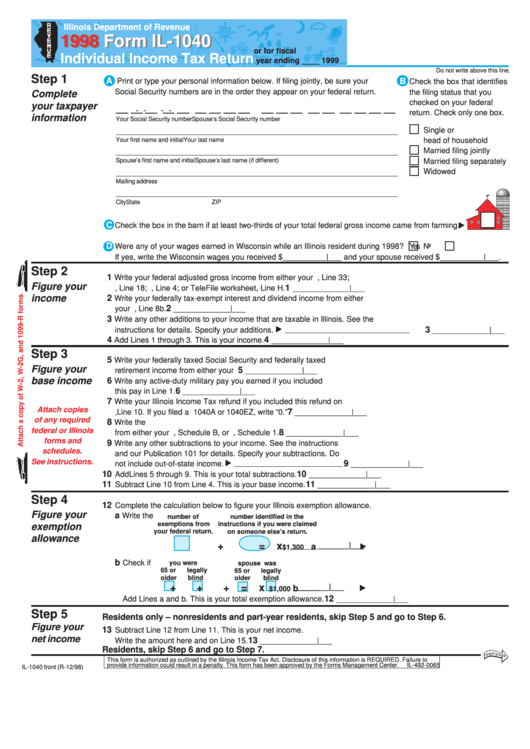

Illinois Department of Revenue

1998

Form IL-1040

1998 Form IL-1040

or for fiscal

Individual Income Tax Return

year ending ____ 1999

Do not write above this line.

Step 1

A

B

Print or type your personal information below. If filing jointly, be sure your

Check the box that identifies

Social Security numbers are in the order they appear on your federal return.

the filing status that you

Complete

checked on your federal

your taxpayer

-

-

-

-

return. Check only one box.

information

Your Social Security number

Spouse’s Social Security number

Single or

head of household

Your first name and initial

Your last name

Married filing jointly

Spouse’s first name and initial

Spouse’s last name (if different)

Married filing separately

Widowed

Mailing address

City

State

ZIP

C

Check the box in the barn if at least two-thirds of your total federal gross income came from farming.

D

Were any of your wages earned in Wisconsin while an Illinois resident during 1998?

Yes

No

If yes, write the Wisconsin wages you received $__________|___ and your spouse received $__________|___.

Step 2

1

Write your federal adjusted gross income from either your U.S. 1040, Line 33;

Figure your

1

U.S. 1040A, Line 18; U.S. 1040EZ, Line 4; or TeleFile worksheet, Line H.

_____________|___

income

2

Write your federally tax-exempt interest and dividend income from either

2

your U.S. 1040 or 1040A, Line 8b.

_____________|___

3

Write any other additions to your income that are taxable in Illinois. See the

3

instructions for details. Specify your additions.

_____________|___

4

4

Add Lines 1 through 3. This is your income.

_____________|___

Step 3

5

Write your federally taxed Social Security and federally taxed

Figure your

5

retirement income from either your U.S. 1040 or 1040A.

_____________|___

base income

6

Write any active-duty military pay you earned if you included

6

this pay in Line 1.

_____________|___

7

Write your Illinois Income Tax refund if you included this refund on

Attach copies

7

U.S. 1040, Line 10. If you filed a U.S. 1040A or 1040EZ, write “0.”

_____________|___

of any required

8

Write the U.S. government obligations and U.S. agency income

federal or Illinois

8

from either your U.S. 1040, Schedule B, or U.S. 1040A, Schedule 1.

_____________|___

forms and

9

Write any other subtractions to your income. See the instructions

schedules.

and our Publication 101 for details. Specify your subtractions. Do

See instructions.

9

not include out-of-state income.

_____________|___

10

10

Add Lines 5 through 9. This is your total subtractions.

_____________|___

11

11

Subtract Line 10 from Line 4. This is your base income.

_____________|___

Step 4

12

Complete the calculation below to figure your Illinois exemption allowance.

Figure your

a

Write the

number of

number identified in the

exemptions from

instructions if you were claimed

exemption

your federal return.

on someone else’s return.

allowance

+

=

x

_______|___

a

$1,300

b

H

Check if

you were

spouse was

65 or

legally

65 or

legally

older

blind

older

blind

+

+

+

=

x

_______|___

b

$1,000

12

Add Lines a and b. This is your total exemption allowance.

_____________|___

Step 5

Residents only – nonresidents and part-year residents, skip Step 5 and go to Step 6.

Figure your

13

Subtract Line 12 from Line 11. This is your net income.

net income

13

Write the amount here and on Line 15.

_____________|___

Residents, skip Step 6 and go to Step 7.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0065

IL-1040 front (R-12/98)

1

1 2

2