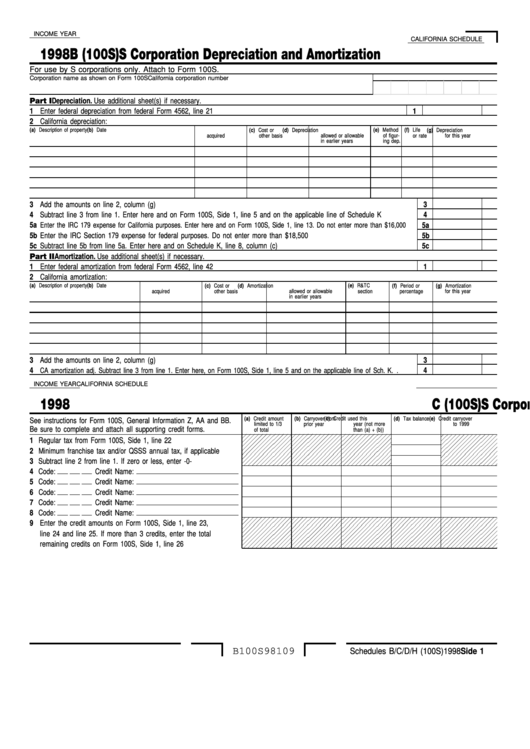

INCOME YEAR

CALIFORNIA SCHEDULE

1998

S Corporation Depreciation and Amortization

B (100S)

For use by S corporations only. Attach to Form 100S.

Corporation name as shown on Form 100S

California corporation number

Part I

Depreciation. Use additional sheet(s) if necessary.

1 Enter federal depreciation from federal Form 4562, line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 California depreciation:

(a) Description of property

(b) Date

(c) Cost or

(d) Depreciation

(e) Method

(f) Life

(g) Depreciation

acquired

other basis

allowed or allowable

of figur-

or rate

for this year

in earlier years

ing dep.

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Subtract line 3 from line 1. Enter here and on Form 100S, Side 1, line 5 and on the applicable line of Schedule K . . . . .

4

5a

5a

Enter the IRC 179 expense for California purposes. Enter here and on Form 100S, Side 1, line 13. Do not enter more than $16,000

5b Enter the IRC Section 179 expense for federal purposes. Do not enter more than $18,500 . . . . . . . . . . . . . . . . . . .

5b

5c Subtract line 5b from line 5a. Enter here and on Schedule K, line 8, column (c) . . . . . . . . . . . . . . . . . . . . . . . . .

5c

Part II Amortization. Use additional sheet(s) if necessary.

1 Enter federal amortization from federal Form 4562, line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 California amortization:

(a) Description of property

(b) Date

(c) Cost or

(d) Amortization

(e) R&TC

(f) Period or

(g) Amortization

acquired

other basis

allowed or allowable

section

percentage

for this year

in earlier years

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

CA amortization adj. Subtract line 3 from line 1. Enter here, on Form 100S, Side 1, line 5 and on the applicable line of Sch. K . .

4

INCOME YEAR

CALIFORNIA SCHEDULE

1998

S Corporation Tax Credits

C (100S)

(a) Credit amount

(b) Carryover from

(c) Credit used this

(d) Tax balance

(e) Credit carryover

See instructions for Form 100S, General Information Z, AA and BB.

limited to 1/3

prior year

year (not more

to 1999

Be sure to complete and attach all supporting credit forms.

of total

than (a) + (b))

1 Regular tax from Form 100S, Side 1, line 22 . . . . . . . . . . . . .

2 Minimum franchise tax and/or QSSS annual tax, if applicable . . . .

3 Subtract line 2 from line 1. If zero or less, enter -0- . . . . . . . . .

4 Code:

Credit Name:

5 Code:

Credit Name:

6 Code:

Credit Name:

7 Code:

Credit Name:

8 Code:

Credit Name:

9 Enter the credit amounts on Form 100S, Side 1, line 23,

line 24 and line 25. If more than 3 credits, enter the total

remaining credits on Form 100S, Side 1, line 26 . . . . . . . . . . .

B100S98109

Schedules B/C/D/H (100S) 1998 Side 1

1

1