Form 51a205 Instructions - Kentucky Sales And Use Tax

ADVERTISEMENT

51A205 (8-99)

Commonwealth of Kentucky

REVENUE CABINET

KENTUCKY SALES AND

USE TAX INSTRUCTIONS

E D U C A T I O N

P A Y S

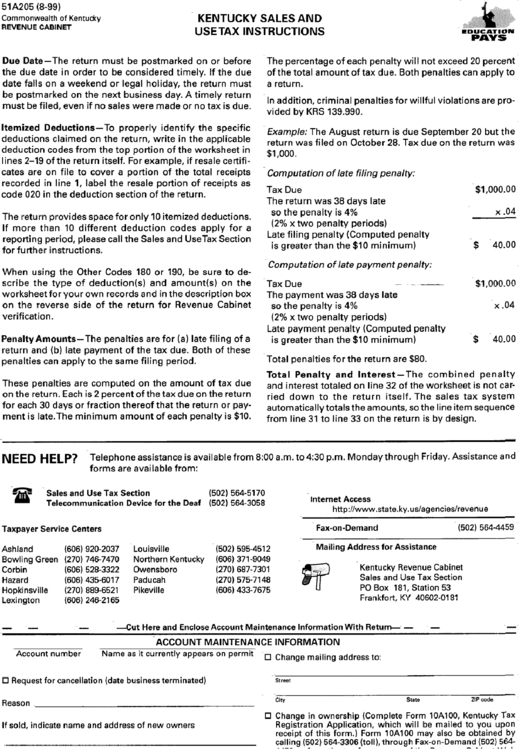

Due

Date--The return must be postmarked on or before

the due date in order to be considered timely. If the due

date falls on a weekend or legal holiday, the return must

be postmarked on the next business day. A timely return

must be filed, even if no sales were made or no tax is due.

I t e m i z e d D e d u c t i o n s - - T o

properly identify the specific

deductions claimed on the return, write in the applicable

deduction codes from the top portion of the worksheet in

lines 2-19 of the return itself. For example, if resale certifi-

cates are on file to cover a portion of the total receipts

recorded in line 1, label the resale portion of receipts as

code 020 in the deduction section of the return.

The return provides space for only 10 itemized deductions.

If more than 10 different deduction codes apply for a

reporting period, please call the Sales and UseTax Section

for further instructions.

When using the Other Codes 180 or 190, be sure to de-

scribe the type of deduction(s) and amount(s) on the

worksheet for your own records and in the description box

on the reverse side of the return for Revenue Cabinet

verification.

Penalty A m o u n t s - - T h e

penalties are for (a) late filing of a

return and (b) late payment of the tax due. Both of these

penalties can apply to the same filing period.

These penalties are computed on the amount of tax due

on the return. Each is 2 percent of the tax due on the return

for each 30 days or fraction thereof that the return or pay-

ment is late.The minimum amount of each penalty is $10.

The percentage of each penalty will not exceed 20 percent

of the total amount of tax due. Both penalties can apply to

a retu rn.

In addition, criminal penalties for willful violations are pro-

vided by KRS 139.990.

Example:

The August return is due September 20 but the

return was filed on October 28. Tax due on the return was

$1,000.

Computation of late filing penalty:

Tax Due

$1,000.00

The return was 38 days late

so the penalty is 4%

x .04

(2% x two penalty periods)

Late filing penalty (Computed penalty

is greater than the $10 minimum)

$

40.00

Computation of late payment penalty:

Tax Due

--

$1,000.00

The payment was 38 days late

so the penalty is 4%

x .04

(2% x two penalty periods)

Late payment penalty (Computed penalty

is greater than the $10 minimum)

$

40.00

Total penalties for the return are $80.

T o t a l P e n a l t y

a n d

I n t e r e s t - - T h e c o m b i n e d p e n a l t y

and interest totaled on line 32 of the worksheet is not car-

ried down to the return itself. The sales tax system

automatically totals the amounts, so the line item sequence

from line 31 to line 33 on the return is by design.

NEED HELP?

Telephone assistance is available from 8:00 a.m. to 4:30

p.m.

Monday through Friday. Assistance and

forms are available from:

Sales and Use Tax Section

Telecommunication Device for the Deaf

Taxpayer Service Centers

(502) 564-5170

(502) 564-3058

Internet Access

Fax-on-Demand

(502) 564-4459

Ashland

(606) 920-2037

Louisville

(502) 595-4512

Bowling Green (270) 746-7470

Northern Kentucky

(606) 371-9049

Corbin

(606) 528-3322

Owensboro

(270) 687-7301

Hazard

(606) 435-6017

Paducah

(270) 575-7148

Hopkinsville

(270) 889-6521

Pikeville

(606) 433-7675

Lexington

(606) 246-2165

Mailing Address for Assistance

Kentucky Revenue Cabinet

Sales and Use Tax Section

PO Box 181, Station 53

Frankfort, KY 40602-0181

- - C u t Here and Enclose Account Maintenance Information With Return-- - -

- -

Account number

ACCOUNT MAINTENANCE

Name as it currently appears on permit

[]

[] Request for cancellation (date business terminated)

Reason

If sold, indicate name and address of new owners

[] Change location address to:

Street

City

[] Change of business name

State

ZIP code

INFORMATION

Change mailing address to:

Street

City

State

ZIP code

[] Change in ownership (Complete Form 10A100, Kentucky Tax

Registration Application, which will be mailed to you upon

receipt of this form.) Form 10A100 may also be obtained by

calling (502) 564-3306 (toll), through Fax-on-Demand (502) 564-

4459 or from the tax forms page of the Revenue Cabinet Web

site listed above.

Types of Ownership Changes Requiring Form 10A100:

Individual to Partnership

Partnership to Corporation

Individual to Corporation

Corporation to Individual

Individual to Individual

Corporation to Partnership

Partnership to Individual

Corporation to Corporation

The statements indicated are hereby certified to be correct to the

best knowledge and belief of the undersigned who is duly

authorized to sign this request.

Name change only

Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1