17 of

However, losses incurred while the corporation was a

However, LARZ NOL carryovers can be utilized to the

the Bank and Corporation Tax Law. The loss carryover may

C corporation may be applied against the built-in gains

extent of business income apportioned to the former

be deducted from income of that corporation apportioned

which is subject to tax. If the corporation incurred losses

LARZ. Get FTB 3806, Los Angeles Revitalization Zone

and allocable to California in subsequent years.

while it was a C corporation and an S corporation, and the

Business Booklet, for more information.

C Combined Reporting

S corporation is using C corporation losses to offset its

A Purpose

built-in gains, the corporation must complete two forms

Corporations that are members of a unitary group filing a

FTB 3805Q and attach them to Form 100S, California

Use form FTB 3805Q to figure the current year NOL and to

single return must use intrastate apportionment, separately

S Corporation Franchise or Income Tax Return. The

limit NOL and disaster loss carryover deductions.

computing the loss carryover for each corporation in the

unused losses incurred while the corporation was a

group using its individual apportionment factors (R&TC

Note: Exempt trusts should use form FTB 3805V, Net

C corporation are “unavailable” except as provided for

Section 25108). Complete a separate form FTB 3805Q for

Operating Loss (NOL) Computation and NOL and Disaster

above unless and until the S corporation reverts back to a

EACH taxpayer included in the combined report. Attach the

Loss Limitations – Individuals, Estates, and Trusts.

C corporation or the carryover period expires.

form FTB 3805Q for EACH taxpayer member included in

The California NOL is figured the same way as the federal

F Types of NOLs

the combined report BEHIND the combined form

NOL, except that for California:

FTB 3805Q for all members.

The following table shows the types of NOL available, a

• An NOL may be carried over only to future years (no

Unlike the loss treatment for a federal consolidated return, a

description, and the percentages and carryover periods for

carrybacks are allowed); and

California loss carryover for one member in a combined

each type of loss.

• The carryover period and the amount to be carried over

report may not be applied to the income of another member

differ from federal allowances.

included in the combined report. Get FTB Pub. 1061,

Guidelines for Corporations Filing a Combined Report, for

more information.

Year NOL

NOL

Carryover

Type of NOL and Description

incurred

carried over

period

General NOL (GEN)

1993-1999

50%

5 Years

Available as a result of a loss incurred in years after 1986 and allowed under R&TC Section 24416.

1987-1992

None

Expired

Does not include losses incurred from activities that qualify as a new business or an eligible small business, and EZ,

LARZ, LAMBRA, TTA, or disaster loss.

New Business NOL (NB)

Get FTB Legal Ruling 96-5 for more information.

Incurred by a trade or business that first commenced in California on or after January 1, 1994.

Year of

operation

During the first three years of business, 100% of an NOL may be carried over for an extended period, but only to the extent of the net

loss from the new business. The term ‘’new business’’ also includes any taxpayer engaged in biopharmaceutical activities or other

Year 1

100%

8 Years

biotechnology activities described in Codes 2833 to 2836 of the SIC Manual. It also includes any taxpayer that has not received

Year 2

100%

7 Years

regulatory approval for any product from the United States Food and Drug Administration. See R&TC Section 24416(g)(7)(A) for

Year 3

100%

6 Years

more information.

If a taxpayer’s NOL exceeds the net loss from the new business, the excess may be carried over as a general NOL.

If a taxpayer acquires assets of an existing trade or business which is doing business in California, the trade or business thereafter

conducted by the taxpayer or related person is not a new business if the fair market value (FMV) of the acquired assets exceeds 20%

of the FMV of the total assets of the trade or business conducted by the taxpayer or any related person. To determine whether the

acquired assets exceed 20% of the total assets, include only the assets that continue to be used in the same trade or business activity

as were used immediately prior to the acquisition. For this purpose, the same trade or business activity means the same division

classification listed in the SIC Manual.

If a taxpayer or related person has been engaged in a trade or business in California within the preceding 36 months and thereafter

commences an additional trade or business in California, the additional trade or business qualifies as a new business only if the

activity is classified under a different division classification of the SIC Manual.

Business activities conducted by the taxpayer or related persons wholly outside California are disregarded in determining whether the

trade or business conducted within California is a new business. Related persons are defined in IRC Sections 257 or 318.

(continued on next page)

FTB 3805Q 1999 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2