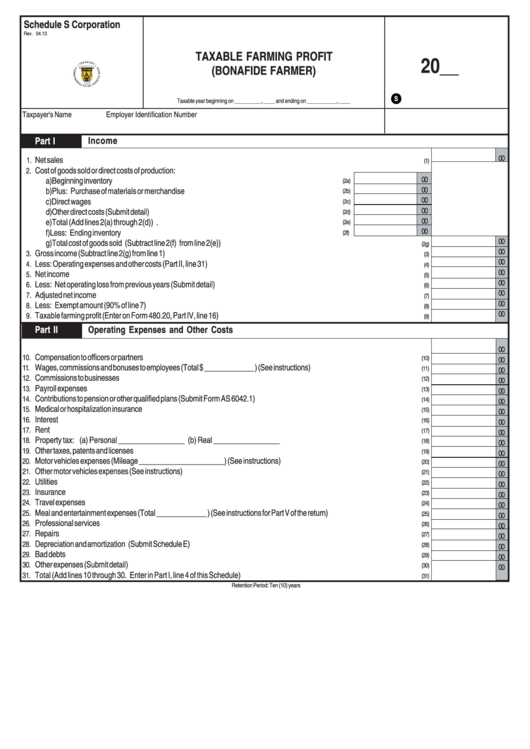

Schedule S Corporation - Taxable Farming Profit (Bonafide Farmer)

ADVERTISEMENT

Schedule S Corporation

Rev. 04.13

TAXABLE FARMING PROFIT

20__

(BONAFIDE FARMER)

S

Taxable year beginning on __________, ____ and ending on ___________, ____

Taxpayer's Name

Employer Identification Number

Part I

Income

00

Net sales .....................................................................................................................................................................................

1.

(1)

Cost of goods sold or direct costs of production:

2.

00

a) Beginning inventory .................................................................................................................

(2a)

00

b) Plus: Purchase of materials or merchandise .............................................................................

(2b)

00

c) Direct wages ............................................................................................................................

(2c)

00

d) Other direct costs (Submit detail) ..............................................................................................

(2d)

00

e) Total (Add lines 2(a) through 2(d)) ..........................................................................................

(2e)

00

f) Less: Ending inventory ...........................................................................................................

(2f)

00

g) Total cost of goods sold (Subtract line 2(f) from line 2(e))..................................................................................................

(2g)

00

Gross income (Subtract line 2(g) from line 1) ................................................................................................................................

3.

(3)

00

Less: Operating expenses and other costs (Part II, line 31) ........................................................................................................

4.

(4)

00

Net income ..................................................................................................................................................................................

5.

(5)

00

Less: Net operating loss from previous years (Submit detail) .....................................................................................................

6.

(6)

00

Adjusted net income ....................................................................................................................................................................

7.

(7)

00

Less: Exempt amount (90% of line 7) .........................................................................................................................................

8.

(8)

00

Taxable farming profit (Enter on Form 480.20, Part IV, line 16) ..................................................................................................

9.

(9)

Part II

Operating Expenses and Other Costs

00

Compensation to officers or partners ............................................................................................................................................

10.

(10)

00

Wages, commissions and bonuses to employees (Total $ _____________ ) (See instructions) .....................................................

11.

(11)

00

Commissions to businesses .........................................................................................................................................................

12.

(12)

00

Payroll expenses ........................................................................................................................................................................

13.

(13)

00

Contributions to pension or other qualified plans (Submit Form AS 6042.1) ................................................................................

14.

(14)

00

Medical or hospitalization insurance ............................................................................................................................................

15.

(15)

00

Interest .......................................................................................................................................................................................

16.

(16)

00

Rent ...........................................................................................................................................................................................

17.

(17)

00

Property tax: (a) Personal _________________ (b) Real _________________....................................................................

18.

(18)

00

Other taxes, patents and licenses ..................................................................................................................................................

19.

(19)

00

Motor vehicles expenses (Mileage ______________________) (See instructions) ...................................................................

20.

(20)

00

Other motor vehicles expenses (See instructions) ......................................................................................................................

21.

(21)

00

Utilities ........................................................................................................................................................................................

22.

(22)

00

Insurance ...................................................................................................................................................................................

23.

(23)

00

Travel expenses .........................................................................................................................................................................

24.

(24)

00

Meal and entertainment expenses (Total _____________ ) (See instructions for Part V of the return) ...........................................

25.

(25)

00

Professional services ..................................................................................................................................................................

26.

(26)

00

Repairs ......................................................................................................................................................................................

27.

(27)

00

Depreciation and amortization (Submit Schedule E) ....................................................................................................................

28.

(28)

00

Bad debts ...................................................................................................................................................................................

29.

(29)

00

Other expenses (Submit detail) ...................................................................................................................................................

30.

(30)

00

Total (Add lines 10 through 30. Enter in Part I, line 4 of this Schedule) .......................................................................................

31.

(31)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1