Exemption From Real Estate Taxation For Property Owned By Non-Profit Organizations Eligibility Requirements And Instructions - Nyc Department Of Finance

ADVERTISEMENT

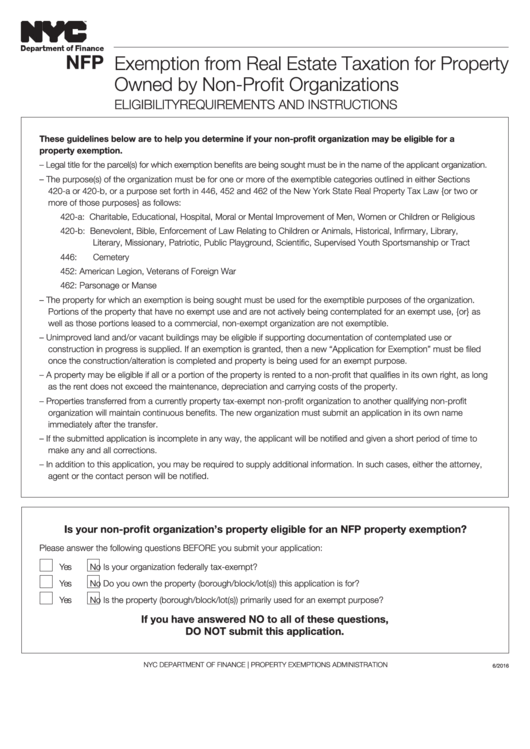

NFP

Exemption from Real Estate Taxation for Property

Owned by Non-Profit Organizations

ELIGIBILITY REQUIREMENTS AND INSTRUCTIONS

These guidelines below are to help you determine if your non-profit organization may be eligible for a

property exemption.

– Legal title for the parcel(s) for which exemption benefits are being sought must be in the name of the applicant organization.

– The purpose(s) of the organization must be for one or more of the exemptible categories outlined in either Sections

420-a or 420-b, or a purpose set forth in 446, 452 and 462 of the New York State Real Property Tax Law {or two or

more of those purposes} as follows:

420-a: Charitable, Educational, Hospital, Moral or Mental Improvement of Men, Women or Children or Religious

420-b: Benevolent, Bible, Enforcement of Law Relating to Children or Animals, Historical, Infirmary, Library,

Literary, Missionary, Patriotic, Public Playground, Scientific, Supervised Youth Sportsmanship or Tract

446:

Cemetery

452:

American Legion, Veterans of Foreign War

462:

Parsonage or Manse

– The property for which an exemption is being sought must be used for the exemptible purposes of the organization.

Portions of the property that have no exempt use and are not actively being contemplated for an exempt use, {or} as

well as those portions leased to a commercial, non-exempt organization are not exemptible.

– Unimproved land and/or vacant buildings may be eligible if supporting documentation of contemplated use or

construction in progress is supplied. If an exemption is granted, then a new “Application for Exemption” must be filed

once the construction/alteration is completed and property is being used for an exempt purpose.

– A property may be eligible if all or a portion of the property is rented to a non-profit that qualifies in its own right, as long

as the rent does not exceed the maintenance, depreciation and carrying costs of the property.

– Properties transferred from a currently property tax-exempt non-profit organization to another qualifying non-profit

organization will maintain continuous benefits. The new organization must submit an application in its own name

immediately after the transfer.

– If the submitted application is incomplete in any way, the applicant will be notified and given a short period of time to

make any and all corrections.

– In addition to this application, you may be required to supply additional information. In such cases, either the attorney,

agent or the contact person will be notified.

Is your non-profit organization’s property eligible for an NFP property exemption?

Please answer the following questions BEFORE you submit your application:

Yes

No

Is your organization federally tax-exempt?

Yes

No

Do you own the property (borough/block/lot(s)) this application is for?

Yes

No

Is the property (borough/block/lot(s)) primarily used for an exempt purpose?

If you have answered NO to all of these questions,

DO NOT submit this application.

NYC DEPARTMENT OF FINANCE | PROPERTY EXEMPTIONS ADMINISTRATION

6/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2