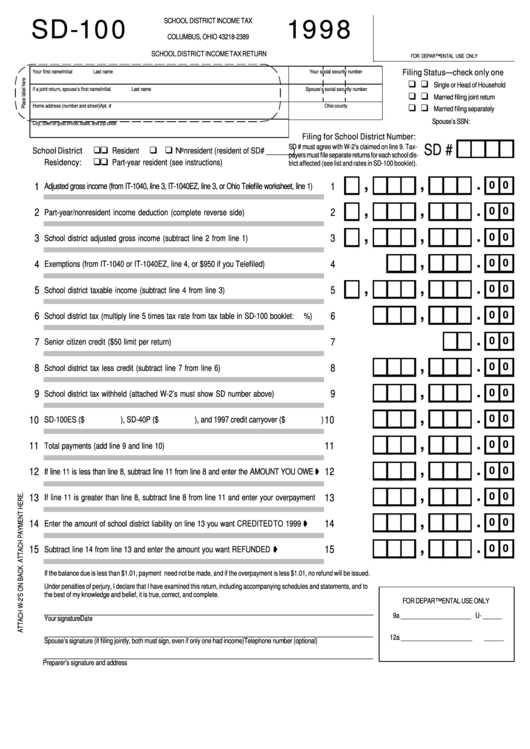

SCHOOL DISTRICT INCOME TAX

SD-100

1998

P.O. BOX 182389

COLUMBUS, OHIO 43218-2389

SCHOOL DISTRICT INCOME TAX RETURN

FOR DEPARTMENTAL USE ONLY

Filing Status—check only one

Your first name

Initial

Last name

Your social security number

q q

Single or Head of Household

If a joint return, spouse’s first name

Initial

Last name

Spouse’s social security number

q q

Married filing joint return

q q

Home address (number and street)

Apt. #

Ohio county

Married filing separately

q q

Spouse’s SSN:

City, town or post office, state, and zip code

Filing for School District Number:

q q

q q

SD #

SD # must agree with W-2’s claimed on line 9. Tax-

School District

Resident

Nonresident (resident of SD# _______)

payers must file separate returns for each school dis-

q q

Residency:

Part-year resident (see instructions)

trict affected (see list and rates in SD-100 booklet).

,

,

.

0 0

1

1

Adjusted gross income (from IT-1040, line 3, IT-1040EZ, line 3, or Ohio Telefile worksheet, line 1)

,

,

.

0 0

2

2

Part-year/nonresident income deduction (complete reverse side)

,

,

.

0 0

3

3

School district adjusted gross income (subtract line 2 from line 1)

,

.

0 0

4

4

Exemptions (from IT-1040 or IT-1040EZ, line 4, or $950 if you Telefiled)

,

,

.

0 0

5

5

School district taxable income (subtract line 4 from line 3)

,

.

0 0

6

6

School district tax (multiply line 5 times tax rate from tax table in SD-100 booklet:

%)

.

0 0

7

7

Senior citizen credit ($50 limit per return)

,

.

0 0

8

8

School district tax less credit (subtract line 7 from line 6)

,

.

0 0

9

9

School district tax withheld (attached W-2’s must show SD number above)

,

.

0 0

10

10

SD-100ES ($

), SD-40P ($

), and 1997 credit carryover ($

)

,

.

0 0

11

11

Total payments (add line 9 and line 10)

,

.

0 0

12

12

If line 11 is less than line 8, subtract line 11 from line 8 and enter the AMOUNT YOU OWE

,

.

0 0

13

13

If line 11 is greater than line 8, subtract line 8 from line 11 and enter your overpayment

,

.

0 0

14

14

Enter the amount of school district liability on line 13 you want CREDITED TO 1999

,

.

0 0

15

15

Subtract line 14 from line 13 and enter the amount you want REFUNDED

If the balance due is less than $1.01, payment need not be made, and if the overpayment is less $1.01, no refund will be issued.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct, and complete.

FOR DEPARTMENTAL USE ONLY

________________________________________________________________________________________________________________

9a ______________________ U- ______

Your signature

Date

_________________________________________________________________________________________________________

12a ______________________

______

Spouse’s signature (if filing jointly, both must sign, even if only one had income)

Telephone number (optional)

___________________________________________________________________________________________________________

Preparer’s signature and address

1

1