A

D

R

LABAMA

EPARTMENT OF

EVENUE

FORM

10

Procedures and Specifications For Filing Wage and

Tax Information by Means of Magnetic Media

8/97

The Alabama Department of Revenue does not require W-2 infor-

figure shown here is the number of “S” records contained on the tape for the

mation to be filed by means of magnetic media. However, the

employer for whom the Form A-3 is being filed.

Department does encourage the use of magnetic media as a means of

It is permissible to send part of your withholding information on

transmitting W-2 information. If you do choose to file by means of

tape and part on paper. However, both the tape and paper copies

magnetic media, the specifications and procedures described in Form

must be sent together with the Form A-3. In situations where tape and

10 must be followed in order for the Department to accept your W-2

paper are submitted, the figure shown in the space provided for the

information by this means. Failure to comply with these specifica-

number of wage and tax statements on Form A-3 must represent a

tions can result in your magnetic media being returned to you

total of the records on both tape and paper. If paper copies of wage

unprocessed. Your magnetic tape or cartridge must be produced

and tax statements are submitted, an adding machine tape of

according to the specifications outlined in Form 10, however, you

amounts of Alabama income tax withheld must accompany such

must refer to SSA Publication 42-007 (TIB-4) for record format and

statements.

record specifications.

• Each withholding tax account on a tape must contain a single

The Department does not require filers to submit test tapes or to

“E” record. Multiple “E” records result in subtotals of the Alabama

obtain prior approval before filing their magnetic media. However,

income tax withheld rather than a single total as is required. This

test tapes can be submitted and the Department will advise the filer

applies to accounts which have multiple locations. All locations

of the acceptability of their tape/cartridge. If the election is made to

reported under a particular Alabama withholding tax account num-

submit a test tape, such tape must be submitted at least 60 days prior

ber must be represented by a single “E” record.

to the due date for filing wage and tax statements. Wage and tax

• At this time the Alabama Department of Revenue does not

statements are due February 28. A label must be affixed to the

accept withholding tax information by way of diskette. We do accept

tape/cartridge stating that it is test. The test tape/cartridge must be

submitted with the completed label from the bottom of this form.

this information by way of either 9 track reel tape or IBM 3480 com-

patible cartridge tape.

“Test” should be printed in red in the space provided for year on the

label.

• If you wish, your tape/cartridge may be returned to you after

processing. However, you must affix a label to the media with your

Procedures For Magnetic Media Reporting of

name and address. All media received without such labels will be

Withholding Information

destroyed after processing.

• Each tape/cartridge must be accompanied by a properly com-

• Complete the label at the bottom of this form. Mail your com-

pleted Form A-3, Annual Reconciliation of Alabama Income Tax

pleted label, tape or cartridge and your completed Form(s) A-3 to the

Withheld, for each withholding account for whom information is

following address:

contained on the tape. If a tape contains multiple accounts, the

Forms A-3 for each account must be arranged in the same order as

Alabama Department of Revenue

the accounts appear on the tape. All items of Form A-3 must be

Withholding Tax Section

properly completed. Form A-3 is found in the employers withhold-

P. O. Box 327480

ing tax coupon booklet. Under no circumstances should the Form

Montgomery, AL 36132-7480

A-3 and the tape be sent under separate cover.

If you have any questions concerning the filing of wage and tax

Note: Form A-3 provides a space for the number of wage and tax state-

information by means of magnetic media, please call the

ments transmitted with the Form A-3. When filing by magnetic media, the

Withholding Tax Section at (334) 242-1300.

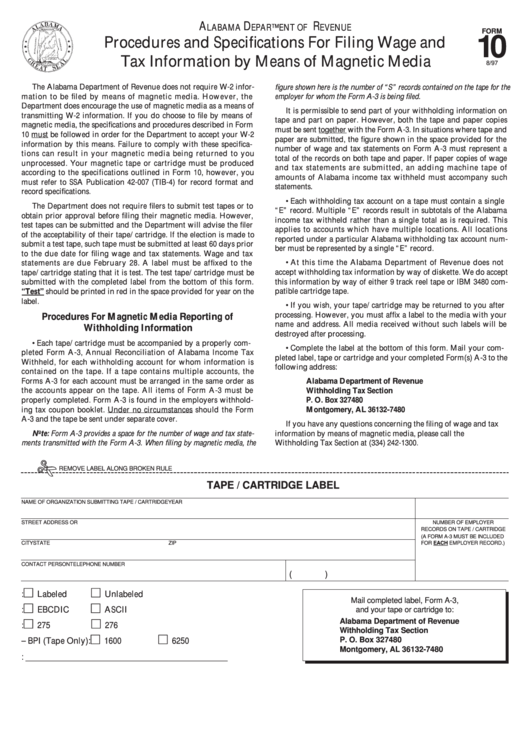

REMOVE LABEL ALONG BROKEN RULE

TAPE / CARTRIDGE LABEL

NAME OF ORGANIZATION SUBMITTING TAPE / CARTRIDGE

YEAR

STREET ADDRESS OR P.O. BOX

NUMBER OF EMPLOYER

RECORDS ON TAPE / CARTRIDGE

(A FORM A-3 MUST BE INCLUDED

CITY

STATE

ZIP

FOR EACH EMPLOYER RECORD.)

CONTACT PERSON

TELEPHONE NUMBER

(

)

1. Tape / Cartridge Is:

Labeled

Unlabeled

Mail completed label, Form A-3,

2. Recording Mode:

EBCDIC

ASCII

and your tape or cartridge to:

Alabama Department of Revenue

3. Record Size:

275

276

Withholding Tax Section

P. O. Box 327480

4. Density – BPI (Tape Only):

1600

6250

Montgomery, AL 36132-7480

5. Block Size: _______________________________________________

1

1 2

2